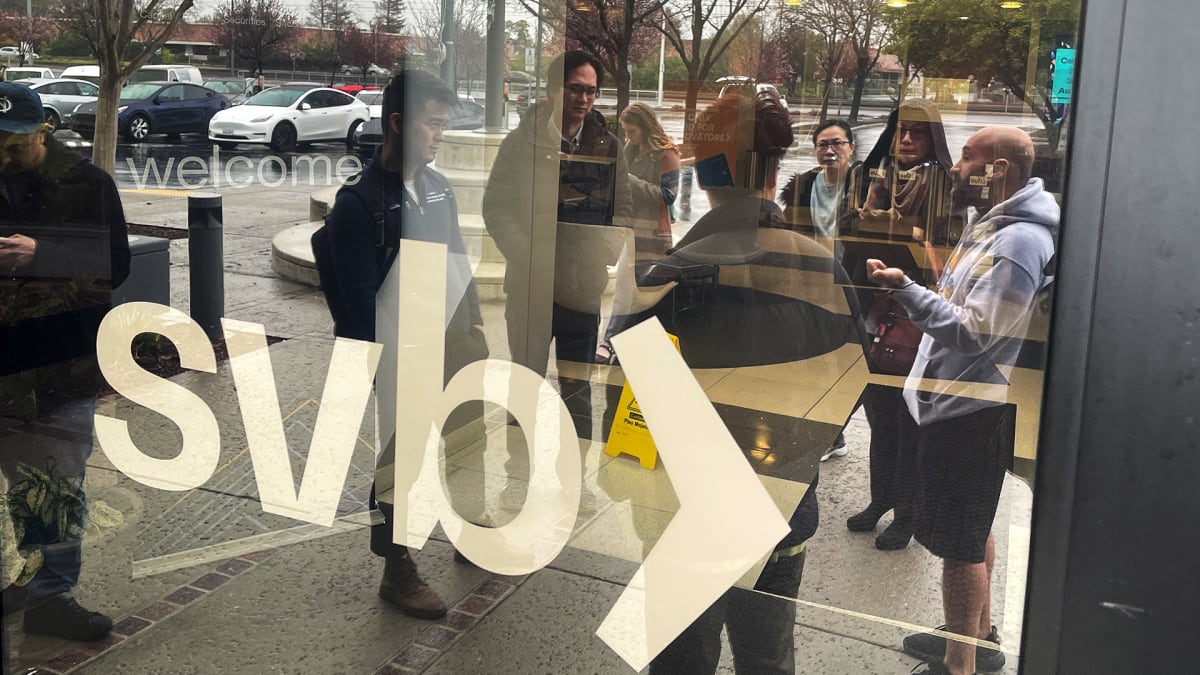

When Silicon Valley Bank (SIVB) collapsed after a drop in investment values and subsequent bank run in March 2023, the government stepped in to rescue affected customers — even those who stored more than the $250,000 cap covered by insurance.

In a remarks from President Joseph Biden and Treasury Secretary Janet Yellen, the White House said that the move was going to help small business owners "breathe easier knowing they’ll be able to pay their workers and pay their bills."

DON'T MISS: Why The Government Bailed Out Silicon Valley Bank

The controversy came when, on the morning of June 23, the Federal Deposit Insurance Corporation (FDIC) accidentally revealed a document showing that those who benefited from the rescue also included tech giants.

Government Bailout of SVB Benefited Tech Giants, Accidentally Published Document Shows

A document that the government agency accidentally sent in unredacted form to Bloomberg News shows that Sequoia Capital held $1 billion of its $85 billion in assets at SVB.

The Silicon Valley-based investment firm rose to prominence with early investments in tech firms such as Apple (AAPL) and PayPal (PYPL) in the 1990s and, more recently, Swedish fintech company Klarna and Turkish grocery startup Getir.

Kanzhun, the company behind large Chinese recruitment platform Boss Zhipin, held $903 million at SVB. Life Sciences giant Altos Lab, Inc. held approximately $680.3 million while streaming box company Roku held roughly 26% of its cash assets, or $420 million, at the bank – a fact that it revealed publicly in March.

According to Bloomberg News, the FDIC sent them the document with this information after they filed a Freedom Of Information Act request but failed to redact information about some of these large clients as intended.

The government agency then asked Bloomberg to not publish the documents that "included confidential commercial or financial information" sent in error but Bloomberg did so in full on its website.

FDIC 'Intended to Partially Withhold Some Details'

"The FDIC, which has been selling off pieces of the bank since its failure, asked that Bloomberg destroy and not share the depositor list, saying the agency intended to 'partially' withhold some details from the document," reporters Lizette Chapman and Jason Leopold write.

Neither the FDIC nor named companies like Sequoia and Kanzhun have been commenting on the information the document revealed. Marqeta, a payments startup that held $634.5 million at the bank, acknowledged that it held significant deposits at SVB to Bloomberg but said in a statement that its "ability to execute as a business and meet our financial obligations would not have been impacted."

The FDIC formerly revealed that it expected to spend $16 billion bailing out SVB customers, which it expected to recoup by increasing the fees it charges banks. The rest of the banking world is still observing reverberations that the collapse had on the economy.

While the accidental leak is generating less scandal than the original news of the bailout, the reveal is embarrassing for the agency given that some have been pushing back against the current administration's story about protecting small businesses and ordinary American workers.

Back in March, former Vice President Mike Pence wrote a Daily Mail op-ed saying that "Americans will also be paying to guarantee the deposits of many Chinese companies that were SVB customers."