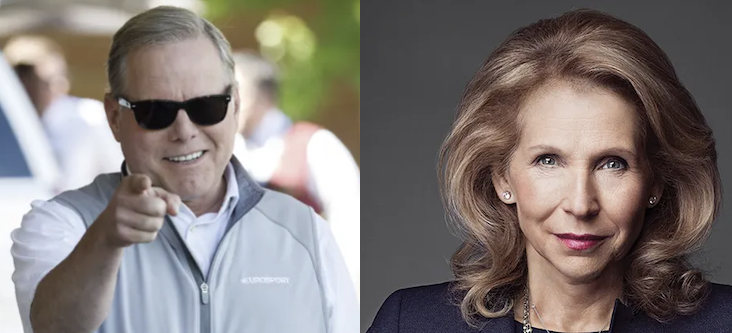

At least early on, it doesn't appear that Wall Street is reacting super-enthusiastically to "Warnamount," the new slanguage that just emerged following Axios' report Wednesday that Warner Bros. Discovery CEO David Zaslav sat down earlier this week to discuss merger with Paramount Global chief executive Bob Bakish.

For starters, stock prices for both companies are (further) down since the news broke -- just over 6% for Paramount and about 4.5 % for WBD.

Equity analysts, meanwhile, have expressed decidedly "meh" opinions in Thursday investor notes.

Describing the possible Warnamount outcome as a result of "desperate times for media companies leading them to explore desperate measures," MoffettNathanson analyst Robert Fishman conceded a deal would produce synergies across linear networks, sports rights portfolios, subscription streaming platforms and news.

But besides adding more than $15 billion of additional debt to Warner's already leveraged books, the merger would cause WBD to pay a premium for yet more declining linear networks and limited IP, while also recouping deceptively low cost savings from shutting down Paramount Plus.

"As pressure mounts from growing secular linear TV advertising headwinds, cord-cutting acceleration and a weaker macro backdrop putting more burden on sustainable cash flows, and leverage moving in the wrong direction for PARA, we still question why any company would try to catch a falling knife? What is the rush with the likelihood of waiting for an even cheaper price if a real advertising recession transpires?," Fishman added.

Meanwhile, Jason Bazinet of Citigroup told Penske showbiz trade Deadline that none of the media mergers in recent years have proven to be "the elixir that allowed you to generate huge amounts of cash flow."

He added, "You can't draw a straight line between M&A and profitability in streaming."

For his part, Fishman believes Comcast -- which is exploring ways to better compete with Disney -- might make a more logical acquirer of Paramount.

"At the end of the day, Comcast may be the one strategic buyer with the capital structure and assets required to benefit either WBD or PARA in a long-term viable way," Fishman wrote. "An NBCU spin could help WBD de-lever depending on deal structure. The key issue is whether this is a path the company really wants to explore, especially over the coming months ahead of likely even more disruption in the ecosystem."