Did you know it's proxy season, that period from roughly April through June when public companies hold annual meetings? When you own stock in a publicly-traded company, you can vote by proxy on shareholder proposals about issues such as new board members. While it may seem boring on its face, remember that shareholder proposals essentially function as the complaints department for investors. If you agree with a shareholder proposal claiming the CEO's salary is too high, for example, this is your chance to vent your frustration.

While important, such shareholder proposals are not binding. However, they send strong signals to corporate management. These proxy season votes have garnered more interest in recent years, thanks to support of various resolutions from large mutual fund companies (which vote on behalf of investors) and proxy advisory companies.

2023 proxy season highlights

With this year's proxy season well underway, several trends have emerged, many of them holdovers from the 2022 season.

In the first half of 2023, at least 803 resolutions were filed with companies in the Russell 3000 index, which is on par with the first half of 2022, according to a Harvard Law 2023 proxy season report. Most of these proposals ask companies to address environmental risks such as climate change or biodiversity. About a quarter of all proposals filed pertain to corporate governance, reflecting concerns about political influence and executive compensation.

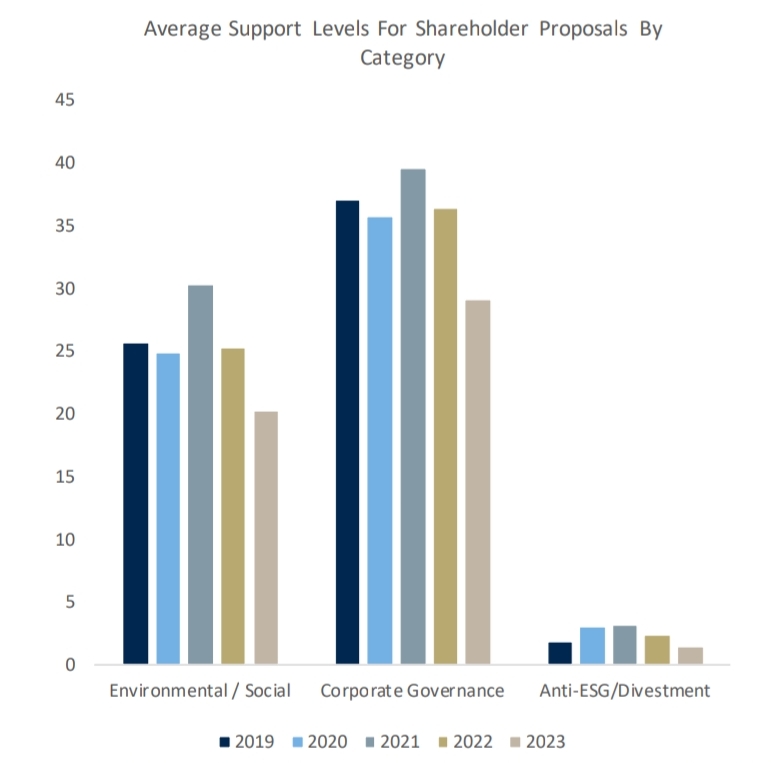

All shareholder proposals (on environmental, social, governance (ESG) and anti-ESG) received less support in 2023. Generally, these resolutions are said to pass if they receive over 50% of shareholder votes.

These low-vote figures obscure important contexts, however.

- Some environmental proposals received a low vote because the company had already implemented the requested changes, such as disclosing greenhouse gas emissions.

- Overly prescriptive proposals did poorly — for example, asking a company to revise a specific carbon-emissions goal. Those asking for disclosure or research did better.

- Regulatory changes in 2022 have made it harder for companies to dispatch a proposal through the "no-action" process; as a result, the total number of resolutions filed in 2022 and 2023 rose dramatically from prior years. Some of these proposals were esoteric or unlikely to attract many votes.

- Finally, the intensifying politics around ESG investing reduced votes for ESG proposals. So-called "anti-ESG" investors also lowered average vote support by submitting less-successful proposals. These proponents submitted almost 90 proposals, none of which passed; the average vote for was only 6%.

"Say on pay" vote results

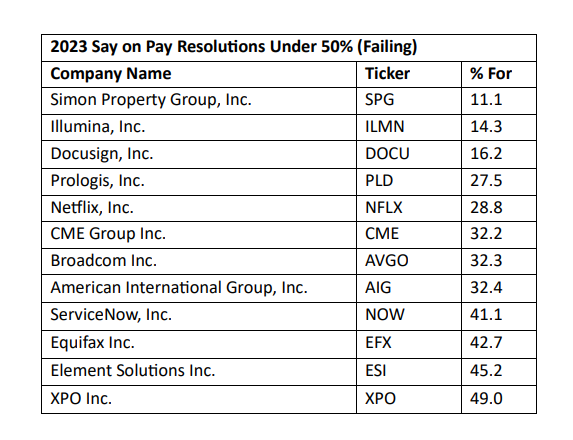

"Say on pay" proposals ask shareholders to support or reject a company's executive pay plan. Unlike other proposals, where a vote under 50% is said to fail, corporate pay watchdogs consider a say on pay vote under 50% to be successful. Such low votes mean that shareholders oppose corporate pay plans. For example, just 27% of shareholders voted in favor of Netflix's proposed executive compensation in 2022, and the measure failed again in 2023 with only 28.8% in favor.

Twelve companies failed say on pay resolutions, acccording to research by RBC Capital Market's ESG Group, shown below.

Why should investors care about these votes? When RBC analyzed the future performance of companies that received lower support for say on pay resolutions, they found that these companies tended to underperform on average in the first and third year after the vote. By the fifth year, company performance had recovered.

How does your mutual fund or ETF vote?

In recent years, the "big three" firms — BlackRock, Vanguard and State Steet — dramatically increased their support for ESG proposals. In fact, BlackRock's CEO defended ESG investing as a no-brainer in his January 2022 letter to shareholders, saying that moving away from fossil fuels as an energy source was the investment opportunity of a lifetime. But after an ESG investing backlash in 2022, these firms reduced or eliminated their voting support for ESG proposals.

If you own an ESG fund or ETF, you may assume that managers vote for shareholder proposals related to sustainability most of the time. However, a report by Planet Tracker found that the big three investment firms are more likely to vote against biodiversity proposals, even for the shareholders they represent in their ESG funds.

To see the kinds of shareholder proposals your fund supports, go to the fund's website and search for "proxy voting guidelines" or "corporate engagement principles."

You can also get a quick sense of your fund's commitment to ESG shareholder engagement and proxy voting by going to As You Sow's Invest Your Values tool. Enter the fund or ETF ticker, and look for the "sustainability mandate" grade. If the fund is listed as being a member of the trade association for sustainable investing, USSIF, it is more likely to vote for ESG proposals.

If you are interested in investments that vote against progressive ESG proposals, check out some of the ETF funds for anti-ESG investors.