/Prudential%20Financial%20Inc_%20HQ%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Newark, New Jersey-based Prudential Financial, Inc. (PRU) is a global financial services company that provides life insurance, retirement solutions, asset management, and annuities for individuals and institutional clients. Valued at a market cap of $37.7 billion, the company offers products that support long-term financial protection, income planning, and wealth accumulation.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and PRU fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the insurance - life industry. The company generates steady cash flow through recurring premiums, long-term customer relationships, and strong brand trust. At the same time, it is reshaping its business to focus more on faster-growing and less capital-intensive areas, which is expected to support better long-term profitability.

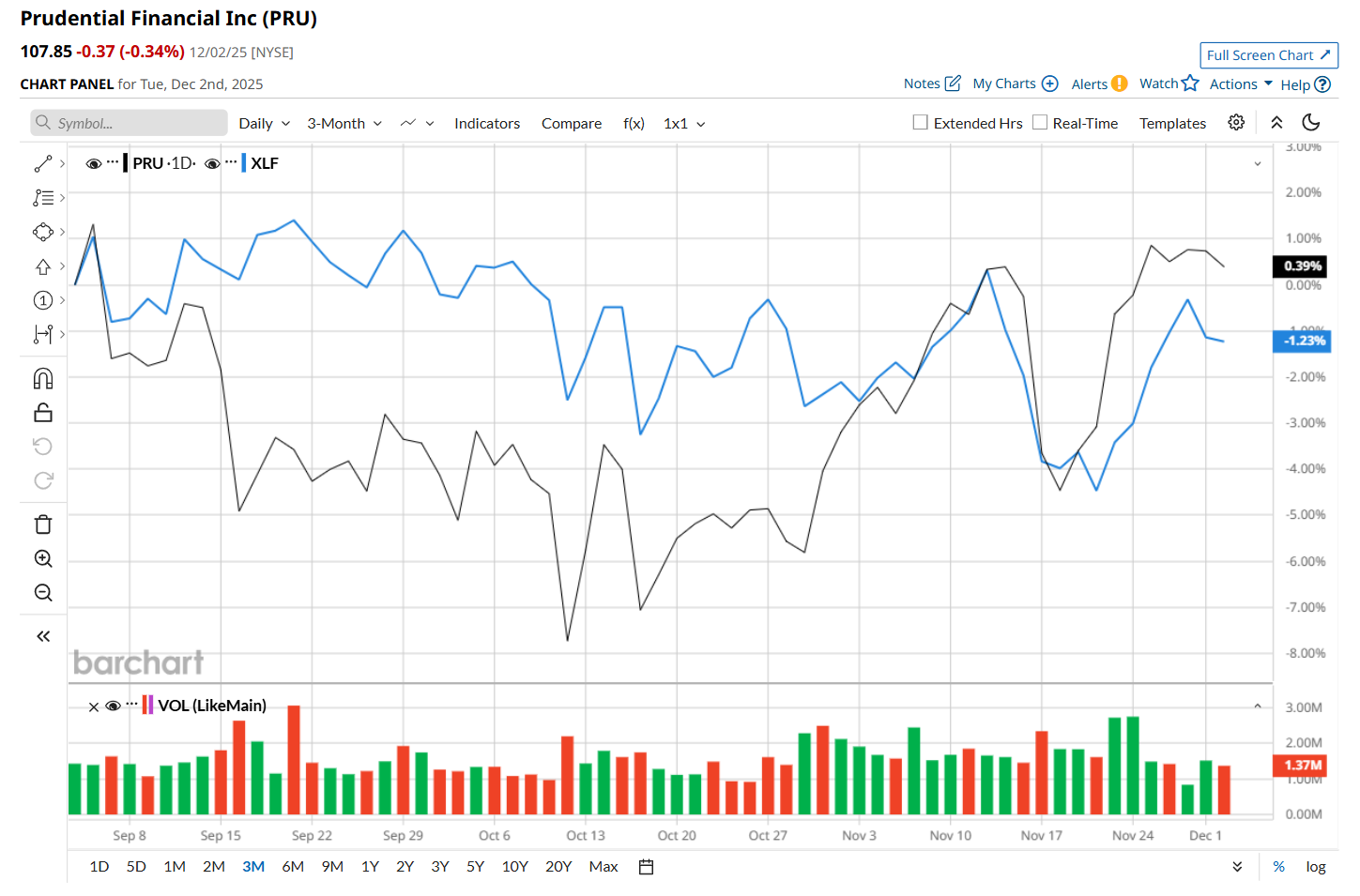

This insurance company is currently trading 16.2% below its 52-week high of $128.72, reached on Dec. 3, 2024. Shares of PRU have gained marginally over the past three months, outperforming the Financial Select Sector SPDR Fund’s (XLF) 1.4% drop during the same time frame.

However, on a YTD basis, shares of PRU are down 9%, trailing behind XLF’s 9.3% return. Moreover, in the longer term, PRU has declined 16% over the past 52 weeks, considerably lagging behind XLF’s 4% uptick over the same time frame.

To confirm its recent bullish trend, PRU has been trading above its 200-day moving average since late November and has remained above its 50-day moving average since late October, with minor fluctuations.

On Oct. 29, Prudential Financial released better-than-expected Q3 results, and its shares surged 1.9% in the following trading session. Due to strong growth in adjusted operating income across all its business segments, the company’s adjusted EPS increased 27.9% year-over-year to $4.26, surpassing consensus estimates by a notable margin of 16.4%. Additionally, its assets under management grew 3.5% year over year to $1.6 trillion.

PRU has also underperformed its rival, MetLife, Inc. (MET), which declined 12.2% over the past 52 weeks and 6.9% on a YTD basis.

Despite PRU’s recent outperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 19 analysts covering it, and the mean price target of $117.07 suggests an 8.5% premium to its current price levels.