First Republic (FRC) went down late last week, another bank failure in the U.S.

It joined Signature Bank (SBNY) and Silicon Valley Bank (SIVB) and continues to weigh on investor sentiment and on the SPDR S&P Regional Banking ETF (KRE).

At last glance the KRE ETF was down about 7.75% on Tuesday and hitting new 52-week lows. That’s clearly weighing on the S&P 500, with the index down more than 1.5% on the day.

The weakness in the KRE ETF is likely setting off a few alarm bells for investors. Prolonged weakness in the regional banks presents risk in the group, even if the larger banks can absorb a lot of the damage.

Don't Miss: Nvidia Stock Broke Out of Resistance; Here's Where It Might Go Next

The decline comes as the Federal Reserve begins its two-day meeting and is expected to raise interest rates by 0.25 percentage point on Wednesday. The Fed's moves affect so many economic aspects, including the regional banks.

We’re seeing some concerning action out of the KRE ETF so far this morning. Let’s have a closer look.

Trading the Regional Banks ETF (KRE)

Chart courtesy of TrendSpider.com

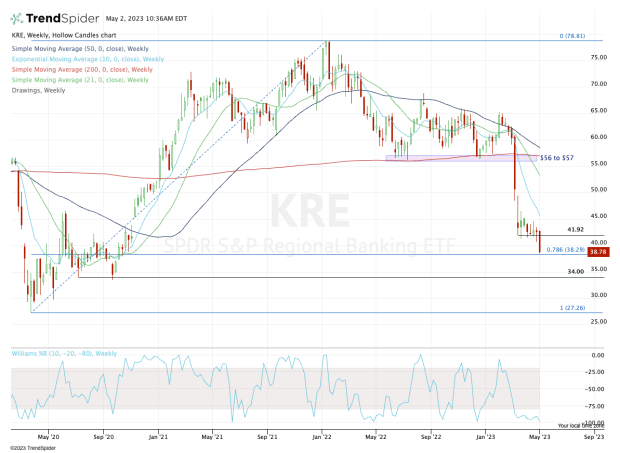

The KRE ETF had been bobbing around the $42 level, which had become key support since the regional-banking concerns began.

But the stock continued to put in a series of lower highs, a bearish technical development. Worse, it continued to test the $42 level. While it bounced each time it got below $42, each dip went a little bit deeper.

Now slicing down deep below this level, the ETF is coming into the 78.6% retracement near $38.25, a potential scenario we highlighted when we previously looked at the KRE.

Don't Miss: Zoom Video Stock Has Slumped; Is It Time to Buy?

From here, we’ll have to see how the ETF handles this level. If it holds, the $41 to $42 zone will be the upside target for those looking for a rebound. If this zone is resistance, the setup remains bearish.

If the 78.6% retracement fails as support, the KRE could be looking at a break down to $34. That level was notable support twice in mid-2020 after the covid-19 selloff had subsided.

If $34 doesn’t hold, it could eventually put $30 back in play.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.