Shares of Peloton (PTON) have been volatile since they topped out in 2021. Case in point:

On Wednesday, the shares erupted more than 20% on reports of a distribution deal with Amazon (AMZN). On Thursday, the stock is down about 20% after the connected-fitness company reported earnings.

The move leaves the shares trading near last week’s low and threatening to move lower if buyers don't step in.

Wednesday's reports said that Peloton “would sell its signature exercise bike, as well as other apparel and accessories, through Amazon.” But a top- and bottom-line miss a day later sapped that bullish momentum.

CEO Barry McCarthy said, “The naysayers will look at our Q4 financial performance and see a melting pot of declining revenue, negative gross margin, and deeper operating losses.”

Quite specifically, that’s exactly what investors are seeing right now.

While McCarthy sees a comeback in Peloton’s future, the charts are not all that constructive at the moment. Let’s check them now.

Trading Peloton Stock

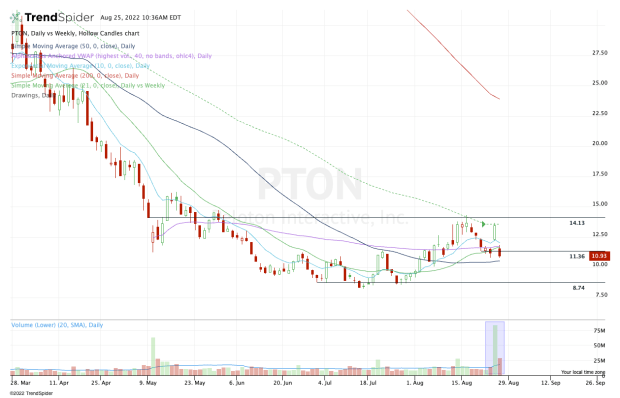

Chart courtesy of TrendSpider.com

Wednesday’s move could have been the perfect precursor to a continued upside move. The Wednesday rally sent Peloton stock right to the 21-week moving average, which was resistance earlier this month as well.

Had the stock had a bullish earnings reaction, Peloton shares could have cleared this month’s high and made a stronger move to the upside.

Instead, investors reacted bearishly, and the stock gapped down below the 10-day and 21-day moving averages and daily VWAP measure.

The stock even tried to rally off the lows and reclaim these levels -- but it has failed so far. Now trading below $11.36, Peloton stock is below last week’s low.

If it breaks below the 50-day moving average and $10, it could open the door to more downside selling pressure, potentially putting the $8.50 to $8.75 level in play.

The quarterly report was not good, even though Peloton linking up with Amazon is a potentially great development. Regardless of the news, it’s the reaction to the news that’s important when it comes to trading.

We’re seeing that play out on Thursday with Nvidia (NVDA). The company reported disappointing results and disappointing guidance, yet the stock is pushing higher. At least for now, the bulls are winning the battle.

The same cannot be said for Peloton stock.

If it can reclaim $11.36 this week and/or get back above the 21-day moving average and the daily VWAP measure, then it may be able to push higher and challenge active resistance via that moving average.