RECAP: Asian stocks shook off worries about rising interest rates and economic risks to advance yesterday as many investors took profits before the Lunar New Year holiday closes many markets in the region next week.

World stocks fell on Thursday as worries mounted that an aggressive stance by central banks could push the global economy into a slowdown. The downbeat mood offset hopes that China's economy would enjoy a strong recovery this year.

Domestically, Kasikornbank (KBANK) reported fourth-quarter results that were well below consensus estimates, leading to negative sentiment about the banking sector.

The SET Index moved in a range of 1,691.35 and 1,672.49 points this week before closing yesterday at 1,677.25, down 0.3% from the previous week in daily turnover averaging 66.69 billion baht.

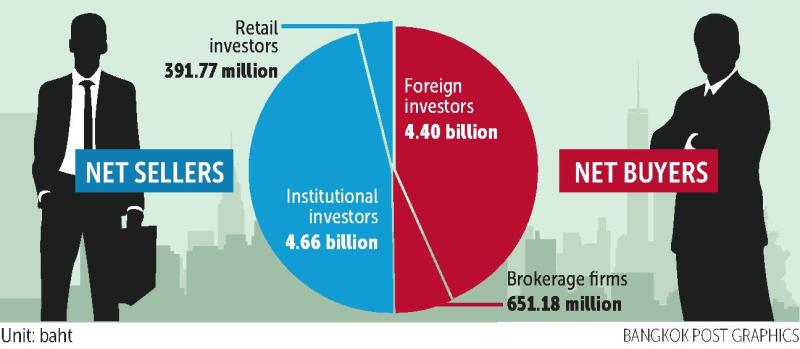

Foreign investors were net buyers of 4.4 billion baht, followed by brokers at 651.18 million. Institutional investors were net sellers of 4.66 billion baht, followed by retail investors at 391.77 million.

NEWSMAKERS: The probability of a US recession this year has increased to 68% from 65%, based on a Bloomberg survey of economists. However, they see a lower probability of recession the euro zone (68% compared with 80% in an earlier survey) and Germany (78%, down from 90%).

China's GDP expanded just 3% in 2022, the worst performance in decades, as zero-Covid policy and faltering overseas demand battered the world's second-biggest economy.

Property investment in China fell 10% year-on-year in 2022, the first decline since records began in 1999. Official data showed property sales by floor area dropped 24.3% from 2021, the most since the data became available in 1992.

China's population shrank last year for the first time in six decades, underscoring a demographic crisis that threatens to derail Beijing's economic ambitions. The decline of 850,000, to 1.41 billion, was the biggest drop since 1961.

Overseas investors increased their holdings of the Chinese bonds in December, with net purchases of $7.3 billion snapping a record 10-month streak of outflows, the country's foreign exchange regulator said.

Bank Indonesia on Thursday raised its benchmark interest rate, now at 5.75%, for a sixth straight month as it tries to tame inflation, which rose to 5.5% in December from 5.4% in November.

Japan on Thursday reported a record annual trade deficit of 19.97 trillion yen (US$155 billion) for 2022, after a combination of high commodity prices and a weak yen increased import costs. Exports grew 18% but imports rose 39%.

Toyota Motor Corp expects its vehicle production this year to exceed pre-pandemic levels, forecasting output of as many as 10.6 million units.

Didi Global has secured Chinese regulators' approval to resume signing up new users, suggesting the worst is over for the ride-hailing giant that symbolised Beijing's bruising campaign to rein in its powerful tech industry.

While Didi is back in business, it will face competition from the government. A new state-backed transport super-app is being launched that will include everything from ride-hailing to rail and road freight and flight booking.

Japan welcomed 3.83 million overseas visitors in 2022, but that was still 88% lower than in 2019. The top source of visitors was South Korea, followed by Taiwan, the US and Vietnam.

Procter & Gamble, the US consumer products giant, said its sales last year fell for the first time in more than five years, as shoppers pulled back in the face of relentlessly rising prices.

The baht this week hit a 10-month high around 32.80 to the dollar amid advances in many Asian currencies and expectations that the US Federal Reserve will opt for a smaller rate hike of just 25 basis points on Feb 1.

Local spending during the Chinese New Year festival, which started yesterday, is expected to rise 13.6% year-on-year to 45 billion baht, says the University of the Thai Chamber of Commerce. Tourism spending during the period is expected to reach 21.3 billion baht, 48% of the total in 2019, says the Tourism Authority of Thailand.

Minor International Plc (MINT), the country's largest hospitality company, is targeting revenue growth of at least 20% this year, banking on a strategy of higher room rates and the return of Chinese tourists.

SCB X, the holding company of Siam Commercial Bank, is interested in setting up a virtual bank as it explores new business opportunities. The Bank of Thailand is expected to award a handful of virtual bank licences sometime next year.

PTT Oil and Retail Business (OR) has vowed to become the country's largest electric vehicle (EV) charging service provider, with 7,000 outlets by 2030, up from just 139 now, says new CEO Disathat Panyarachun.

Oishi Group wants to become an international franchiser, starting by selling branches of its Japanese restaurants in Bangkok for the first time this year.

The cabinet on Tuesday extended the excise tax cut on diesel by 5 baht per litre for another four months to keep prices below 35 baht per litre. The tax cut will cost the government 10 billion baht in lost revenue per month.

Housing prices are projected to rise by 5-10% this year as the standard home construction price index rose 5.6% in the fourth quarter of 2022 amid a labour shortage, says the Real Estate Information Center (REIC).

The Thailand Industry Sentiment Index (TISI) fell for the first time in seven months to 92.6 points in December, from 93.5 in November, because of many holidays, a decrease in production capacity and a drop in new goods orders.

The government aims to accelerate state investment this year to help propel economic growth momentum. A combined investment of 644 billion baht is estimated for fiscal 2023, accounting for 20.9% of total state spending.

The value of investment pledges rose 39% year-on-year to 665 billion baht in 2022, according to the Board of Investment (BoI). The increase was led by large foreign investments in key sectors including electronics, the EV supply chain and data centres.

Big C Supercenter Plc has picked Bank of America and UBS Group to advise on an initial public offering expected to be worth at least 30 billion baht, sources told Bloomberg. The supermarket and convenience store chain was delisted in 2017 after being taken over by the SET-listed trading company Berli Jucker Plc.

COMING UP: The Bank of Japan will hold a policy meeting on Monday and the US will release the Conference Board economic summary. Due on Tuesday are US and euro zone manufacturing and services PMI updates. Looking further ahead, the Federal Reserve will hold its policy meeting on Jan 31 and Feb 1.

Domestically, the Bank of Thailand's Monetary Policy Committee will hold a rate-setting meeting on Wednesday, while the Ministry of Commerce will report December trade figures.

STOCKS TO WATCH: Asia Plus Securities has set a 2023 target of 1,740 points (base case) or 1,820 points (best case) for the SET Index. It favours growth stocks including ERW, STEC, CBG and BEC, and tourism plays such as AOT, ERW and TFG. Stocks benefiting from Lunar New Year include MTC, TFG and ERW.

Capital Nomura Securities recommends China reopening plays: AOT, AMATA, AWC, AAV, ERW, BAFS, CENTEL, MINT, SNNP, WHA, SCGP, SPA, EKH, MC, NER, AU, ANAN, ORI, AP, SIRI and SISB. Stocks that benefit from a strong baht through lower operating costs are AAV, BA, GPSC, GULF, BGRIM, PTTGC, TOP, IVL, PTT, AMATA, WHA, TOA, ICHI, SABINA, JUBILE, JMART, COM7, SYNEX and SIS. Stocks benefiting from economic stimulus are CRC, COM7, HMPRO, MAKRO, BJC, CPALL, BBL, M, ADVANC, DTAC, TRUE, AEONTS, KTC and AMATA. High-growth stocks include BE8, BBIK and JMT. Election plays are STPI, STEC, PR9, SIRI, SC, NWR, ITD and TIDLOR.

TECHNICAL VIEW: Maybank Securities sees support at 1,650 points and resistance at 1,707. Finansia Syrus Securities sees support at 1,670 and resistance at 1,695.