The average monthly rent being asked in London has hit a new record high of £2,142 per month, according to Rightmove

The property website said rents in the capital increased by 10.9% annually in the fourth quarter of 2021.

The average asking rent in London is three percent higher than at the start of 2020, it added.

The capital had experienced a drop in average asking rents in 2020.

Tenants were looking for more space away from cities during lockdown, flats temporarily fell out favour, and landlords offered tenants willing to stay cut-price rents.

The imbalance between supply and demand is set to continue until more choice comes onto the market for tenants, which has led to our prediction of a further 5% increase in average asking rents in 2022

But more recently, London’s popularity has been returning and landlords have been able to negotiate higher rents for the new year.

In inner London, asking rents jumped by a record 16.2% annually in the fourth quarter of 2021 to reach £2,577 on average.

They recovered from a 14% drop at the start of 2021 to also rise just above pre-pandemic levels for the first time.

Meanwhile, the average monthly rent being asked outside London has jumped by a record 9.9% annually.

Across Britain the average asking rent excluding London is £1,068 per calendar month.

Rightmove said the 9.9% annual jump is the biggest on its record, which goes back to 2011.

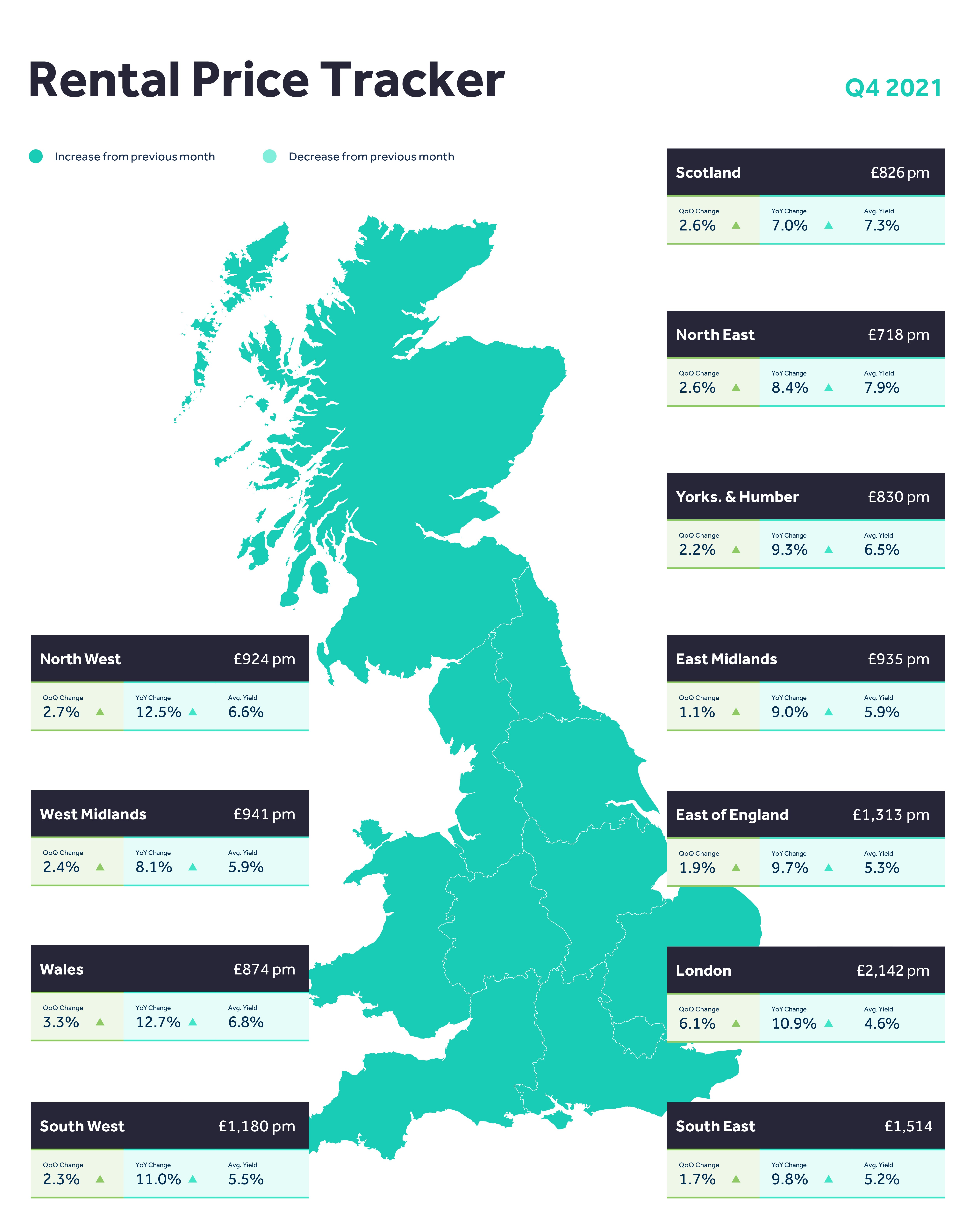

Wales (12.7%), the North West of England (12.5%) and the South West of England (11%) led the way for annual growth in asking rents.

Pontypool in Monmouthshire, Wales, recorded the biggest annual increase in asking rent of any local area, with rents jumping by a fifth (20%), from £562 per month to £674 per month.

In Scotland, asking rents rose by seven percent annually to reach £826 per month on average.

The rises will put a further squeeze on tenants already struggling, with soaring bills as living costs bite.

Some landlords have also seen their incomes squeezed and may now be increasing their rents in response.

A separate study released by the Landlord Works, a platform launched by Nationwide Building Society to help landlords, found one in four (25%) have raised rents to help cover increased tax burdens.

And more than a quarter (26%) of landlords with portfolios of 20 or more properties told the survey they have cut the number of properties they hold in order to reduce the tax impacts.

Meanwhile, a poll for the National Residential Landlords Association (NRLA) found that, between March 2020 and September 2021, 23% of private landlords surveyed in England and Wales had lost rent due to the impact of Covid-19.

Some had agreed rent cuts with tenants, while some had experienced issues with unpaid rents and others had seen an increase in empty properties.

Among those who had lost rental income as a result of the pandemic, the majority (54%) reported losing up to a fifth of their income across their portfolio.

Rightmove’s director of property data Tim Bannister said: “2020 was defined by the race for space outside of cities, as tenant priorities changed and many moved further out looking for a larger property with green space, or temporarily moved back in with family.

“London was perhaps the biggest example of this, where landlords significantly decreased asking rents by the end of the year to encourage tenants to stay in the capital. A year on, asking rents have finally risen beyond pre-pandemic levels, a sign that the capital has not lost its pull and popularity with renters as landlords look to renegotiate previous cut-price terms.

“Tenant demand continues to be really high entering the new year, meaning the imbalance between supply and demand is set to continue until more choice comes onto the market for tenants, which has led to our prediction of a further five percent increase in average asking rents in 2022.

“Landlords understand the importance of having a good, long-term tenant, and there is a limit to what renters can afford to pay, which will prevent rents rising at the same rate we’ve seen over the past year.”

Marc von Grundherr, director of London estate agent Benham and Reeves, said: “The London rental market is drastically different to that seen in 2020…

“In fact, the surplus of available rental stock that accumulated due to the pandemic has now plummeted and this has been driven by a staggered return to the workplace and, in particular, a huge influx of demand from overseas students.

“We’ve also seen a huge increase in the number of tenancy renewals which have even exceeded 2019 levels, and so while some areas are yet to see rental values return to the pre-pandemic norm, it’s only a matter of time as the market looks set to continue to this strong return to form throughout 2022.”