/Prudential%20Financial%20Inc_%20HQ%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Valued at a market cap of $39.9 billion, Prudential Financial, Inc. (PRU) is a financial services company that provides insurance, investment management, and other financial products and services. The Newark, New Jersey-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

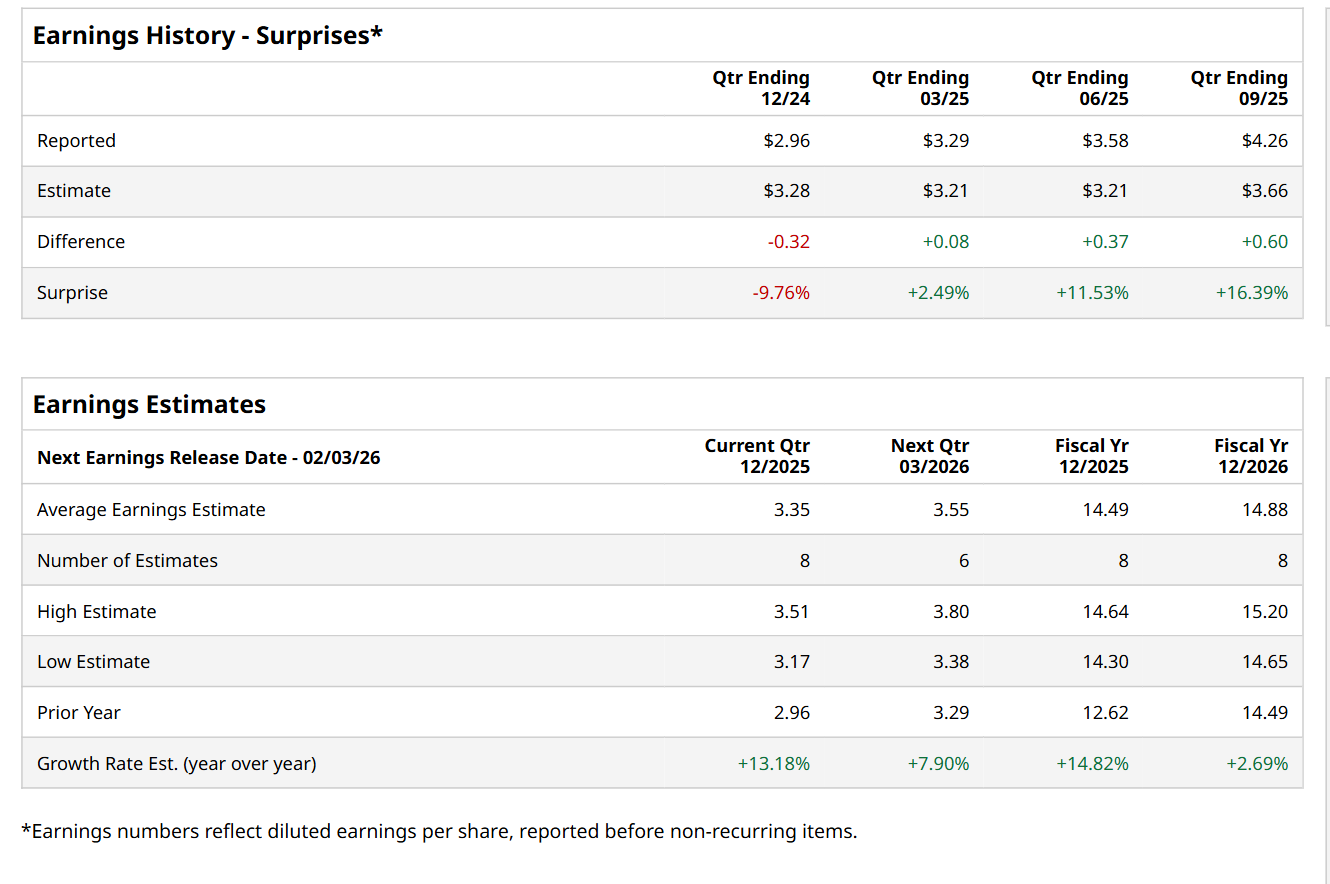

Before this event, analysts expect this financial company to report a profit of $3.35 per share, up 13.2% from $2.96 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $4.26 per share in the previous quarter exceeded the forecasted figure by a notable margin of 16.4%.

For the current fiscal year, ending in December, analysts expect PRU to report a profit of $14.49 per share, up 14.8% from $12.62 per share in fiscal 2024. Furthermore, its EPS is expected to grow 2.7% year-over-year to $14.88 in fiscal 2026.

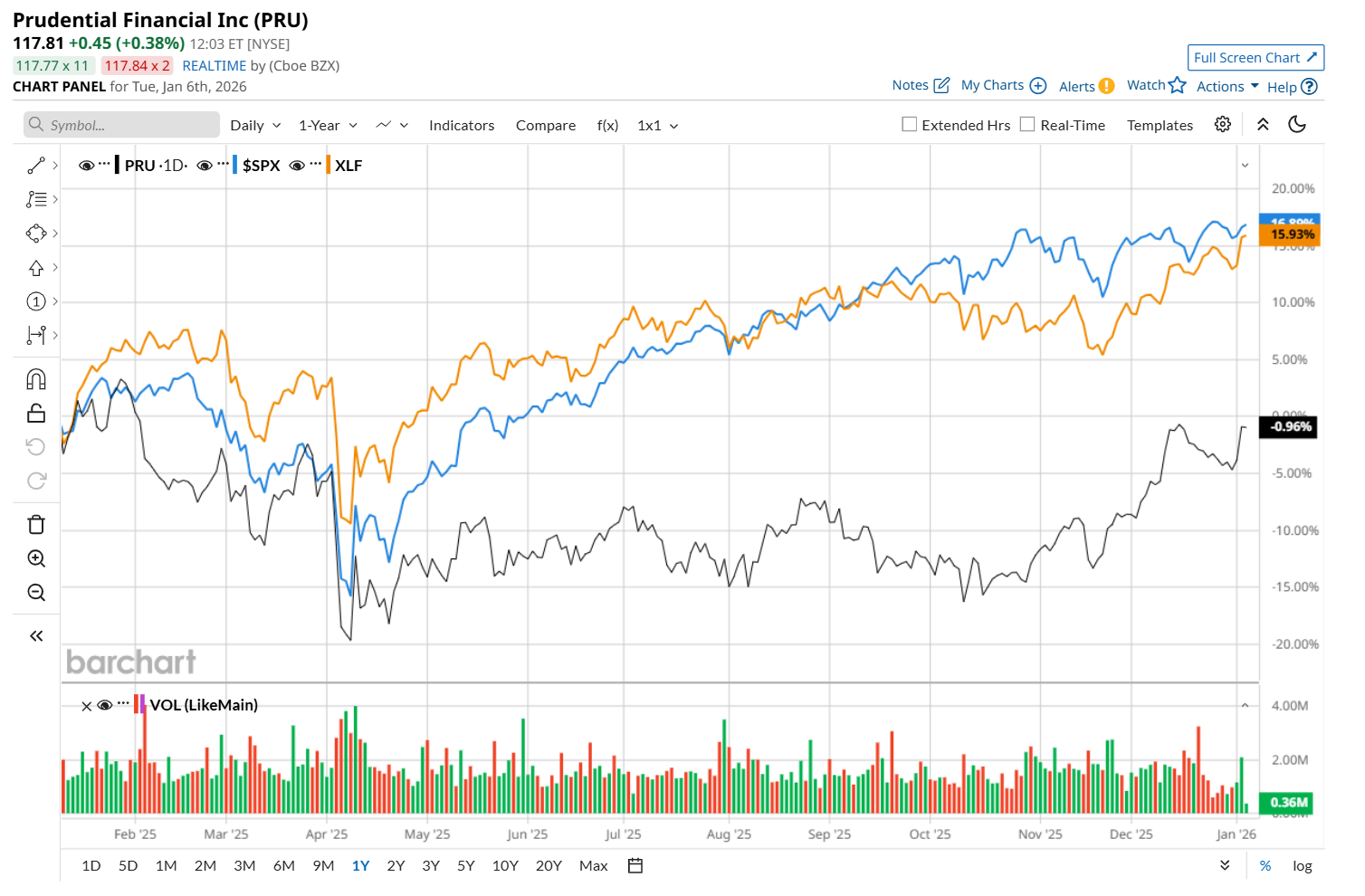

Shares of PRU have declined 1.5% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.2% return and the State Street Financial Select Sector SPDR ETF’s (XLF) 16.1% uptick over the same time period.

On Oct. 29, PRU delivered better-than-expected Q3 results, sending its shares up 1.9% in the following trading session. The company’s adjusted EPS improved 27.9% year-over-year to $4.26, surpassing consensus estimates by a notable margin of 16.4%. Strong growth in adjusted operating income across all its business segments contributed to its robust bottom-line rise. Furthermore, its assets under management grew 3.5% year over year to $1.6 trillion.

Wall Street analysts are cautious about PRU’s stock, with a "cautious" rating overall. Among 19 analysts covering the stock, two recommend "Strong Buy," 15 indicate “Hold,” and two suggest "Strong Sell.” The mean price target for PRU is $118.33, indicating a marginal potential upside from the current levels.