Investors with a lot of money to spend have taken a bullish stance on Regeneron Pharmaceuticals (NASDAQ:REGN).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with REGN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 12 uncommon options trades for Regeneron Pharmaceuticals.

This isn't normal.

The overall sentiment of these big-money traders is split between 58% bullish and 41%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $735,359, and 4 are calls, for a total amount of $167,575.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $700.0 and $800.0 for Regeneron Pharmaceuticals, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Regeneron Pharmaceuticals's options for a given strike price.

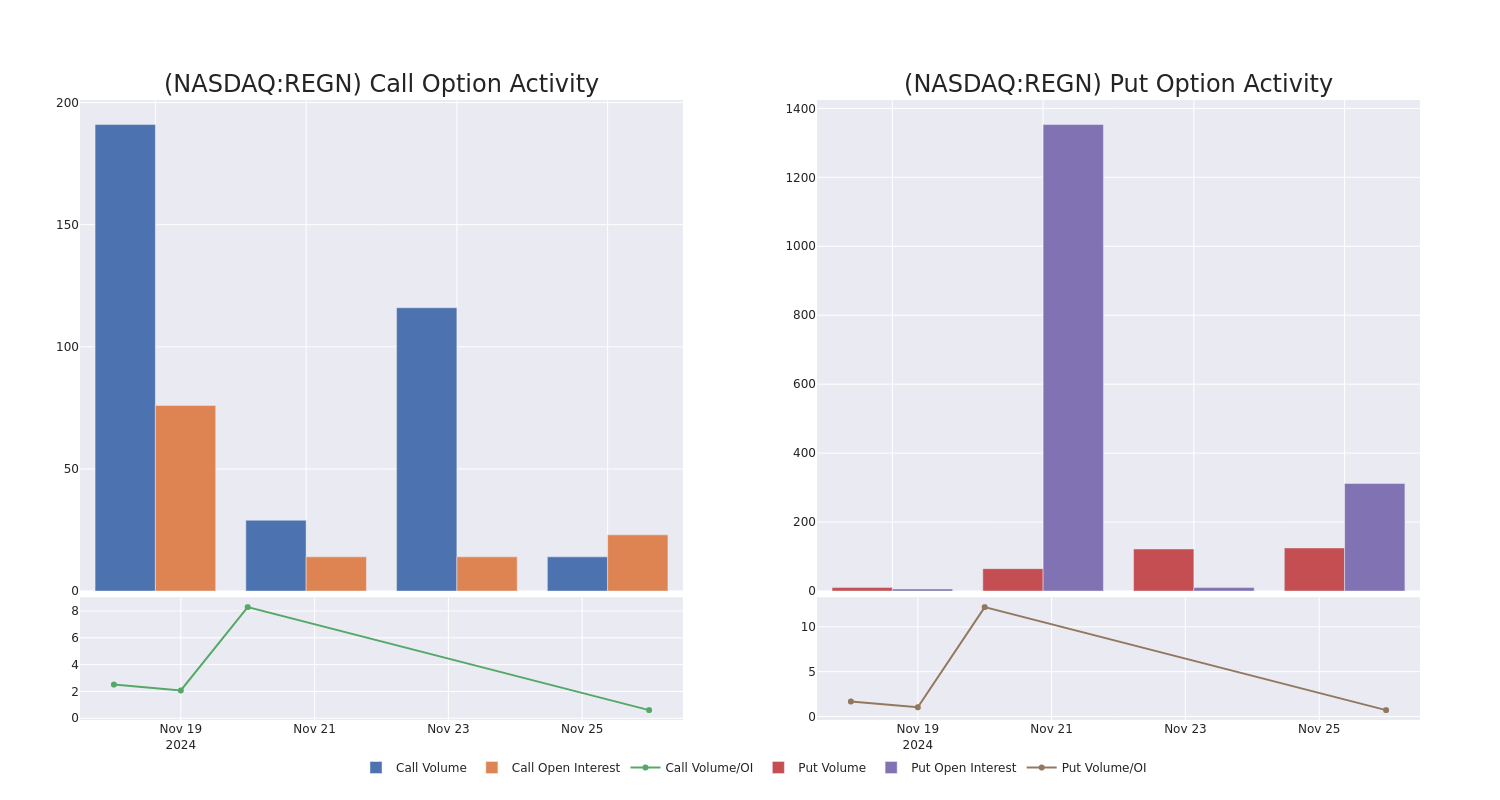

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Regeneron Pharmaceuticals's whale activity within a strike price range from $700.0 to $800.0 in the last 30 days.

Regeneron Pharmaceuticals Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| REGN | PUT | SWEEP | BEARISH | 05/16/25 | $78.7 | $78.3 | $78.7 | $780.00 | $173.0K | 102 | 22 |

| REGN | PUT | SWEEP | BULLISH | 12/19/25 | $60.0 | $58.3 | $58.3 | $700.00 | $104.9K | 210 | 103 |

| REGN | PUT | SWEEP | BULLISH | 12/19/25 | $60.0 | $57.9 | $57.9 | $700.00 | $98.4K | 210 | 103 |

| REGN | PUT | SWEEP | BULLISH | 12/19/25 | $60.0 | $57.9 | $57.9 | $700.00 | $92.6K | 210 | 103 |

| REGN | PUT | SWEEP | BULLISH | 12/19/25 | $60.0 | $58.3 | $58.3 | $700.00 | $81.6K | 210 | 103 |

About Regeneron Pharmaceuticals

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including low-dose Eylea and Eylea HD, approved for wet age-related macular degeneration and other eye diseases; Dupixent in immunology; Praluent for LDL cholesterol lowering; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and Crispr-based gene editing (Intellia).

In light of the recent options history for Regeneron Pharmaceuticals, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Regeneron Pharmaceuticals's Current Market Status

- With a trading volume of 444,007, the price of REGN is down by -0.82%, reaching $743.4.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 66 days from now.

What The Experts Say On Regeneron Pharmaceuticals

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1116.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Truist Securities has decided to maintain their Buy rating on Regeneron Pharmaceuticals, which currently sits at a price target of $1126. * An analyst from Citigroup downgraded its action to Neutral with a price target of $895. * Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Regeneron Pharmaceuticals with a target price of $1215. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Regeneron Pharmaceuticals with a target price of $1195. * In a cautious move, an analyst from Wolfe Research downgraded its rating to Outperform, setting a price target of $1150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Regeneron Pharmaceuticals, Benzinga Pro gives you real-time options trades alerts.