The average rent being asked across Britain, excluding London, has hit a record of £1,126 per calendar month, according to a property website.

The average monthly rent being asked is 11.8% higher than a year earlier, Rightmove said, adding that the average rent is now 19% or £177 per month higher than when the coronavirus pandemic started.

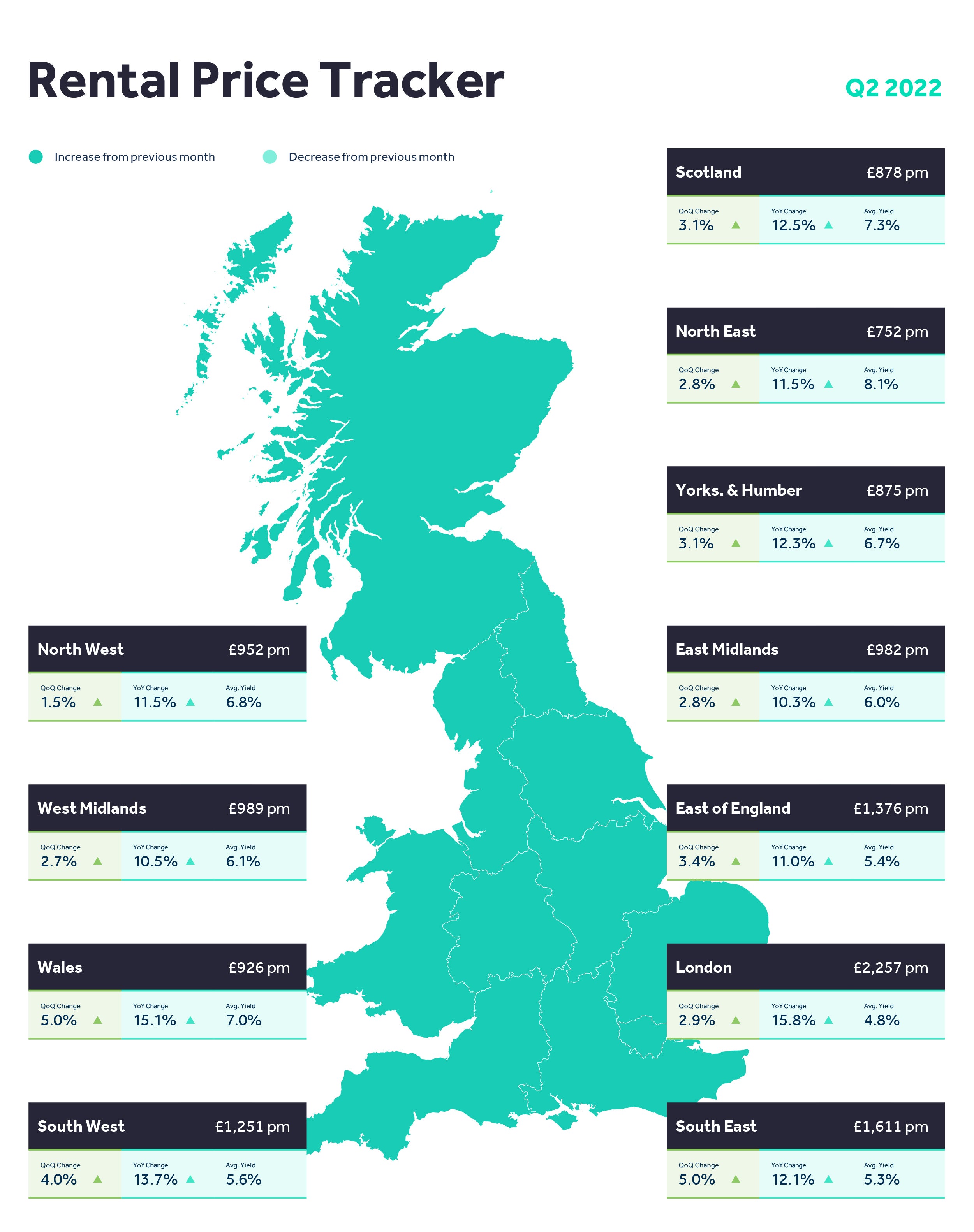

Asking rents in London have surged by 15.8% over the past year, pushing the average asking rent there to a record £2,257 per month, according to Rightmove, whose latest figures cover the second quarter of 2022.

Rising rents continue to be driven by a shortage of available rental stock, although there have been some recent signs of improvement, the website added.

June saw the highest number of new rental listings coming to market of any month this year so far.

Despite this, the available rental stock is still down by 26% compared with last year’s levels, while demand is up by 6%, which means competition between tenants remains extremely fierce, Rightmove said.

Rightmove’s director of property science Tim Bannister said: “The story of the rental market continues to be one of high tenant demand but not enough available homes to meet that demand.

“Last year, we saw exceptional numbers of tenants looking to move and this year we have seen no let-up in this trend.

“Whilst stock levels are beginning to improve, with June seeing the highest number of new rental listings coming to market so far this year, the wide gap that has been created between supply and demand over the last two years will take time to narrow.

“Until then, this imbalance will continue to support asking rent growth. This has led to our revised forecast of (an) 8% rise in asking rents by the end of the year, up from 5%.”

Rightmove also quoted the views of property professionals.

Nicola Fleet-Milne, CEO at FleetMilne in Birmingham, said: “Quarter two 2022 has seen a sharp increase in rental prices in Birmingham city centre; a hangover of the stifled growth throughout the pandemic.

“Couple this with a lack of good quality stock, and the result is an applicant base looking for homes six to 10 weeks in advance of their need.”

She added: “Older stock is falling dramatically behind the standards of the new units coming through, and whilst initially, they may demand similar rents, as more developments complete, the older stock may be relegated to a markedly lower price band.”

Richard Davies, MD of Chestertons, said: “Throughout quarter two of this year, London’s rental market has seen continuous growth in tenant inquiries as well as in the number of tenants extending their rental agreements.

“Those who secured a property at a discounted rental rate during the pandemic are keen to hold on to this deal as long as possible, particularly in the face of rising living costs.”

He added that with the return of office workers, international students and corporate tenants alike, the rental market in London is seeing demand outstripping supply.

Mr Davies said: “This has created an extremely competitive market for tenants where many offer landlords over asking price in order to secure a property.”