Quicken has been around for many years, with budget management roots that date all the way back to 1983. Thankfully, that means it continues to undergo transitions that keep it reassuringly relevant. It also comes with the added benefit of being available as software that will work on a Windows machine or a Mac too, alongside its mobile-based counterparts.

In fact, Quicken undergoes constant updates and is currently available in Simplifi or Classic (Premier or Deluxe) editions. The former option is aimed at folks who prefer a mobile or web app approach for keeping their finances in order. Either way, here's a continually improving interface along with a raft of features that allows users to exploit the power of the latest Apple OS, as well as the option of using it as a mobile or desktop application plus Windows too.

Whilst Quicken does have some rather more sprightly competitors these days, it’s still a super-useful finance management package. Add on other practical features such as the optional ability to synchronize it with your bank accounts, 256-bit security encryption plus cloud-based back-ups and there’s lots to like.

Lookout for the likes of Mint, You Need a Budget (YNAB), Banktree, Money Dashboard or Moneydance if you want to check what some of the competition has to offer.

- Want to try Quicken? Check out the website here

Quicken: Pricing

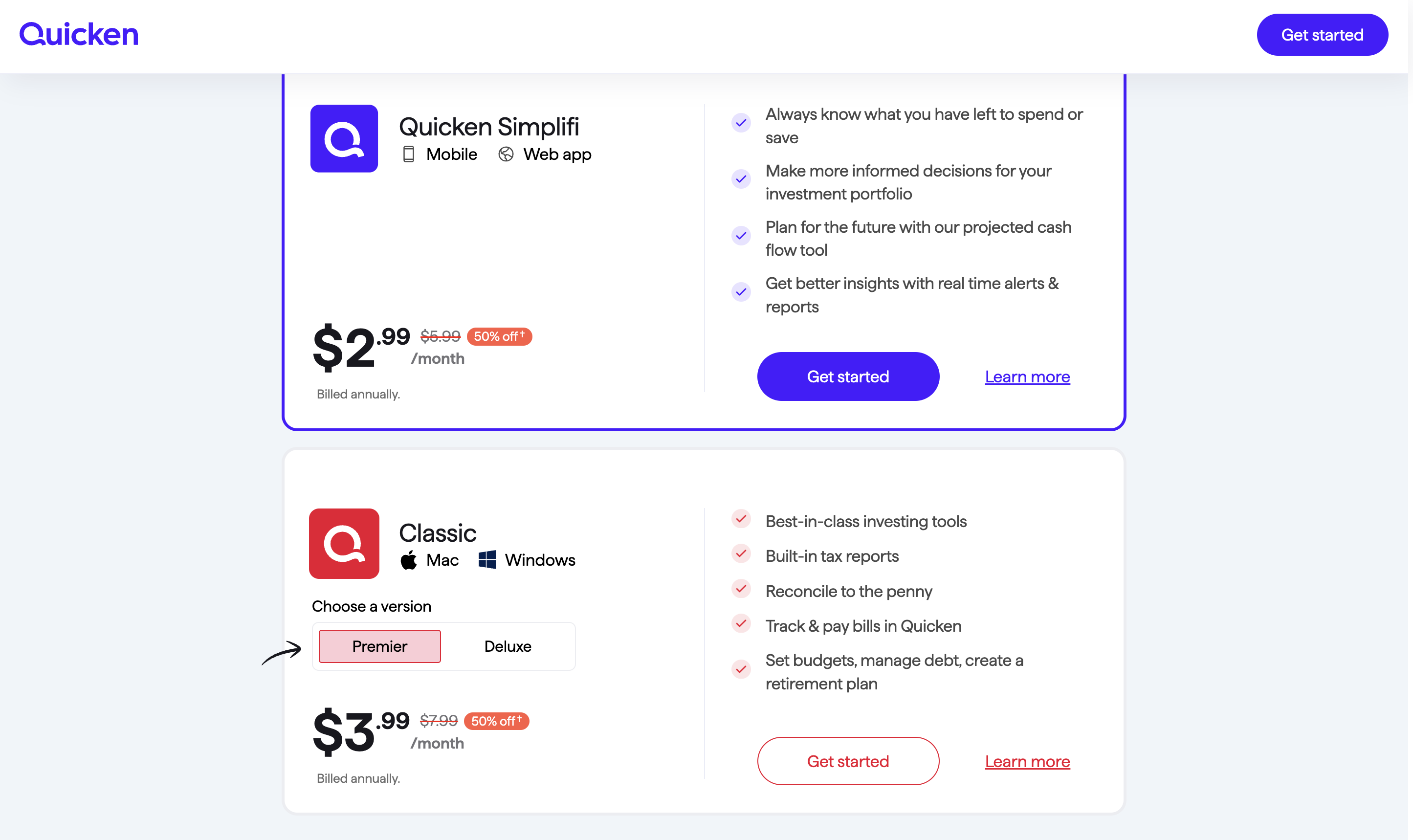

Currently prices for Quicken Simplify kick off at $2.99 per month (50 percent off), with a Quicken Classic version (Premier) currently on offer for $3.99 (50 percent off). The Quicken Deluxe edition is currently $4.99 a month (16 percent off).

You should note, however, that while the prices were accurate at the time of writing they may well change as per all of our other software reviews. Nevertheless, Quicken comes in with a reasonably attractive pricing structure, even if you’re considering the product at its more normal cost.

Quicken: Features

The most recent update of Quicken resulted in a few handy new features being added, with some real benefits coming along in the Mac version. You’ll find that it works better on that platform now, more so than it used to, while all users can enjoy the benefits of the familiar-but-friendly interface.

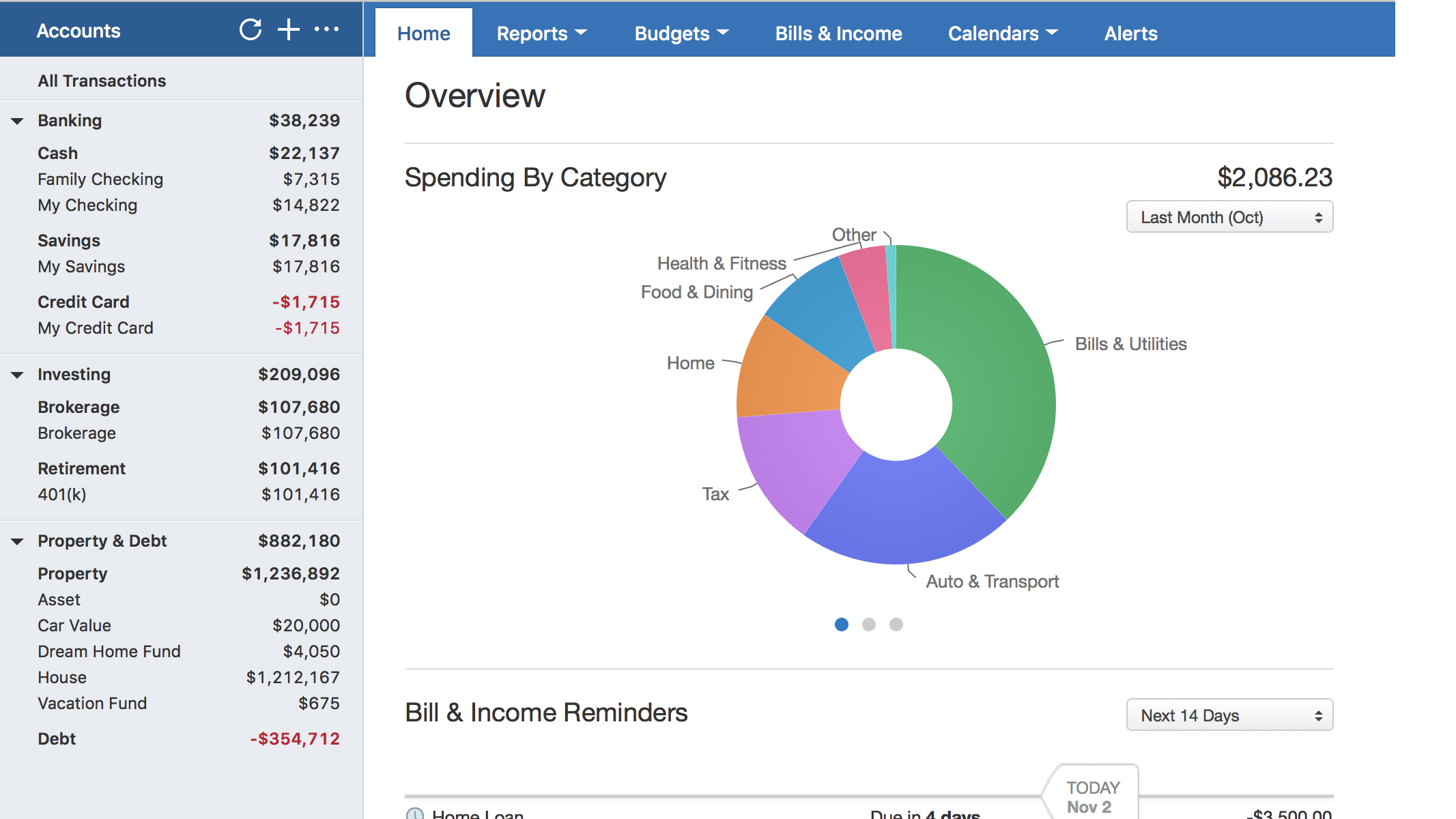

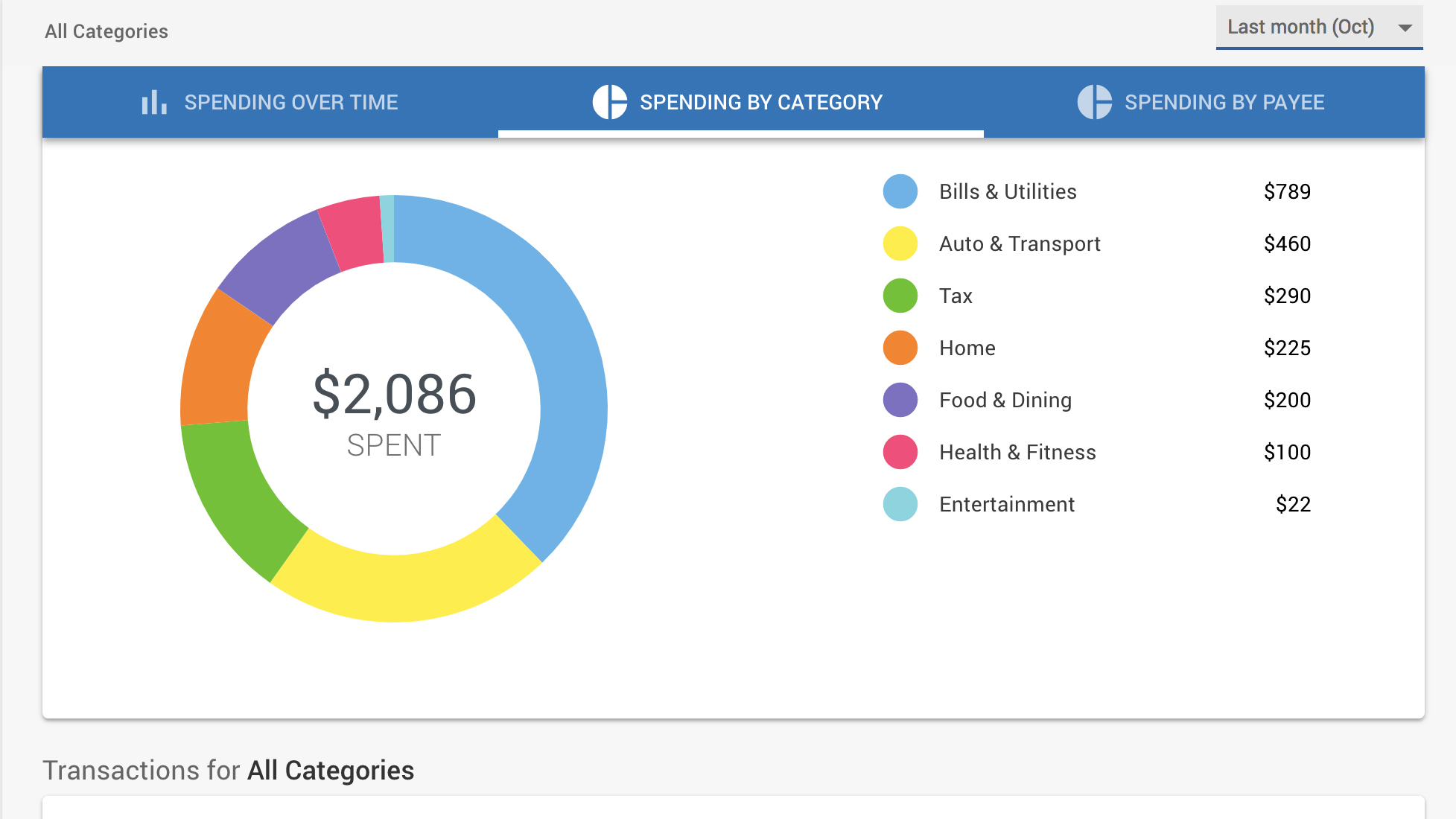

You’ll begin your financial journey on the Home tab, which delivers a comprehensive snapshot of where you are with your finances. For newbies there is also a neat Wizard-style system that will help you pick your way through getting set up. Of course, once you’ve got a lot of your data into Quicken the processes involved in managing your money gets easier.

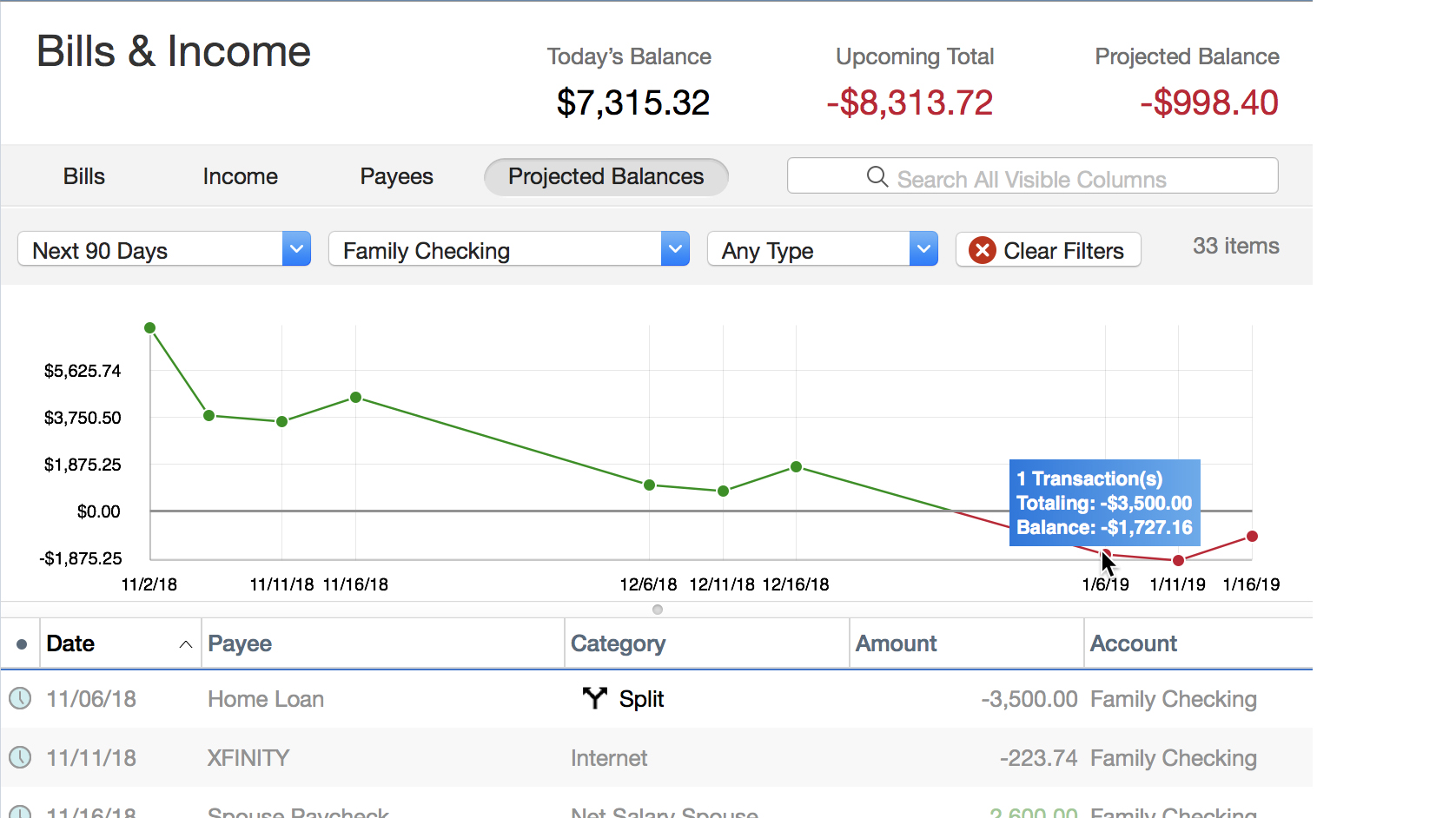

There are core areas that help build up a picture of your money situation, with a Spending tab, Bills and Income section and so on, all of which are pretty easy to get the hang of. Customization of these areas is also key by allowing you to make Quicken completely personal to your needs.

Quicken: Performance

One of the more appealing aspects in the latest incarnation of Quicken is that it can be used as an online-only solution if you prefer. This is good news for anyone who tends to flit from one machine, or device, to another and lacks the inclination to start downloading software on multiple computers.

As a result, the performance you can expect from Quicken is largely reliant on your internet connection, but if that’s all fine and dandy then you’ll find the software rolls along very nicely. You get less features in this edition however, so for consistent performance and the full suite of tools, features and functions then you’ll still want to go down the downloadable software route.

Quicken: Ease of use

While we do like the multiple options for customization in Quicken, there is a slight downside to this as it can be finicky to get things just how you like them. While usability is generally pretty good, you’ll need to devote some quality time to Quicken in order to shape it to perform as you’d expect.

However, others areas of Quicken are designed with total efficiency in mind, and this works particularly well for the extra touches you get in the Premier edition and upwards. The bill paying option, for example, is a great way of streamlining your outgoings, but we’re also very keen on the alert tools that really do allow you to get your finances in line and keep them that way.

This is especially so when it comes to paying bills on time. You’ll need to sign up for an account to do any of this, of course, but that takes mere moments as indeed does syncing the application with your bank accounts.

Quicken: Support

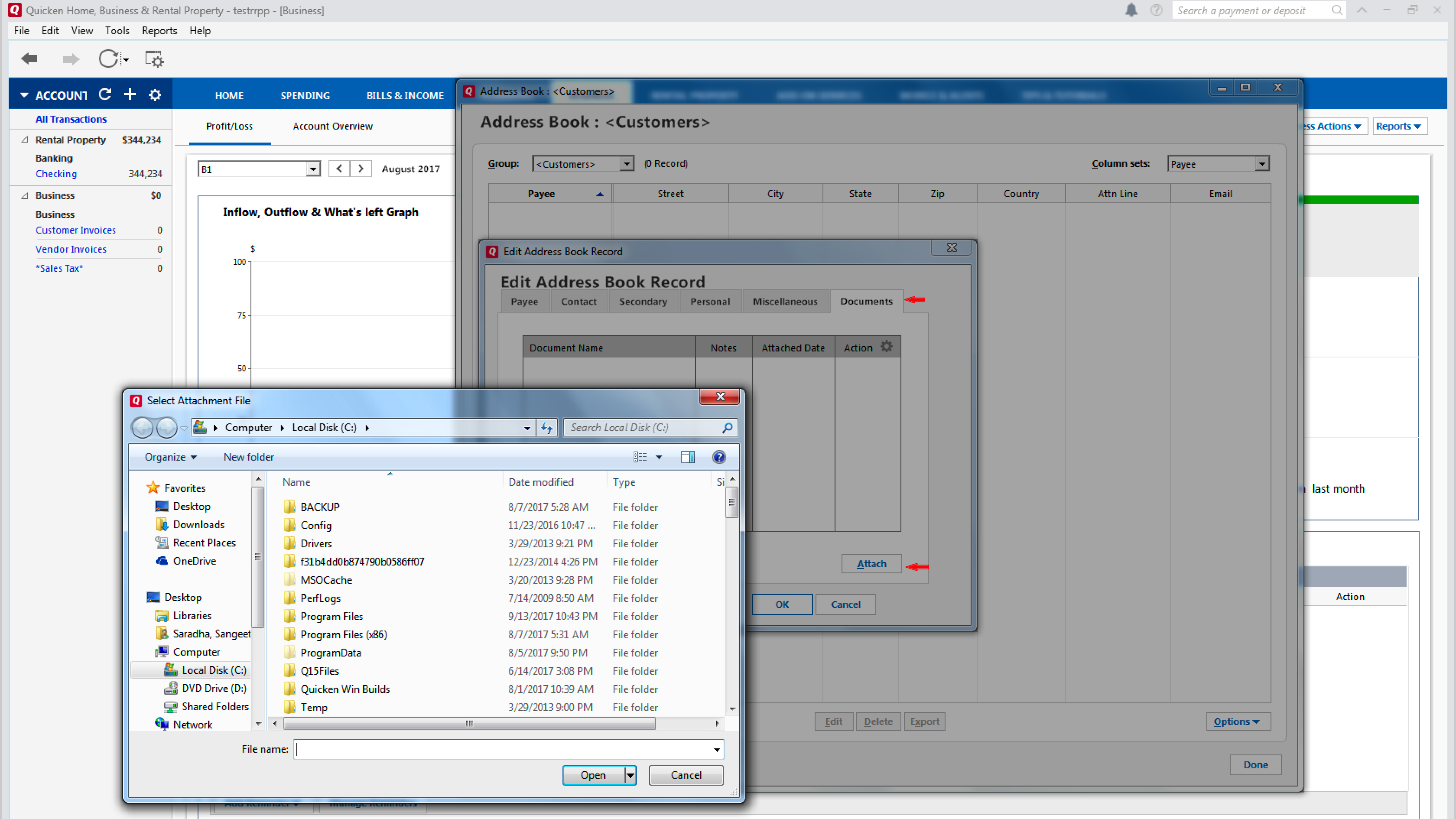

Considering just how long Quicken has been in existence it comes as no surprise to find lots of online advice and video tutorials for getting the best from its charms. Added on to that there are reams of documents that will take you through the inner workings of this occasionally quite complex software.

We also find the community aspect of Quicken quite pleasing, with lots of user experiences that give you a valuable insight into its trickier corners. If you plump for Quicken Premier or above you gain free access to a premium level of phone support for one year.

Quicken: Final verdict

We think that Quicken ticks a lot of the boxes when it comes down to getting your finances into shape. If you’re happy with the subscription costs and you use it a lot then the package seems to represent pretty good value for money. Although we think it will probably deliver most value to small business types with more to think about than individuals with simpler finances to manage.

Much has been done to beef up the interface, features and usability with the current edition. As a result, mobile versions are solid, while the access-from-anywhere option is great for people who need to access Quicken via a browser over multiple machines. A good level of security, powerful syncing with bank accounts and the ability to use cloud-based back-ups adds to the value here.

- We've also highlighted the best budgeting software