The PGA Tour and LIV Golf have filed to dismiss their respective antitrust lawsuits against each other and bring an end to their lengthy legal battle that had divided the men's professional game.

It comes after the PGA Tour announced a shock merger had been agreed with the Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia that bankrolls LIV Golf. Specifically, the planned merger will combine the commercial assets of the PGA Tour, DP World Tour and the PIF into a new, for-profit entity.

In the official press release, the PGA Tour hailed it as a "landmark agreement to unify the game of golf" and added that it would bring a "mutually agreed end to all litigation between the participating parties."

This was considered a key component of the deal for the PGA Tour amid mounting legal costs, with a provision included that the pending litigation would be dropped within 10 days, which has now happened.

The US District Court in the Northern District of California has dismissed the case with prejudice, which means the same claims cannot be made by either side in future, regardless of what happens with the merger.

It is a step forward for the relevant parties, but the deal has come in for scrutiny since it was announced. The US Senate has opened an investigation, citing concerns about the "risks posed by a foreign entity assuming control over a cherished American institution."

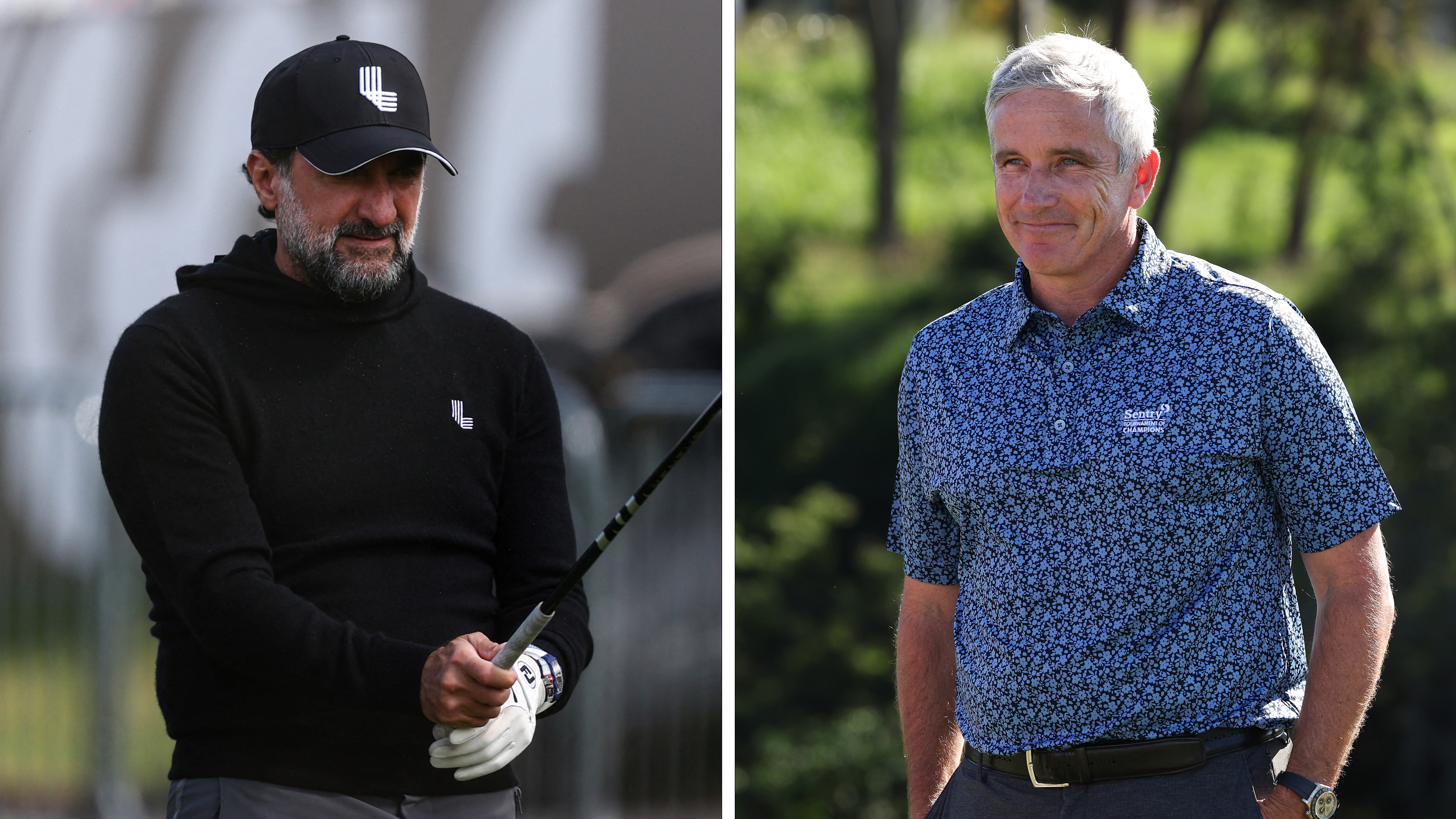

US Senator Richard Blumenthal sent letters to PGA Tour commissioner Jay Monahan and LIV Golf CEO Greg Norman requesting a wide range of information dating back to October 2021, including how the Tour planned on maintaining its tax-exempt status. The pair were given until June 26 to respond.

According to the Wall Street Journal, the Department of Justice (DOJ) has also told the PGA Tour of its plan to conduct a review of the proposed merger.