In general, real estate investment trusts (REITs) are failing to beat the market as a whole so far this year.

The S&P 500 is off by 1.8% having dropped from 4,800 at the beginning of 2022 to its current level of 4,137. The benchmark Real Estate Select Sector SPDR Fund (NYSE:XLRE) is off by slightly more than that –14.21%. It began the year at $51 and now trades for $43.75.

That’s a close call, of course, and a case could be made that careful selection of certain dividend-paying REITs would have done better than the S&P 500 and the XLRE exchange-traded fund (ETF). Those REITs that did better tend to trade like utility stocks since both sectors are sending out dividends to investors.

Here’s the daily price chart for XLRE:

Similar to many stock indexes, REITs seem to have bottomed in mid-June and rallied for most of the rest of the summer. The index is pulling back over the last few days as investors assess the likelihood of interest rate hikes on the eve of the Federal Reserve’s Jackson Hole, Wyoming retreat.

Related: This Little Known REIT Has Produced Double Digit Annual Returns For The Past Five Years

Which REITs, if any, outperformed the rest of the market? Among the major names, the best one is VICI Properties Inc. (NYSE:VICI), which is one of the dividend payers well-liked this year. It’s paying a 4.64% dividend. The average daily volume is 13.55 million shares – that kind of enormous volume makes it possible for large institutional investors to participate because liquidity is present with so many investors involved.

The VICI Properties daily price chart looks like this:

It’s definitely out-performing both the S&P 500 and the Real Estate Select Sector SPDR Fund so far this year, even with the drop from the mid-August peak. VICI is a net-lease operation with significant hotel and gaming properties in major markets such as Las Vegas, Nevada; Atlantic City, New Jersey; New Orleans, Louisiana; and other spots around the country.

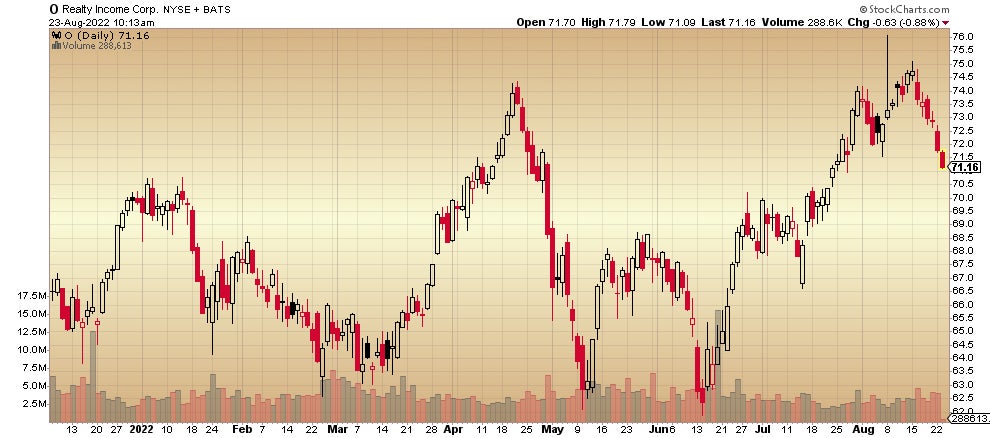

Another clear outperformer is Realty Income Corp. (NYSE:O). Here’s its daily price chart:

It began the year at $70 and now trades for $71.16. That may not seem like much progress but the point is that it’s better than the REIT benchmark and better than the S&P 500. Realty Income pays a 4.14% dividend monthly and operates as a net-lease REIT.

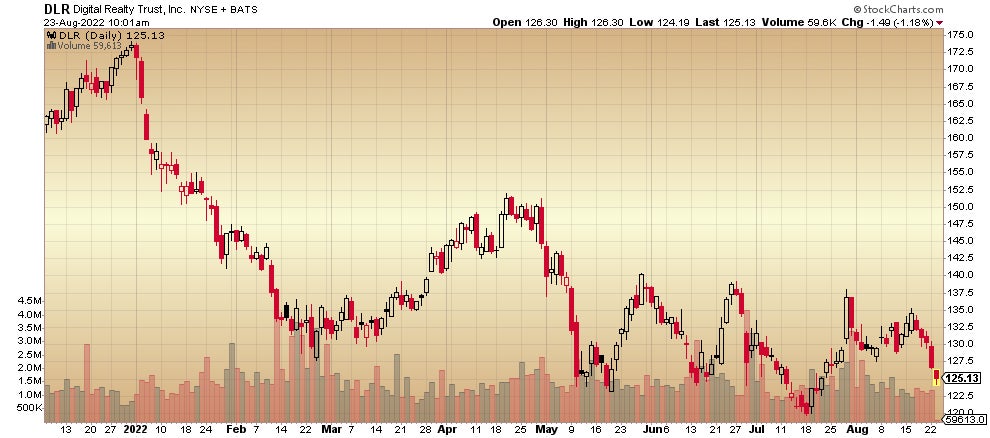

Which major REIT is underperforming? Here’s the daily price chart for Digital Realty Trust Inc. (NYSE:DLR):

It started the year at $172.50 and has never recovered. Today’s price of $125.13 represents a drop of just over 25%. Digital Realty pays a decent dividend of 3.85% but that hasn’t seemed to help this data-center-focused operation. It’s been more sellers than buyers for months now.t

These three examples of widely different kinds of REITs demonstrate the importance of careful selection. Although it might be easier in general to own the Real Estate Select Sector SPDR Fund, it’s possible to do better.

Related News Highlights in Real Estate Investing

- The Bezos-backed real estate investment platform Arrived Homes launched a new batch of offerings to allow retail investors to purchase shares of single-family rental homes with a minimum investment of $100. The platform has already funded over 150 properties with a total value of over $50 million.

- Vacation rental investment platform Here set to launch new offering for San Diego property with $100 minimum investment. The company says vacation rentals generate up to 160% more revenue on average than traditional long-term rentals, according to data from Zillow and AirDNA.

Find more current offerings and news on Benzinga Alternative Investments

Not investment advice. For educational purposes only.