G-III Apparel Group (NASDAQ:GIII) is set to give its latest quarterly earnings report on Tuesday, 2024-12-10. Here's what investors need to know before the announcement.

Analysts estimate that G-III Apparel Group will report an earnings per share (EPS) of $2.27.

Investors in G-III Apparel Group are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

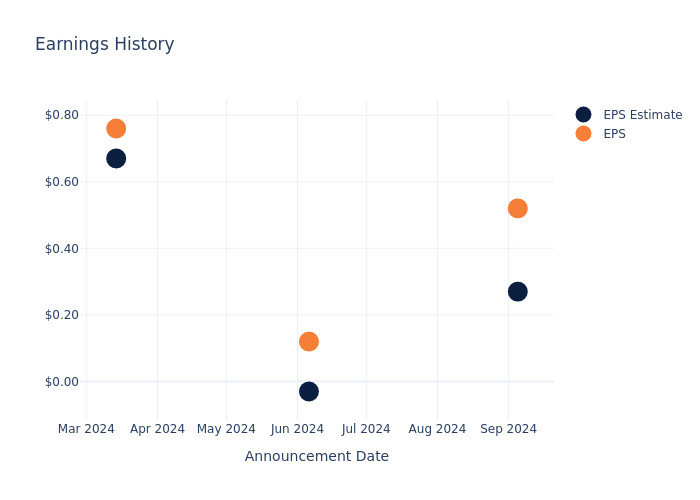

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.25, leading to a 5.34% increase in the share price on the subsequent day.

Here's a look at G-III Apparel Group's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.27 | -0.03 | 0.67 | 2.06 |

| EPS Actual | 0.52 | 0.12 | 0.76 | 2.78 |

| Price Change % | 5.0% | -1.0% | -2.0% | -2.0% |

Market Performance of G-III Apparel Group's Stock

Shares of G-III Apparel Group were trading at $31.42 as of December 05. Over the last 52-week period, shares are down 7.21%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts' Take on G-III Apparel Group

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on G-III Apparel Group.

With 2 analyst ratings, G-III Apparel Group has a consensus rating of Buy. The average one-year price target is $34.0, indicating a potential 8.21% upside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of Oxford Industries, FIGS and Carter's, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- For Oxford Industries, analysts project an Neutral trajectory, with an average 1-year price target of $79.0, indicating a potential 151.43% upside.

- For FIGS, analysts project an Neutral trajectory, with an average 1-year price target of $6.0, indicating a potential 80.9% downside.

- The consensus among analysts is an Neutral trajectory for Carter's, with an average 1-year price target of $57.5, indicating a potential 83.0% upside.

Overview of Peer Analysis

In the peer analysis summary, key metrics for Oxford Industries, FIGS and Carter's are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| G-III Apparel Group | Buy | -2.27% | $275.87M | 1.60% |

| Oxford Industries | Neutral | -0.10% | $265.01M | 6.69% |

| FIGS | Neutral | -1.51% | $94.03M | -0.42% |

| Carter's | Neutral | -4.19% | $356.01M | 6.96% |

Key Takeaway:

G-III Apparel Group ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit and Return on Equity.

Discovering G-III Apparel Group: A Closer Look

G-III Apparel Group Ltd is a textile company. It makes a wide range of apparel, footwear, and accessories that it sells under its own brands, licensed brands, and private-label brands. G-III has a substantial portfolio for licensed and proprietary brands, anchored by five global power brands: DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld. The company has two reportable operations: Wholesale Operations and Retail Operations. The Wholesale operations segment includes sales of products under brands licensed by from third parties, as well as sales of products under its own brands and private label brands. The retail operations segment consists primarily of Wilsons Leather, G.H. Bass, and DKNY retail stores. It derives most of its revenues from Wholesale operations.

Breaking Down G-III Apparel Group's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: G-III Apparel Group's revenue growth over 3 months faced difficulties. As of 31 July, 2024, the company experienced a decline of approximately -2.27%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: G-III Apparel Group's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 3.76%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): G-III Apparel Group's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.6%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): G-III Apparel Group's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.92%, the company may face hurdles in achieving optimal financial returns.

Debt Management: G-III Apparel Group's debt-to-equity ratio is below the industry average at 0.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for G-III Apparel Group visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.