The state of the union is hopelessly divided and nearly paralyzed by rancor and bitterness. But as this is an election year, the state of spending on political advertising — even in a media world that is increasingly fragmented — has gone from robust to record-shattering.

Perry Sook, chairman and CEO of Nexstar Media Group, projected “a record level of political spending” on a fourth-quarter earnings call. Fox Television Stations has created a political unit in its advertising sales division to meet the rising demand.

Steve Lanzano, president and CEO of the Television Bureau of Advertising (TVB), the broadcast industry trade association, projected political campaigns would deliver a $10.2 billion infusion into the media economy, more than 10% higher than the last presidential cycle.

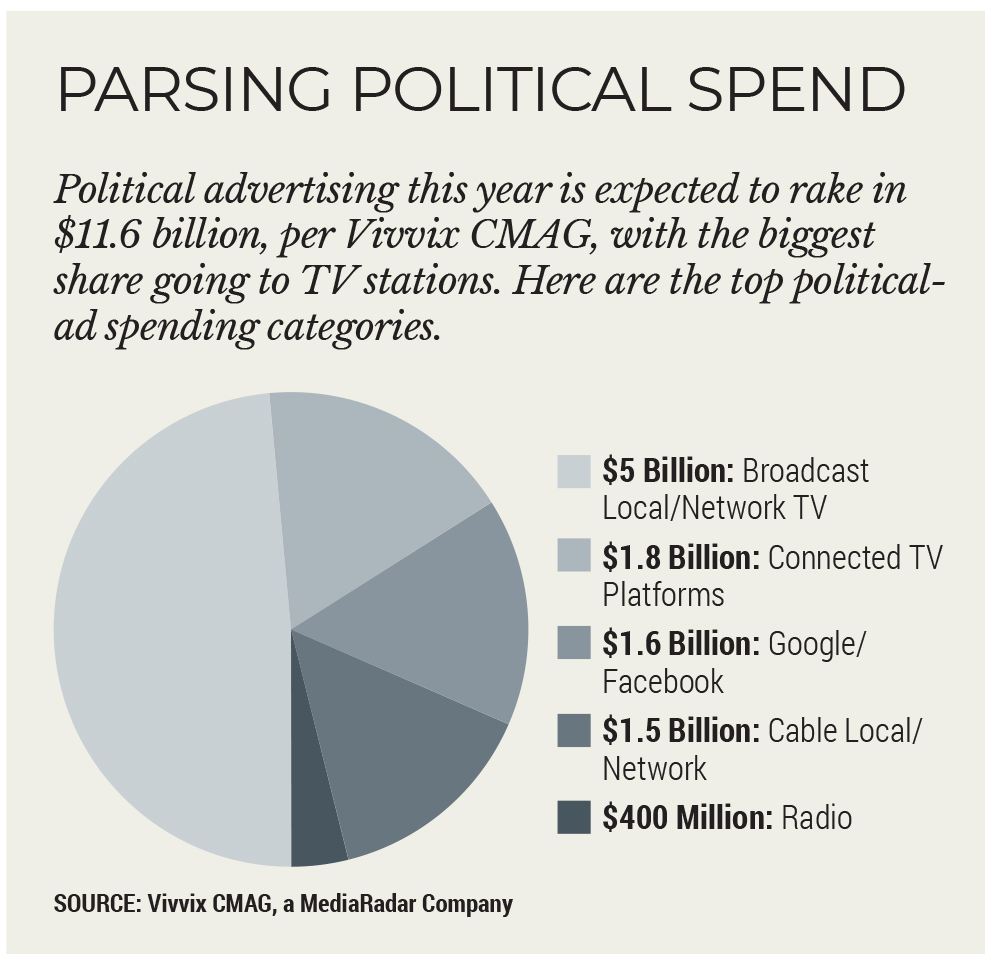

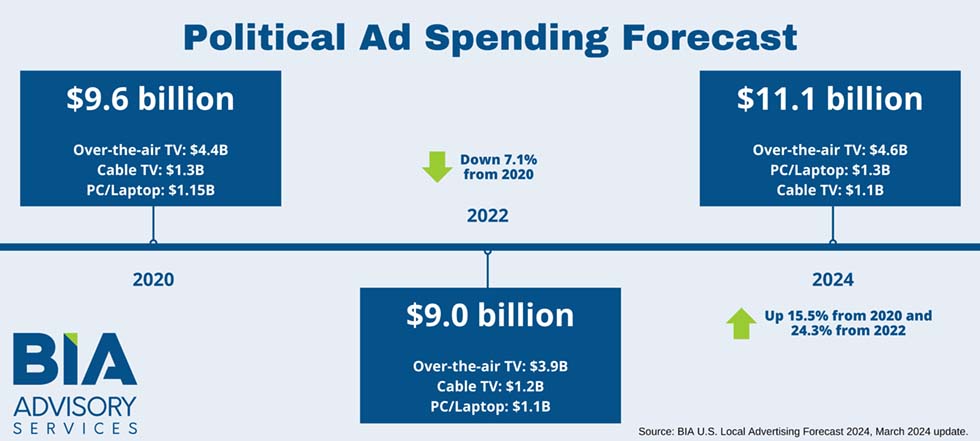

Mitchell West, director of CMAG (Campaign Media Analysis Group) at the ad-intelligence platform Vivvix, predicted the cycle’s “massive spend” would reach $11.6 billion. BIA Advisory Services put out a recent forecast calling for $11.1 billion in political ad spending this year, up $2.2 billion (24%) over 2022 and up $1.5 billion (15.5%) over 2020, the last presidential year. Broadcast TV again is the biggest spending category with $4.6 billion, per BIA. EMarketer pegs this year's political ad-spending at more than $12.3 billion.

The primary season in 2024 was modest, with both major candidates locked in from the beginning, but the presidential grudge match started early. President Joe Biden recently launched a $30 million ad spend in battleground states, in part to offset his faltering popularity and in part, West said, because he might spend less time on the trail shaking hands and kissing babies than past (younger) candidates. “They may just blanket the entire country with ads.”

West said campaigns typically spend 60 cents of every dollar raised on advertising, but Biden might up that spend to 65-70 cents. Plus, outside groups have pledged to spend more than $1 billion in ad support.

Former President Donald Trump loves campaigning, but Lanzano said he’ll need to spend more since his earned media has declined since 2016, not counting the focus on his multiple criminal trials. “They’re going to have to balance out that message on the airwaves,” West agreed.

While the pie is growing, it is changing, too. “There’s more and more spending but the media landscape and viewership are evolving,” Madhive senior VP, sales Kristin Wnuk said. “Local broadcast television is still the powerhouse, but CTV is absolutely taking a larger share.”

West said that while broadcast stations’ share will climb, reaching $5 billion, its share of money spent will dip as connected TV soars well beyond $1 billion from “almost nothing” a few election cycles ago. Much of CTV’s growth is coming out of digital this time, Lanzano noted, with radio remaining relatively flat and cable spending “taking a bit of a hit.”

Madhive’s data analysis lets politicians use CTV to target ads more efficiently than an old-fashioned broadcast TV ad, Wnuk said, aiming at just, say, Democrats or Republicans or independents, or voters within specific ZIP codes. “It’s a different buying model and there are different levels you can pull,” she said.

West said the shift is slow because political groups “are always a little late to the game with new technologies so they’re just beginning to harness the power.” For now, most CTV ads are just broadcast TV ads, achieving reach but not using the more precise targeting possible with OTT. “When that gets embraced by politicians, it will become a really huge tool for them,” he said.

The shift is slow also because voters, like broadcast viewers, tend to be older, Sook noted. That favors broadcast and with its local viewership share, it remains “the medium of choice for campaigns and PACs.”

Big Down-Ballot Spending

This year’s battles for control of both the Senate and House will fuel extra spending, Lanzano said. That growth is now fueled by an inversion of Tip O’Neill’s adage that “all politics is local.”

“Politics has become kind of almost like the national sport — campaigns openly solicit money by advertising out of their state and then money flies all over the country,” West said.

West pointed to the $56 million poured into a race for a Wisconsin State Supreme Court seat last year, while Lanzano said spending on races below the presidential level is skyrocketing. “We’re seeing more money spent where once there was hardly any,” the TVB CEO said. “There are hundreds of millions of dollars spent on races for attorney general because people see the power there now.”

West said that since the Supreme Court’s June 2022 decision in Dobbs v. Jackson Women’s Health Organization overturned abortion-rights protections, and with numerous public battles over redistricting, the public has focused more on ballot initiatives and state legislature races. “Those contests used to fly under the radar more,” he said. “Now you are seeing unprecedented amounts of money going to local races. Both sides are fired up over a woman’s right to choose.”

Lanzano and West both said the spending spigots should remain open in future elections, allowing broadcast stations to build those dollars into their budgets at a time when overall TV ad spending is not doing that well.

And, of course, soon enough it’ll be time for another presidential cycle — the first one with two contested primaries in over a decade — meaning another year when spending records will likely fall.