In the preceding three months, 6 analysts have released ratings for Fastly (NYSE:FSLY), presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 5 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

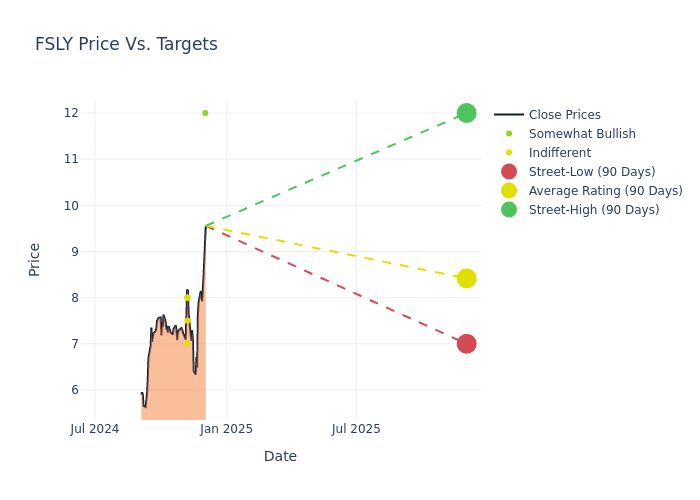

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $8.42, with a high estimate of $12.00 and a low estimate of $7.00. This upward trend is evident, with the current average reflecting a 38.03% increase from the previous average price target of $6.10.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Fastly is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Timothy Horan | Oppenheimer | Announces | Outperform | $12.00 | - |

| Jeff Van Rhee | Craig-Hallum | Raises | Hold | $8.00 | $6.00 |

| Rudy Kessinger | DA Davidson | Raises | Neutral | $7.50 | $5.50 |

| William Power | Baird | Raises | Neutral | $8.00 | $7.00 |

| Rishi Jaluria | RBC Capital | Raises | Sector Perform | $7.00 | $6.00 |

| James Fish | Piper Sandler | Raises | Neutral | $8.00 | $6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Fastly. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fastly compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Fastly's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Fastly's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Fastly analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Fastly

Fastly operates a content delivery network, which is necessary for entities to provide faster and more reliable online content. Fastly's strategy differs from traditional CDNs, which focus on locating servers in as many locations as possible to store copies of files that consumers most use. Fastly is in far fewer sites than traditional CDNs, but it houses servers in the most network-dense data centers. Instead of simply storing static content, it allows its customers to program on its platform, enabling edge computing and better service of the more dynamic content that was traditionally not well served by CDNs. Fastly gears its service to the largest, most sophisticated enterprises rather than small companies and generated nearly three fourths of its revenue in the United States in 2023.

Fastly's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Fastly displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 7.35%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -27.71%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -3.9%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -2.57%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Fastly's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.43.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

.jpg?w=600)