Dollar Tree (NASDAQ:DLTR) is set to give its latest quarterly earnings report on Wednesday, 2024-12-04. Here's what investors need to know before the announcement.

Analysts estimate that Dollar Tree will report an earnings per share (EPS) of $1.06.

The announcement from Dollar Tree is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

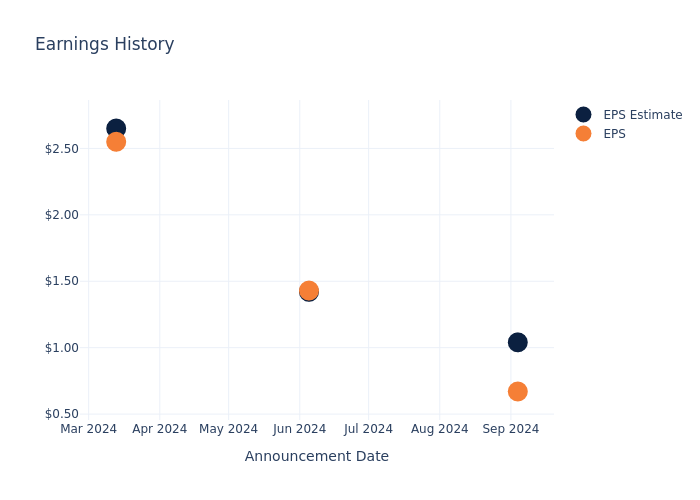

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.37, leading to a 7.72% increase in the share price the following trading session.

Here's a look at Dollar Tree's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.04 | 1.42 | 2.65 | 1.01 |

| EPS Actual | 0.67 | 1.43 | 2.55 | 0.97 |

| Price Change % | 8.0% | -2.0% | -2.0% | 2.0% |

Performance of Dollar Tree Shares

Shares of Dollar Tree were trading at $72.81 as of December 02. Over the last 52-week period, shares are down 42.23%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Observations about Dollar Tree

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Dollar Tree.

A total of 21 analyst ratings have been received for Dollar Tree, with the consensus rating being Neutral. The average one-year price target stands at $81.62, suggesting a potential 12.1% upside.

Understanding Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Dollar Gen and BJ's Wholesale Club, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Dollar Gen, with an average 1-year price target of $87.88, suggesting a potential 20.7% upside.

- As per analysts' assessments, BJ's Wholesale Club is favoring an Buy trajectory, with an average 1-year price target of $101.0, suggesting a potential 38.72% upside.

Overview of Peer Analysis

In the peer analysis summary, key metrics for Dollar Gen and BJ's Wholesale Club are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Dollar Tree | Neutral | 0.73% | $2.22B | 1.80% |

| Dollar Gen | Neutral | 4.23% | $3.06B | 5.25% |

| BJ's Wholesale Club | Buy | 3.55% | $975.48M | 9.12% |

Key Takeaway:

Dollar Tree ranks lowest in revenue growth among its peers. It also has the lowest gross profit and return on equity.

Get to Know Dollar Tree Better

Dollar Tree operates discount stores across the United States and Canada, with over 8,600 shops under its namesake banner and nearly 7,800 under Family Dollar. About 47% of Dollar Tree's sales in fiscal 2023 were composed of consumables (including food, health and beauty, and cleaning products), around 45% from variety items (including toys and homewares), and over 5% from seasonal items. The Dollar Tree banner sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. Conversely, Family Dollar primarily sells consumable merchandise (80% of the banner's sales) at prices below $10. About two-thirds of Family Dollar's stores are located in urban and suburban markets, with the remaining one-third located in rural areas.

Dollar Tree: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Dollar Tree's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 0.73%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Dollar Tree's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 1.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Dollar Tree's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.8%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Dollar Tree's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.59%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 1.46, Dollar Tree adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Dollar Tree visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.