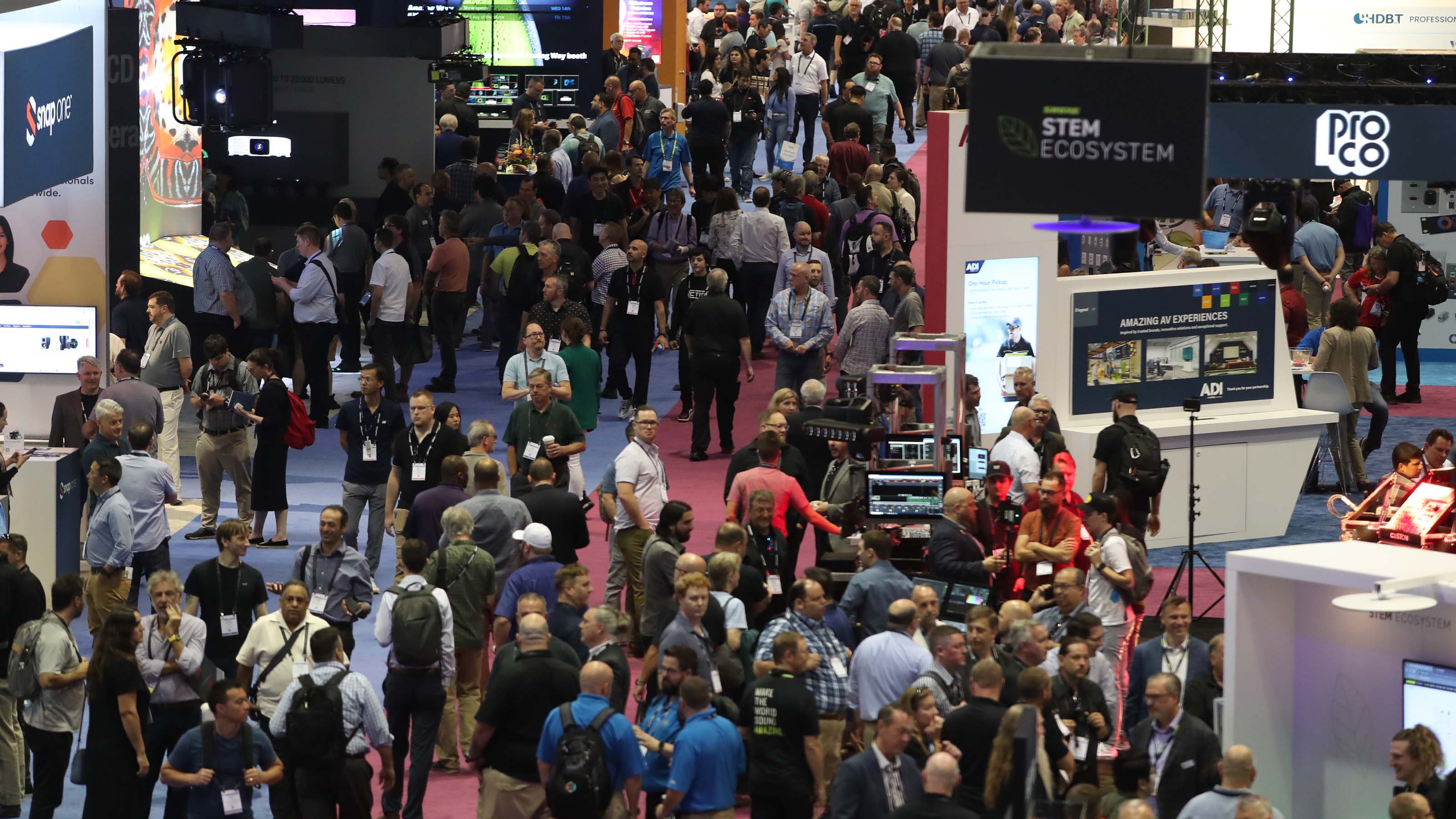

Last week’s InfoComm in Orlando, FL, was another solid outing. Plenty to digest, of course, but here were a few observations that jumped off the pages of my reporter’s notebook.

1) All signs point to a Pro AV recovery.

I’ve been saying this for about a year, but it’s time to put the whole “tradeshows are back” narrative to bed once and for all. This is the third InfoComm I’ve attended in 20 months. During that time, I’ve also been to two ISEs, two NABs, and even an Exertis Almo E4 for good measure. Tradeshows have been back for some time; that’s not news.

What is news is how well the Pro AV industry’s premier U.S. trade show has recovered from its pandemic-induced tumble, not to mention how the industry as a whole is moving toward blue skies.

[3 Things Everyone Was Talking about on the InfoComm 2023 Show Floor]

According to AVIXA, the association that produces InfoComm, total registration for this year’s show was 36,639, with 29,325 verified attendees from 115 countries. International attendance accounted for 20% of the crowd. There were also 700 exhibitors across the Orange County Convention Center. Plus, more than 2,000 individuals participated in the extensive educational offerings at the show. Compare that to 19,681 verified attendees and 522 exhibitors from InfoComm 2022 in Las Vegas and there’s one logical conclusion: growth.

Speaking of growth, Pro AV is on track for a steady state of it over the next five years. Sean Wargo, vice president of market intelligence for AVIXA, expects the Pro AV industry to not only return to pre-pandemic levels, but experience a steady state of modest growth.

According to estimates shared during AVIXA’s Market Insights Lunch, Pro AV will bring in $307 billion this year, and will add nearly $100 billion more in annual revenue by 2028. A U.S. recession is a 50/50 gamble, but AVIXA researchers feel that if a recession does happen, it would likely be mild and not completely derail Pro AV business.

Research also indicated most Pro AV market segments will grow over the next five years. Conferencing and collaboration will remain the strongest market segment, with learning, digital signage, content production and streaming, and performance/entertainment rounding out the top five. Two product segments positioned for significant growth are standalone software (11.6%) and control collaboration in-room technology (8.5%).

2) The projector market is not dead (or even dying).

I know, video walls are all the rage. And yes, they look amazing. I mean, did you see the LG MAGNIT 272-inch 8K MicroLED display? Literally stunning. With displays like this, who needs projectors anymore?

Turns out, lots of markets still use projectors. And yet, the projector market is … shrinking? During the Market Insights Lunch, AVIXA reported the video projection product segment was expected to drop by 3%.

When I interviewed Wargo, he clarified the numbers. If you remove screens and accessories—including replacement bulbs, which are becoming less common as laser projectors dominate new sales—projector sales are actually growing. In fact, they are “thriving in a lot of sectors,” he said.

So, things aren’t as dire as recent statistics initially indicate. That makes more sense. dvLED prices are coming down, but it’s still a much more expensive display option. Meanwhile, larger projectors just keep getting lighter and brighter, bolstered by advances in edge blending, while smaller projectors are delivering very good images and value.

Companies like Epson are doing their part to keep projector shoppers happy. Epson had several projectors on display in its booth, including the new PowerLite 810E, its first extreme short-throw fixed lens laser projector with 4K Enhancement technology. The 3LCD projector delivers 5,000 lumens as well as 16:9 and 21:9 aspect ratios, so higher education and corporate spaces can manage the “front row” layout for Microsoft Teams as well as other content. And earlier this year, Draper announced 21:9 screens in several sizes among its projector screen offerings, so you have plenty of projection options if you want to go ultrawide.

Lies, damned lies, and statistics, as the old saying goes. Considering all the classrooms (particularly higher education), immersive exhibits, and live events, and despite growing competition from other display options, the prospects for projectors will continue to be healthy for quite some time.

3) Videobars are everywhere, even where you might not expect them.

All-in-one conferencing devices popped up all over the show floor. You expect them at certain booths—Hall Technologies, Boom Collaboration, EPOS, Jabra, MAXHUB—they’ve been at this for years. Even Crestron wasn’t a surprise, though its new Videobar 70 and its four(!) cameras could bring this product category to new and interesting places.

[SCN Unveils Installation Product Awards at InfoComm 2023]

What did surprise me was discovering not one but two new videobars at Sennheiser. The TeamConnect Bar Solutions are part of the company’s TeamConnect product line, which already included speakerphones and ceiling microphones, two products that certainly fit within the company’s expertise.

With four microphones and two speakers, the TeamConnect Bar S is for smaller spaces, while the TeamConnect Bar M, for mid-sized rooms, has six mics and four speakers (not that anyone was worried about the audio quality). The company partnered with Image Engineering, an image quality test equipment manufacturer, to make sure its 4K camera (which touts some AI functionality) could keep pace with the audio tools.

I guess I shouldn’t have been that surprised. After all, this is not an unprecedented move. Yamaha UC, another company synonymous with professional audio, unveiled its CS-800 video sound bar late last year, and Bose Professional unveiled its first of two videobar options in 2020.

But this trend tells me two things. First, in today’s environment, established companies are willing to bet on brand extensions that stray from their core competencies. Partnerships, once scorned in public but now heralded to all who will listen, as well as the economic uncertainty that the pandemic thrust upon the industry, have likely helped to pave the way for executive teams to embrace potential new revenue streams.

Second, videobars are one of the hottest products in Pro AV. It makes sense—an all-in-one solution can be a quick fix for outdated conference rooms, huddle rooms, and classrooms. Or it can be a central piece of a more comprehensive renovation or new build. Either way, one device can substantially improve several aspects of your meeting equity efforts.