Pfizer Inc. (PFE) is dealing with weakening demand for its COVID antiviral treatment Paxlovid and the COVID vaccine. Due to the weakening demand for its COVID-related products, the company recorded an adjusted loss per share of $0.17 in the third quarter, while its $13.23 billion revenue missed the analyst-expected figure of $13.34 billion.

However, PFE is looking to shift its focus away from COVID-19 to other growth opportunities. The company’s CEO, Albert Bourla, noted that the company is nearing its target of launching 19 new products or drug indications in an 18-month span. It is also focusing on acquisitions, such as a $43 billion acquisition of drug-making company Seagen, as well as cost-cutting measures.

While the company navigates a post-pandemic backdrop, it might be wise to wait for a better entry point in the stock. Let’s look at the trends of its key financial metrics to gain further insight.

Analyzing Pfizer Inc.'s Financial Performance from 2020 to 2023: Trends and Fluctuations

The trend of PFE’s trailing-12-month net income from the end of 2020 to late 2023 shows clear fluctuations but an overall upward growth, with a significant drop in the last reported quarter:

- At the end of December 2020, the net income was $9.62 billion.

- This value then showed a stable increase throughout the following years, reaching its peak at $31.37 billion at the end of December 2022, representing an astonishing 227% growth from 2020.

- The upward trend continued until the second quarter of 2022, when the net income dropped slightly to $29.77 billion in April 2023 before plunging drastically to $10.48 billion by October 2023, a sharp decrease of nearly 65% from its peak.

The net income increased significantly from $9.62 billion at the end of 2020 to its high point of $31.37 billion in just two years despite the substantial decline toward the end of 2023. This demonstrates that despite dramatic fluctuations, the overall trend for PFE's net income showed considerable growth before the recent drop.

PFE has demonstrated substantial fluctuations in its trailing-12-month revenue over the past years. Here are key points to consider:

- PFE closed 2020 with revenue of $41.91 billion.

- By April 2021, the revenue had grown to $44.46 billion, representing a noticeable surge in a span of four months.

- The revenue continued on an escalatory trend, reaching its peak by December 31, 2022, when it reached $100.33 billion.

- This indicated a significant growth rate when compared with the initial value and marked the highest point for the company’s revenue.

- However, after this high point, PFE has been experiencing a decline in its revenue with each passing quarter of 2023. The last reported revenue in October 2023 was $68.54 billion, substantially less than the peak value recorded.

It's vital to note that these trends and fluctuations represent the company’s performance dynamics over time. The recent decline in revenues may necessitate further examination into the factors contributing to these apparent downturns.

The series presents a summary of the fluctuations of PFE's gross margin over a span from December 2020 to October 2023.

- As of December 31, 2020, PFE's gross margin stood at 79.30%.

- It then dipped to 76.30% on April 4, 2021, and further dropped to 70.40% by July 4, 2021.

- The gross margin showed continued decline in subsequent months, reaching 64.20% in October 2021 and 62.10% by the end of the year.

- In the first half of 2022, gross margin decreased to a low of 60.40% before beginning an upward trend in July, rising to 62.20% and then to 65.60% by October 2nd.

- By the end of 2022, the gross margin was slightly higher, at 65.80%, indicating a slowdown in the rate of rise.

- In 2023, the gross margin continued its upward trend in the first half, reaching 68.50% in April and 69.40% in July before falling drastically to 60.50% in October.

The data shows a general downward trend for PFE's gross margin between 2020 and 2021. In 2022, the gross margin started to recover, but the improvement has been somewhat inconsistent. Overall, the gross margin experienced a growth rate of -18.80%, measured from the initial value in December 2020 to the latest reading in October 2023.

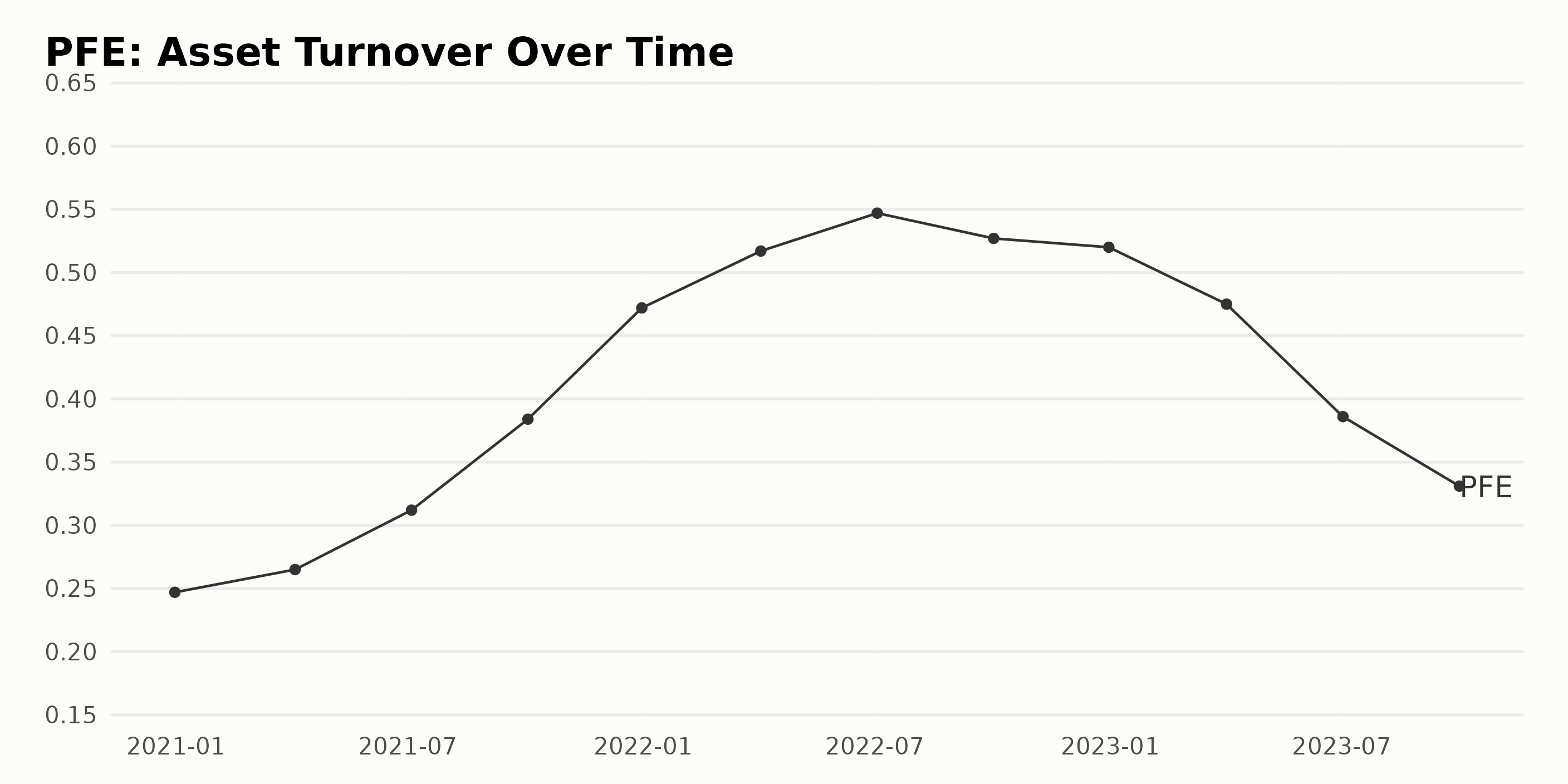

Based on the data provided, PFE showed a general upward trend in its asset turnover from December 2020 to July 2022. However, after that period, there was a marked downturn.

- Starting at 0.247 in December 2020, PFE's asset turnover rose steadily until reaching a peak of 0.547 in July 2022.

- From this peak, there was a small dip to 0.527 in October 2022, which held roughly stable at 0.52 by the end of December 2022.

- Unfortunately, the asset turnover then declined sharply in 2023, dropping to 0.475 by April, further to 0.386 by July, and down to 0.331 by October.

In terms of the growth rate measured from the first to the last value in the series, there was an increase of approximately 34%. That said, it's important to note that most of this growth occurred before July 2022, with a noticeable decline after that.

Six-Month Decline: Chronicling Pfizer Inc.'s Share Price Fluctuations in the Second Half of 2023

The share prices of PFE have demonstrated notable fluctuations over the span of six months, from July 2023 to the end of December 2023. Key observations:

- The share price on July 7, 2023, was $36.15. Over the course of the month, it saw a negligible decrease and then an increase, ending at $36.92 by July 28, 2023.

- An initial fall in August 2023 was witnessed, with the share price dropping to $35.52 by August 4, 2023. After that slight dip, the stock began a steady climb to reach $36.65 by August 25, 2023.

- Starting September 2023, a clear and constant decelerating trend was observed. The share price fell steadily from $35.96 on September 1, 2023, to $32.51 by the end of the month on September 29, 2023.

- This decelerating trend continued through October 2023 - the share price further slid down to $30.74 by October 27, 2023.

- In November 2023, the shares' values hovered around the low 30s and higher 20s, with a notable drop to $29.62 by November 17, 2023. The sharing price ended slightly higher at $30.26 by November 24, 2023.

- A significant deceleration was observed in December 2023. The share price began at $29.86 on December 1, 2023, and steadily declined to $27.30 by December 15, 2023. Although the stock recovered a bit, closing at $28.79 by the end of the month (December 28, 2023), this still signifies a notable decrease compared to the beginning of the month.

In conclusion, over these six months, the share price of PFE demonstrated a clear decelerating trend, especially prominent from September onward. This trend reached its lowest point in mid-December 2023 before showing a slight recovery toward the end of the year. Here is a chart of PFE's price over the past 180 days.

Assessing Pfizer's Performance: High Value but Decreasing Stability and Quality Ratings

Based on the provided data, PFE's latest POWR Ratings grade is a C (Neutral). As of the most recent date in the data, December 29, 2023, it ranks #67 in the Medical - Pharmaceuticals category, which comprises a total of 156 stocks.

The C (Neutral) grade and ranking reflect a relatively middle-of-the-road performance compared to other stocks within the same category. The company's POWR grade and rank within the category have somewhat fluctuated throughout the year:

- In July 2023, PFE maintained a steady POWR grade of C (Neutral), ranking #40 at its best and #44 at its worst.

- By August, while the grade remained a C (Neutral), the rank had slipped to #59 in the category.

- Throughout September, the ranking ranged from #59 to #64.

- In October, the rank fluctuated between #63 and #66 in its category.

- By November, the ranking had dropped to as low as #74, although it recovered somewhat by the month's end.

- Ultimately, in December, PFE ended with a ranking of #67 in the Medical - Pharmaceuticals category of stocks.

It is worth noting that having a C (Neutral) grade suggests average performance. However, the shift in rankings, particularly the downward trend in the latter half of the year, may be an area to further investigate for potential factors impacting performance.

Based on the data given, the three most noteworthy POWR Ratings dimensions for PFE are Value, Stability and Quality. Here's how these dimensions are rated over time:

Value:

- PFE had its highest Value rating in July 2023 with a score of 99.

- Although it decreased marginally each subsequent month, it remains consistently high, with ratings barely dipping below the 90s till December 2023.

Stability:

- The Stability rating started at 62 in July 2023, slightly dipped to 60 from August to September 2023, continued to decrease to 56 in October and dropped further to 50 by December 2023.

- This suggests a clear downward trend in the Stability dimension over this period.

Quality:

- Starting at 74 in July 2023, the Quality rating of PFE experienced a somewhat steady decline throughout the given timeframe, reaching a low of 50 in November before slightly increasing to 53 in December 2023.

- This indicates a gradual decreasing trend in the Quality dimension over this period.

The progressive decrease in ratings for Stability and Quality dimensions reflects some concerning trends for PFE. On the other hand, the company's Value dimension maintains a high rating throughout the observed period, speaking to its perceived financial strength.

How does Pfizer Inc. (PFE) Stack Up Against its Peers?

Other stocks in the Medical - Pharmaceuticals sector that may be worth considering are Taro Pharmaceutical Industries Ltd. (TARO), Santen Pharmaceutical Co., Ltd. (SNPHY), and AbbVie Inc. (ABBV) - they have better POWR Ratings. Click here to explore more Medical - Pharmaceuticals stocks.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

PFE shares were trading at $28.65 per share on Friday morning, down $0.14 (-0.49%). Year-to-date, PFE has declined -41.55%, versus a 25.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Pfizer (PFE) 2024 Preview: What to Expect From the Pharma Stock? StockNews.com