YouTuber Jeff Geerling recently flew over to the UK to sit down with Raspberry Pi CEO Eben Upton for a chat about shortages, predictions, the Raspberry Pi Pico and other hot topics. The short of it is that stock levels are improving, close to Upton's 2022 prediction and that we are now seeing better stock levels than 2022 as Raspberry Pi slowly catches up with the backlog. Upton explained the reasoning behind prioritizing OEM customers over consumers, and addresses some of the negativity that was levied on Raspberry Pi by a minority of the passionate and vocal community.

The video starts with Geerling candidly explaining that his trip to the UK was not funded by Raspberry Pi, rather it was funded via sponsorship and Patreon supporters. With that out of the way Geerling covers a series of topics with Upton, and we've been through the video and pulled out the key points, with timestamps for you to listen to.

Shortages, the Backlog and Predictions

You will have noticed that Raspberry Pi has been in short supply since the pandemic hit. Resellers, which once had a plentiful supply ,were forced to use varying methods to restrict sales. Geerling asks Upton about this period of attrition and Upton remarks "people came into this shortage situation holding lots and lots and lots of Raspberry Pi's already.

So to some extent, for a limited period of time, people can survive a transient shortage by just as a company might survive a transient shortage by having some buffer of supplies and buffer of inbound componentry, so a hobbyist can survive for a period of time by using the Raspberry Pis they already have." Upton then continues with a story of Reddit posts claiming that hobbyist users "stock" of Raspberry Pi was dwindling down as they created more projects. It seems that this period of attrition is only temporary.

Geerling asks Upton about his November 2022 predictions. Predictions that stated that Q2 and Q3 of 2023 would see improved stock levels, and from Q4 that stock should return to pre-pandemic levels. Upton broadly confirms Geerling's question, and then remarks that "quarter one this year (2023) was our worst quarter in terms of productions and shipment. Partly because we pulled quite a lot of production into the Christmas period because we wanted to build out a reasonably good Christmas. Quarter one this year (2023) was our lowest output quarter, I think since Q3 of 2015. We did about 750,000 to 800,000 units in Q1 2023."

Upton then explains that it has been some time since Raspberry Pi produced such a low number of units, remarking that it is incredible to think that 750,000 to 800,000 units is seen as being "not many Raspberry Pi". Upton continues his remarks with the public misperception that because there are no Raspberry Pis available for purchase, that none are being made. Upton counters this perception stating that "in a bad quarter, you're not far off making 10,000 Raspberry Pis a day"

But 10,000 Raspberry Pis per day is still only partly feeding the backlog which has grown during the global supply chain issues and pandemic. Both industrial and individual customers have been waiting for their supply of Raspberry Pi. Upton states that this quarter, supply is moving towards becoming a "really healthy level" and that even "large amounts of production just get swallowed up by backlog."

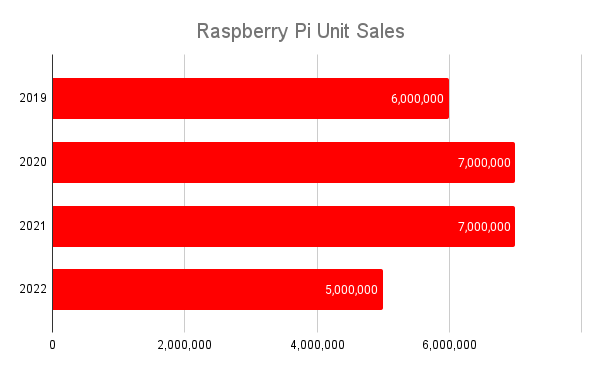

Geerling presses Upton to put a figure on the volumes once the supply and demand for Raspberry Pi equalizes. Upton, candidly answers "I don't know how big my business is. I've been in constraint for two years". Upton then provides volume data for 2019 (six million units), 2020 (seven million) with 2020 being "a strange year, but it was unconstrained year for us (Raspberry Pi)." Upton reveals that "we normally run about a half million in backlog which is about a month's backlog...we went into 2020 with a half million backlog, went into 2021 with a half a million backlog, came out of 2021, having sold another seven million units, with a 4.5 million backlog (of Raspberry Pi)."

Later Upton reveals that in 2022, Raspberry Pi made five million units. For 2023, things are starting off in Q1 with around 750,000 to 800,000 units, which Upton states is "an annualized rate of barely three million units." He later explains that in 2023 they "probably have capacity to do a 10 million unit year, if we have to, we probably won't have to, we could do a 10 million unit year, if we did a 10 million unit year, more than nine million of that would be packed into the last nine months of the year."

Upton is confident that Raspberry Pi are where he predicted they would be. "A fairly lousy first quarter. A second quarter which would be about two million units, which is a pre-pandemic quarter, which is great, but obviously still catching up the backlog. Then a third and fourth quarter which are broadly speaking, unconstrained. Certainly by chip supply, you actually will eventually hit factory manufacturing capacity limitations. I expect that we will have satisfied, wound down all of our backlogs and got everything into general availability before we bump into a factory capacity limit."

Raspberry Pi Zero 2 W Back for Good?

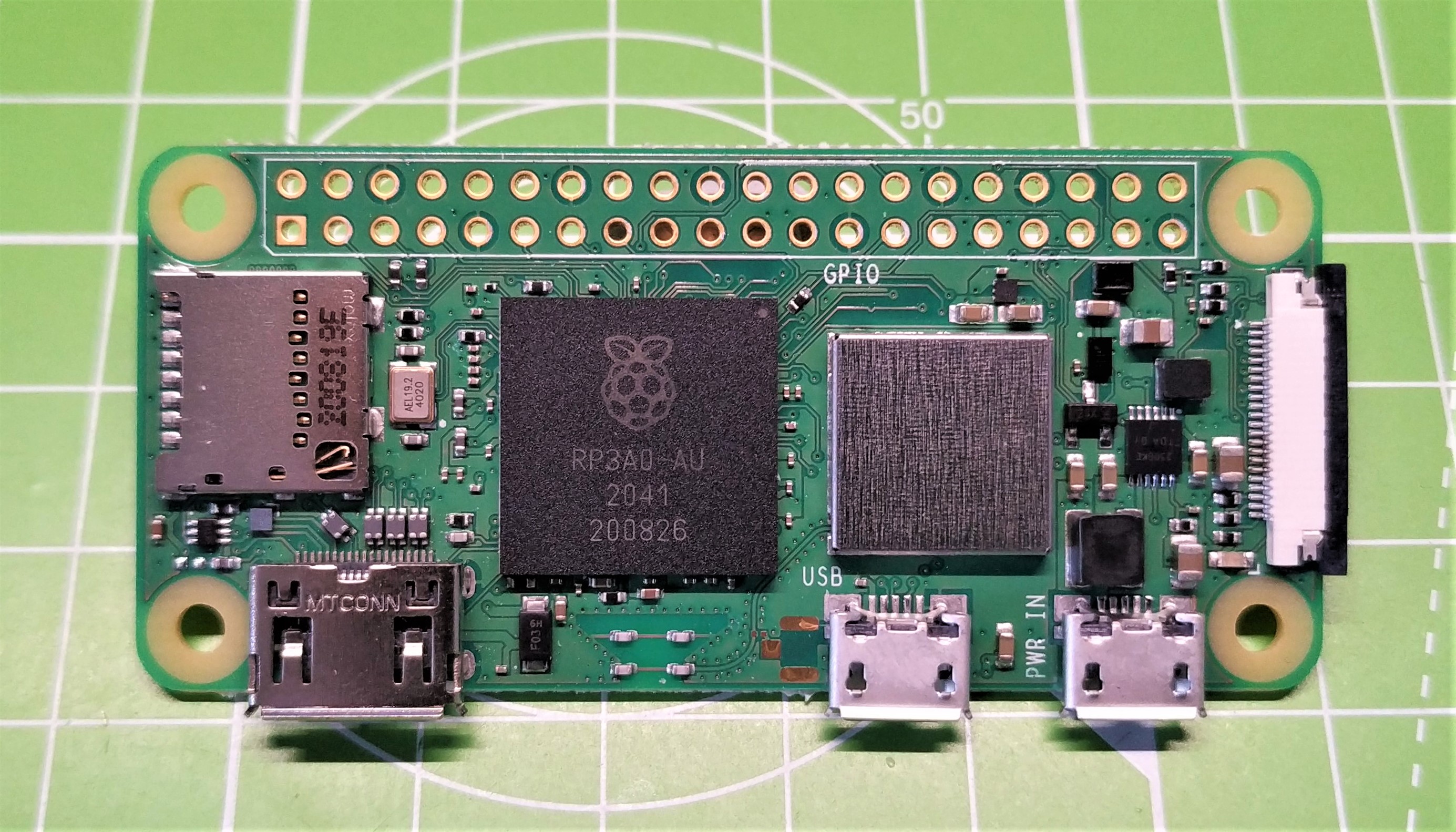

Geerling and Upton discuss the stock of Raspberry Pi 3A+, an older board with similar performance to the Raspberry Pi Zero 2 W which uses a new SoC (RP3A0). The Zero 2 W was released in 2021, but it has largely been out of stock since it was launched.

At the eight minute mark, Upton believes there is a reasonable chance that the Zero 2 W may come back into stock, for good. Older Raspberry Pi Zero boards have seen better availability, but the Zero 2 W has sadly not, largely down to the impact of the supply chain and pandemic. Upton seems confident on Zero 2 W supply: "We actually got a lot of wafer supply and manufacturing test capacity for that (Zero 2 W) now," he said.

Upton elaborates that the Zero 2 W was "a child of the shortage" as it arrived in late 2021, just as the shortage took hold. This shortage also meant that it has yet to see demand from industrial customers. "It's too young and for most of its life it been very supply constrained. So it hasn't accumulated industrial demand. So all of that supply, that's hundreds and thousands of units will all go into hobbyist and education, explains Upton. The original range of Zero boards have more interest from industrial customers, given their maturity. Upton then explains that the Raspberry Pi 3A+ will likely stay in stock, with Raspberry Pi Zero and Zero 2W supply and demand shifting as time progresses.

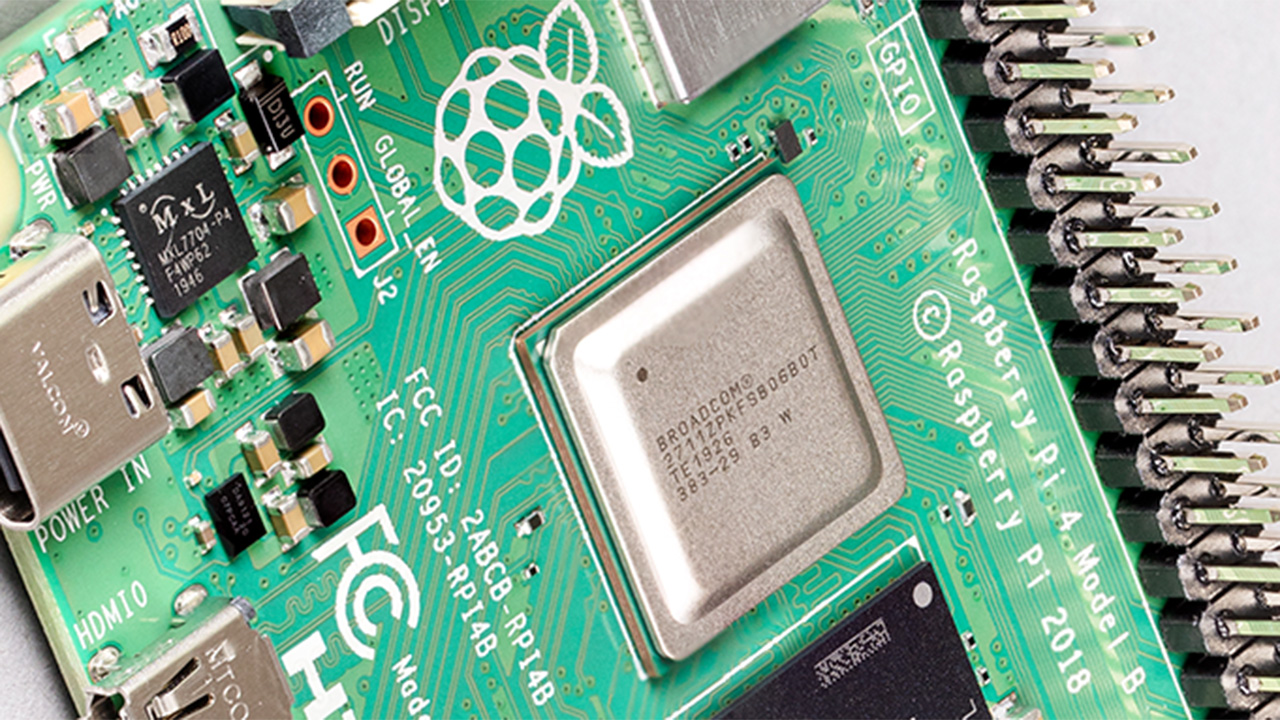

What About The Raspberry Pi 3B, 3B+ and 4?

What about the Model B boards? The Raspberry Pi 3B, 3B+ and the flagship Raspberry Pi 4? Upton believes that we will start to see "substantial sort of recovery in 3B and 3B+ and then in Pi 4 towards the end of this quarter."

Geerling then talks directly to the camera, clarifying that Upton's predictions were largely correct. This is good news for all of the Raspberry Pi fans who have been eagerly waiting for their favorite SBC. In the UK both The Pi Hut and Pimoroni have seen stock of the Raspberry Pi 4, with units lasting over 24 hours. This is largely down to anti-scalping practices. In the case of Pimoroni, it requires users to have an account with them, created months in advance, and to have made a purchase. The Pi Hut went with a simple "one Pi per customer" approach.

A Vocal Community

Some members of the community have been vocal in their disappointment with stock levels, some even stating that they are switching away from the Raspberry Pi. Upton believes that the anger is completely understandable and that it was the "single hardest decision I've ever had to make in my business career[.]" Upton continues "It's extremely hard to decide when you are a hobbyist, as I am, and you built this thing (Raspberry Pi) for hobbyists and education, to prioritize a different market (industrial customers).

Upton then explains that OEM customers are mainly 3,000 boards per year, with between one to ten employees who build some specific product using the Raspberry Pi and cannot use an alternative SBC. If these customers do not have access to Raspberry Pi, then they are likely to "go to the wall". Upton then explains "So the real question, when people are saying, 'Should you do this prioritization call?' is 'Should I zero some of those customers or constrain them so heavily that they go out of business or take very serious damage?'. It didn't feel like the moral thing to do."

Upton then explains that it felt like Raspberry Pi were doing the right thing, or hoped that community members would give them the benefit of the doubt. But Upton is aware that some members will be permanently disgruntled. Upton clarifies the misconceptions that Raspberry Pi are not making boards, they are, they are just not making enough. The second misconception being that Raspberry Pi are favoring large customers (Upton uses IBM as an example) over the communtiy, when in reality it is the smaller OEM customers who are the median customer base. Upton concludes by saying that they are looking forward to now making that judgment call anymore.

Upton then discusses a "What if?" scenario which sees Upton talk about planning for the shortages if there had been forward sight of both the shortage and the pandemic. Plans to actively manage the supply would've been enacted earlier, and OEM customer needs would be understood early on.

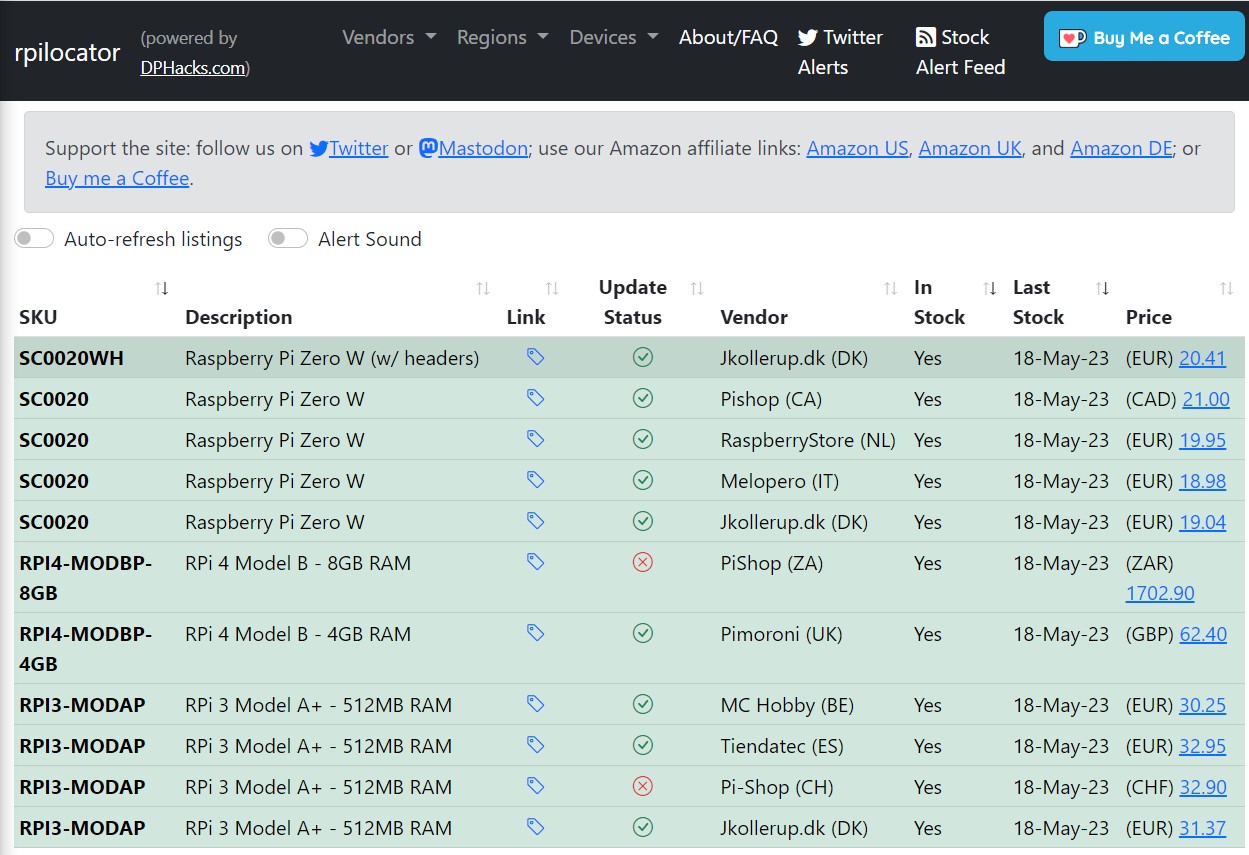

It seems that Upton's predictions are largely on track, and we should soon see more Raspberry Pi boards in stock via our favorite resellers. In recent weeks there has been better stock levels across the world, as tracked via rpilocator. We took a quick look as we wrapped up this story and we can see that there is stock of Raspberry Pi 4 in the UK and South Africa. Pi Zero W is in stock across Europe, as are the Raspberry Pi 3A+. Things are looking much better in 2023!