Qualcomm is reported to have approached Intel about a potential takeover.

It's uncertain what parts of the business Qualcomm would acquire and if it would pass anti-trust scrutiny.

Qualcomm has reportedly approached Intel with potential plans for a takeover.

That's according to a story that emerged on 20 September from the Wall Street Journal. While no official bid is on the table, the coming together of these two giants of the processor world could completely change the tech landscape.

Qualcomm is best known for its involvement in mobile devices. It powers plenty of flagship phones, while also being heavily invested in connectivity, providing modems and other parts for mobile devices. Intel is best known for powering PCs over many decades. But it's widely known that Intel has been suffering over the past few years, with an industry that's changing direction.

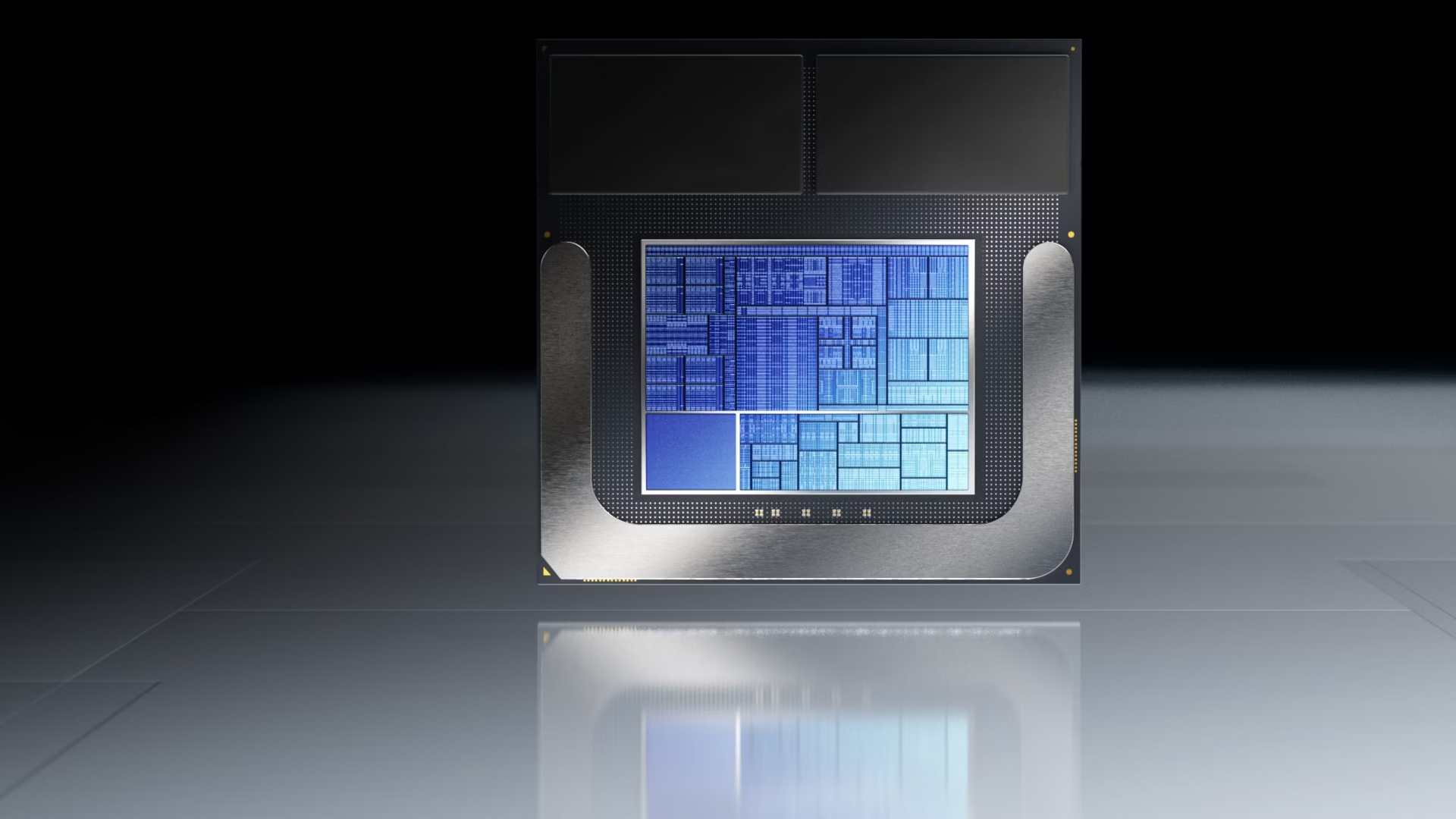

That change sees momentum shifting from the traditional PC market that Intel powered, towards a market that's more power efficient and mobile. That's seen Qualcomm entering the PC space in the big way with hardware like Snapdragon X Series, while Intel attempts to compete with its latest Intel Core Ultra Series 2.

The market is shifting rapidly, however. Qualcomm faces challenges from manufacturers designing their own chips (like Apple) and the potential that Apple could develop its own modem for future iPhone use, for example. Moving into the PC space makes sense for Qualcomm, therefore, and strengthening its offering in the PC segment makes sense.

However, the rumours of this approach draw more attention to Intel, with all eyes on where Intel goes from here.

What could Qualcomm be after?

It's likely that Qualcomm wants to bring more diversity to its business with more potential in PC and data centres, which Intel could bring. Intel also sits on a lot of intellectual property, but Qualcomm might find that it then has to deal with AMD thanks to existing agreements between Intel and AMD surrounding x86 chips. So it's complicated.

Then there's Intel Foundry.

Intel has invested a lot into the foundry business to manufacture chips, but it was already announced by its CEO Pat Gelsinger that Intel Foundary would become an independent subsidiary. The San Diego company has no experience running a foundry so that might be something of a radical move.

More recently it's come to light that Apollo Global Management might be looking to invest $5 billion in the PC chip manufacturer and it might be that these investors are going to end up fighting over the scraps of Intel and picking apart the business.

Then we're likely to see this deal run into regulators. Qualcomm with its dominant position in mobile devices taking over one of the dominant forces in PCs is likely to ring anti-trust / anti-competition alarm bells.

There's no doubt that this interest in Intel is part of a huge shift in the chip business as we've known it for many years. Exactly how this will play out remains to be seen, but it looks like there's a lot more of this story to come.