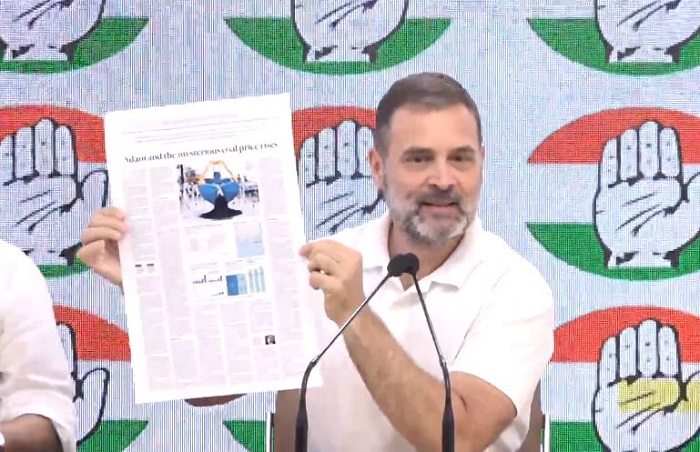

New Delhi: Citing UK-based newspaper, Financial Times which claimed that the Adani Group was purchasing coal above its market value from Asian countries, Congress leader Rahul Gandhi on Wednesday alleged that it is due to this reason for prices of electricity in country are getting inflated.

Addressing a press conference in Delhi, Rahul Gandhi alleged,"In a report from the famous Financial Times, London, Now we know that Adani Group has committed another fraud of Rs 12,000 crore. So now the total corruption of the Adani Group stands at Rs 32,000 crore. They overinvoice their coal imports, and when the coal enters India, its price changes leading to surge in electricity prices. These Rs 12,000 crore are getting paid from the pocket of common masses."

Emphasising that Congress is already providing subsidy in Karnataka, Rahul Gandhi said," We are also ready to provide subsidies in Madhya Pradesh. No media has an interest in this story.

No one is interested in asking questions from the Adani group.

This cannot happen without protection being provided from Prime Minister. Adani buys coal in Indonesia, and by the time the coal arrives in India, its price doubles. Our electricity prices are going up."

Rahul Gandhi further alleged that Adani Group is involved in a direct theft of the public money."This time the theft is happening from the pockets of the public.When you push the button for a switch, Adani gets money in his pocket.Enquiry is happening in different countries, and people are asking questions, but nothing is happening in India," he said.

Earlier last week, the Adani Group had said there is a renewed attempt by the UK based newspaper Financial Times and its collaborators to rehash old and baseless allegations to tarnish the name and standing of the Indian business conglomerate.

In a media statement, Adani Group said on October 9 that these articles were part of an extended campaign to advance vested interests under the guise of public interest.

"Continuing their relentless campaign, the next attack is being fronted by Dan McCrum of the Financial Times, who jointly with the OCCRP put out a false narrative against the Adani Group on 31 August 2023. The OCCRP is funded by George Soros, who has openly declared his hostility against the Adani Group," the Adani Group statement said.

Having failed earlier, the UK daily is making another effort to financially destabilise the Adani Group by raking up an old, baseless allegation of over-invoicing of coal imports, the statement added.

Adani Group said in the case of Knowledge Infrastructure, one of the 40 importers mentioned in the General Alert Circular, the DRI's Show Cause Notice alleging over-valuation in the import of coal was quashed by the appellate tribunal (CESTAT).

The question of over-invoicing price manipulation does not arise, it noted.

Meanwhile, when asked why he was not raising questions about Sharad Pawar's meeting with Adani despite INDIA alliance being united on Adani issue, the Congress MP said, "I have not asked Sharad Pawar, he is not the Prime Minister of India. Sharad Pawar is not protecting Adani, Mr Modi is and that's why I asked Mr Modi this question. If Sharad Pawar was sitting as PM of India and protecting Adani, then I would be asking Sharad Pawar this question"

Earlier this year, an American short seller Hindenburg Group had launched an attack on Adani Group in January this year through a report that allegedly claimed accounting fraud, stock price manipulation and improper use of tax havens.Post the Hindenburg report, the group had erased close to USD 150 billion in its market value.

Adani Group has been denying all allegations since the beginning of the controversy. The Adani Group had then attacked Hindenburg as "an unethical short seller", stating that the report by the New York-based entity was "nothing but a lie". A short-seller in the securities market books gains from the subsequent reduction in the prices of shares. (ANI)