Last week, Parliament passed sweeping reforms to Australia’s aged care system. These “once-in-a-generation” changes, set to begin next year on July 1, aim to improve how care is provided to older Australians at home, in their communities and in nursing homes.

The new Aged Care Act focuses on improving quality and safety, protecting the rights of older people and ensuring the financial sustainability of aged care providers.

A key change is the introduction of a new payment system, requiring wealthier people to contribute more for non-clinical services.

If you – or a loved one – are planning for aged care, here’s what the changes could mean for you.

What to expect from the home care overhaul

Over the past decade, there’s been a noticeable shift towards “ageing at home”. The number of Australians using home care has more than quadrupled, surpassing those in nursing homes.

To meet growing demand, the government is adding 107,000 home care places over the next two years, with a goal to reduce wait times to just three months.

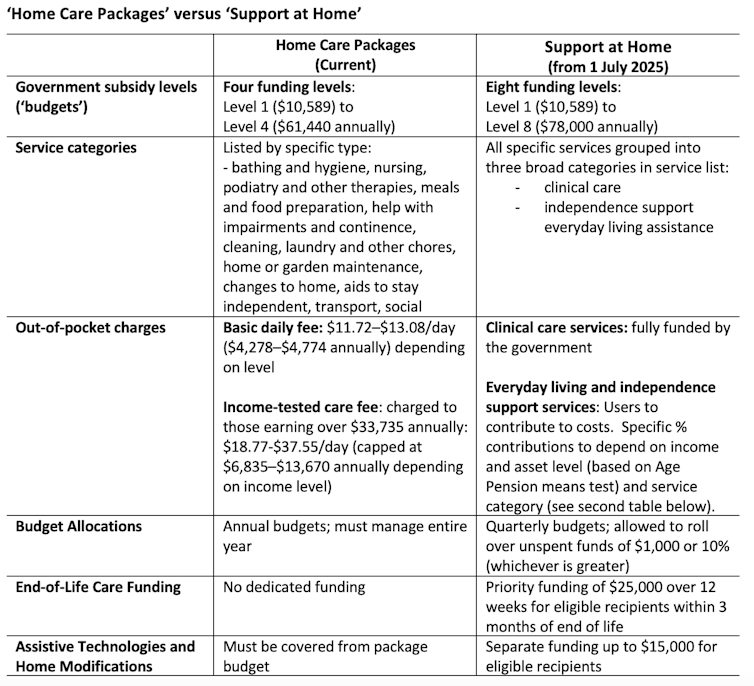

Starting July 1 2025, Support at Home will replace the Home Care Packages program. The table below shows some of the key differences between these two programs.

Home Care Packages are currently delivered under four annual government subsidy levels, covering care and provider management costs. Under Support at Home, the number of home care budget levels will double to eight, with the highest level increasing to A$78,000.

This aims to provide more tailored support and accommodate those needing higher levels of care.

Under the new system, recipients will receive quarterly budgets aligned to their funding level and work with their chosen provider to allocate funds across three broad service categories:

clinical care, such as nursing or physiotherapy

independence support, including personal care, transport and social support

everyday living assistance, such as cleaning, gardening and meal delivery.

Clinical care services will be fully government-funded, as these are crucial to supporting health and keeping people out of hospitals.

But recipients will contribute to the costs of independence and everyday living services under a new payment model, reflecting the government’s stance that these are services people have traditionally funded themselves over their lifetimes.

This will replace the basic daily fee and income-tested care fee that some people currently pay. Contributions will vary by income and assets (based on the age pension means test) and by service type.

Support at Home also includes additional funding for specific needs:

older Australians with less than three months to live will receive priority access to $25,000 in funding over 12 weeks

up to $15,000 will be available for assistive technologies and home modifications, eliminating the need to reserve home care budgets for these.

What if I or my loved one is already receiving a Home Care Package?

If you were receiving a package, on the waiting list, or assessed as eligible for one on September 12 2024, the government’s “no worse off” principle guarantees you won’t pay more under the new system.

Current recipients will have their Support at Home budget aligned with their existing package, and any unspent funds will roll over.

How nursing home fees will change

Australia’s nursing home sector is struggling financially, with 67% of providers operating at a loss. To ensure sustainability and support upgrades to facilities, the government is introducing major funding changes.

What stays the same?

The Basic Daily Fee, that everyone in nursing homes pays, set at 85% of the basic age pension (currently $63.57 a day or $23,200 annually), will not change.

What’s changing?

The government currently pays a Hotelling Supplement of $12.55 per day per resident to cover everyday living services like cleaning, catering and laundry ($4,581 annually).

From July 1 2025, this supplement will become means-tested. Residents with annual incomes above $95,400 or assets exceeding $238,000 (or some combination of these) will contribute partially or fully to this cost.

Currently, residents with sufficient means also pay a means-tested care fee between $0–$403.24 per day. This will be replaced by a “non-clinical care contribution”, capped at $101.16 daily and payable for the first four years of care. Only those with assets above $502,981 or incomes above $131,279 (or some combination of these) will pay this contribution.

Importantly, no one will pay more than $130,000 in combined contributions for Support at Home and non-clinical care in nursing homes over their lifetime.

Changes to accommodation payments

The way nursing home accommodation costs are paid is also changing from July 1 2025:

residents who pay their room price via a refundable lump sum will have 2% of their payment retained annually by the provider, up to a maximum of 10% over five years. For example, a $400,000 lump sum payment would result in $360,000 being refunded if a person stays five years or more, with the provider keeping $40,000

daily accommodation payments (a rent-style interest charge) will no longer remain fixed for the duration of a person’s nursing home stay. Instead, these payments will be indexed twice annually to the Consumer Price Index

providers will be able to set room prices up to $750,000 without government approval, an increase from the current $550,000 limit.

People with lower means (those who are fully subsidised by the government for their accommodation costs) will not be affected by these changes.

What if I own my home?

The treatment of the family home in means testing for nursing home costs will remain unchanged.

Its value is only assessed if no “protected person” (such as a spouse) lives in it, and even then, it’s capped at $206,039 (as at September 20 2024).

What happens to current nursing home residents?

The new rules for contributions and accommodation will apply only to those entering nursing homes from July 1 2025.

Existing residents will maintain their current arrangements and be no worse off.

Feeling overwhelmed?

These reforms aim to improve care delivery, fairness and sustainability, with the government emphasising that many older Australians – particularly those with lower incomes and assets – will not pay more.

The government has provided case studies to illustrate how home care and nursing home costs will differ under the new system for people at various income and asset levels.

Still, planning for aged care can be daunting. For more tailored advice and support, consider reaching out to financial advisors, services, or online tools to help you navigate the changes and make informed decisions.

Anam Bilgrami does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.