U.S. rental consumers have been spinning their wheels over the last two years, waiting for good deals on rental properties only to see monthly rent costs continue to skyrocket.

Data from IProperty Management tells the story, with the median U.S. rental cost standing at $1,191 at year-end 2021. Compare that to 2017, when the median rental cost per month was $982, and in 2005 when the median rental cost was $604.

In late 2022, however, the rental market has popped a little discount into rental consumers’ holiday stockings.

According to Apartment List’s November Rent Report, the company’s national index fell by 0.7% over the course of October, “marking the second straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017.”

Some of the drop-off is due to seasonality.

By and large, Americans don’t rent as many units in November as they do in April. Even so, “going forward it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market,” the Apartment List report stated.

More of the Same in ’23?

Real estate experts nod at the seasonality issue. But maintaining falling rental prices should carry over into 2023.

“Prices are contracting after the run-up over the last few months,” said Awning chief executive officer Shri Ganeshram. “This is expected, especially in major markets that saw returning residents and not organic growth like New York. In markets like Miami and Austin, we are seeing rents stay relatively stable.”

For 2023, renters can expect stabilized rental prices in communities that are not growing or growing very slowly.

“For example, the suburbs of Atlanta will remain relatively stable,” Ganeshram said. “In some major cities that continue to attract people from other states, rents will continue to rise as supply struggles to keep up with demand. Renters should try to lock in rents for one-to-two years in 2023 to avoid further increases.

Other rent-reducing factors come into play.

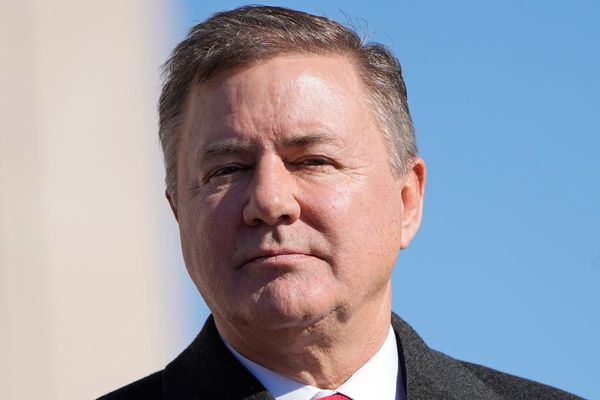

“The headlines will suggest rentals nationwide will continue to increase, but I expect them to start flattening and even pull backward as the recession deepens and unemployment starts to increase,” said Cardone Capital founder Grant Cardone.

The burgeoning number of new apartment units coming online with builders facing increased rates should help tamp down rental prices, too. “This has happened across the U.S. and especially all of Arizona, Dallas, Austin, Houston, and the entire southeast from the Carolinas to Miami,” Cardone told The Street.

Tips for Getting a Great Rental in ‘23

It may not appear so on the surface, but U.S. renters have a lot to look forward to in 2023.

“The renter is going to get more choices than they’ve ever had before, including better locations, better amenities, and a better community,” Cardone said. “The apartments that are being built today are not the apartments of the ’70s and ’80s. This is no longer about affordability. It’s about choices.”

To get into the action sooner rather than later, rental experts advise taking these tips to the rental experience.

Emphasize payment history. One way to find a great apartment at a great price is to prioritize a good payment history.

“Residents or tenants that regularly pay their rent on time every month should leverage that proven payment history,” Cardone said. “Emphasizing that should help get a good rental.”

Go to the owner directly. Look for properties where the owner is an operator owner and not just a builder.

“That’s what is called a merchant builder seller,” Cardone said. “For instance, at Cardone Capital we manage 12,000 apartments that we are long-term holders on and want to create a relationship with the resident. Renters will always get a better deal when they talk to us about being a long-term resident.”

Go public with your search. In your social circle or at work, keep an eye out for people moving out.

“Talk to them and ask if they can connect you with their landlord,” Ganeshram said. “It's a great way to get into a rental and skip the line when the property gets listed on places like Zillow.”