Peloton (PTON) stock tanked more than 25% on Thursday morning after the connected fitness company reported disappointing Q2 revenue and issued downbeat guidance for the current quarter. The selloff pushed PTON’s standard relative strength index (14-day) down to about 26, indicating deeply oversold conditions that often precede a meaningful rebound.

Still, there’s reason for conservative investors to steer clear of Peloton stock that’s now down more than 35% versus its year-to-date high.

Why Peloton Stock Remains Unattractive to Own

Investors must practice caution in playing PTON stock on post-earnings weakness, since the firm’s Q2 release confirms its attempt to innovate its way out of a slump hasn’t sparked the necessary demand.

Despite a high-stakes rollout of artificial intelligence (AI)-driven tracking cameras, hands-free controls, and 360-degree swivel screens, Peloton sees its sales declining (sequentially) in the third financial quarter.

This suggests customers — already wary of PTON’s recent subscription price hikes — have basically ghosted its new product line.

In short, the quarterly report feeds right into the mounting consensus that Peloton’s turnaround plan has failed, which makes its stock a high-risk bet for 2026.

PTON Shares Are More Expensive Than Nvidia

Peloton shares also remain unattractive to buy on the post-earnings dip because they’re still trading at a premium that’s nearly impossible to justify given its free cash flow declined by more than 30% in Q2.

According to Barchart, the connected fitness company is going for nearly 51x forward earnings at the time of writing, which makes it even more expensive to own than Nvidia (NVDA).

From a technical perspective, PTON currently sits miles below its major moving averages (50-day, 100-day, 200-day), indicating bears are firmly in control.

More importantly, insiders have predominantly unloaded Peloton stock in the trailing 12 months, reinforcing that it’s indeed overvalued at current levels.

What’s the Consensus Rating on Peloton?

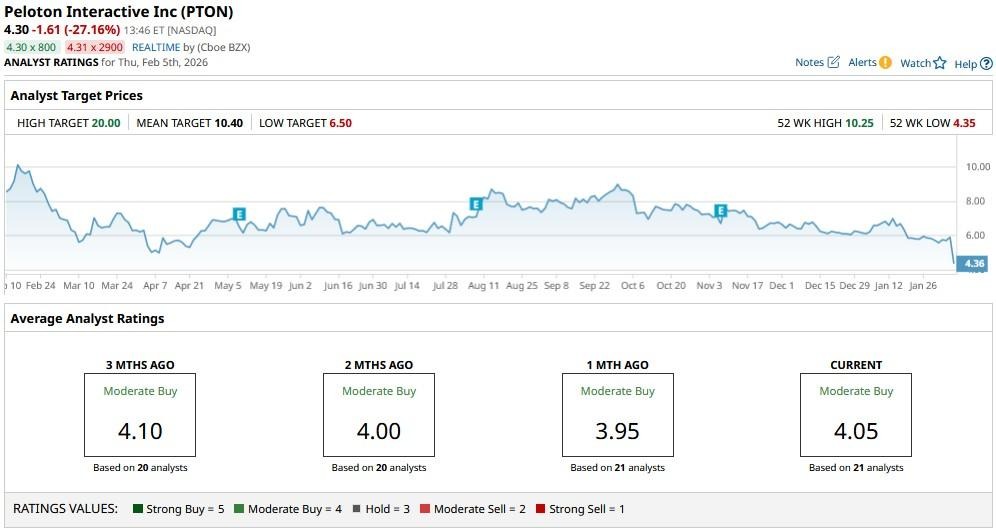

Heading into the Q2 print, Wall Street had a consensus “Moderate Buy” rating on PTON shares, with a mean target of about $10.

However, it’s reasonable to assume that analysts will downwardly revise their estimates for Peloton after its disappointing release on Feb. 5.