Fitness equipment maker Peloton (PTON) may want a do-over for its past few months. The company has seen its market cap plunge to under $10 billion as sales have stalled and market demand for its pricey connected-fitness bikes and treadmills seems to have evaporated.

The company also faces activist investors at Blackwells Capital LLC to change CEOs and it had an unfortunate run of bad publicity with actor Chris Noth. The "Sex and the City Star" appeared in an ad for Peloton's bike after his character on the "Sex and the City" reboot, "And Just Like That" died riding one.

That made for a clever commercial, which would have been playful, had Noth not been accused by various women of inappropriate behavior on set. That sequence sort of summed up how Peloton's past few months have gone and the company has seen its value plummet.

That's, of course, bad news for shareholders, but with spending on virtual or online fitness, turbo-charged by the pandemic and expected to jump ten times to $60 billion by 2027, the company may be an acquisition target. Peloton still has a strong brand and a loyal customer base and that could bring interest from tech giants like Apple (AAPL) and Alphabet (Google) (GOOGL) that have already made inroads into the fitness space.

Peloton Has Struggled

Shares of the New York company have stumbled fiercely over the past six months and Peloton's market value has dropped over fivefold to $9 billion from $50 billion, roughly a year ago.

Chief Executive Jon Foley reportedly told employees last week that Peloton will rethink the size of its workforce and revise production levels, as the company adapts to more seasonal demand for its equipment.

Peloton will report fiscal second-quarter earnings on Feb 8.

"The $2,500 price tag of its flagship bike is also routinely seen as extravagant, and critics think there’s something inherently unfair, even sinister, about a company selling an expensive bit of hardware that is effectively useless without a monthly subscription fee," The Financial Times reported last week.

Peloton charges an additional $39 monthly subscription fee from its customers.

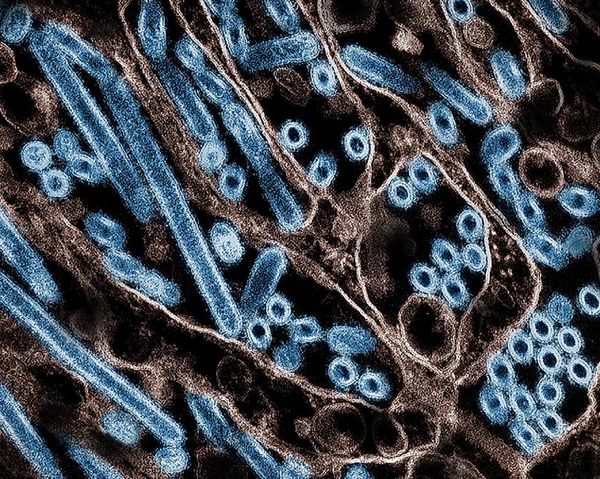

Shutterstock

Is Peloton an Asset?

Despite the precarious state of its business, the connected fitness company is reportedly seen as a potential asset for companies like Apple, Disney (DIS), and Nike (NKE), Bloomberg reported citing a letter from Blackwells.

Separately, Google recently completed its $2.1 billion acquisition of fitness tracker Fitbit and maintained it is looking to build further into the fitness space.

"Technology can change the way people manage their health and wellness, and that's especially important these days. We’ll work closely to create new devices and services that help you enhance your knowledge, success, health, and happiness," wrote Google Senior Vice President (Devices and Services) Rick Osterloh in a company blog.

Apple, which has invested heavily in fitness, is being floated as a potential buyer of Peloton's troubled fitness business.

"If Peloton is to have a future, it would be better off as part of a bigger, more diversified company. Apple is an ideal candidate to take on that project. It has the Fitness+ subscription service for classes and it markets the Apple Watch as a device that can help with jogging and other exercise activities," tech news website The Information reported last week.

Apple Has Made Service Business a Priority

Apple's services business performed better-than-expected and clocked $18.3 billion a 26% jump year over year, Chief Executive Time Cook noted in the October earnings report.

"Also, paid subscriptions continue to show very strong growth. We now have more than 745 million paid subscriptions across the services on our platform, which is up more than 160 million from last year, and nearly five times the number of paid subscriptions we had less than five years ago," said Chief Financial Officer Luca Maestri.

Athleisure company Lululemon (LULU) which bought at-home fitness company Mirror for half a billion dollars in July 2020 has said it will continue to invest in the brand even though it nearly halved its Mirror sales outlook.

"We simply don't need to, but we will invest to define our unique proposition and to bring Mirror to market through our owned marketing channels," Chief Executive Calvin McDonald told investors in a call in December 2021.