/Paychex%20Inc_%20office-by%20Eric%20Glenn%20via%20Shutterstock.jpg)

With a market cap of $33.9 billion, Paychex, Inc. (PAYX) is a leading provider of human capital management (HCM) solutions, offering payroll, HR, employee benefits, and insurance services to small and medium-sized businesses across the United States, Europe, and India. It delivers end-to-end workforce solutions ranging from recruiting and payroll processing to retirement planning, compliance, and risk management.

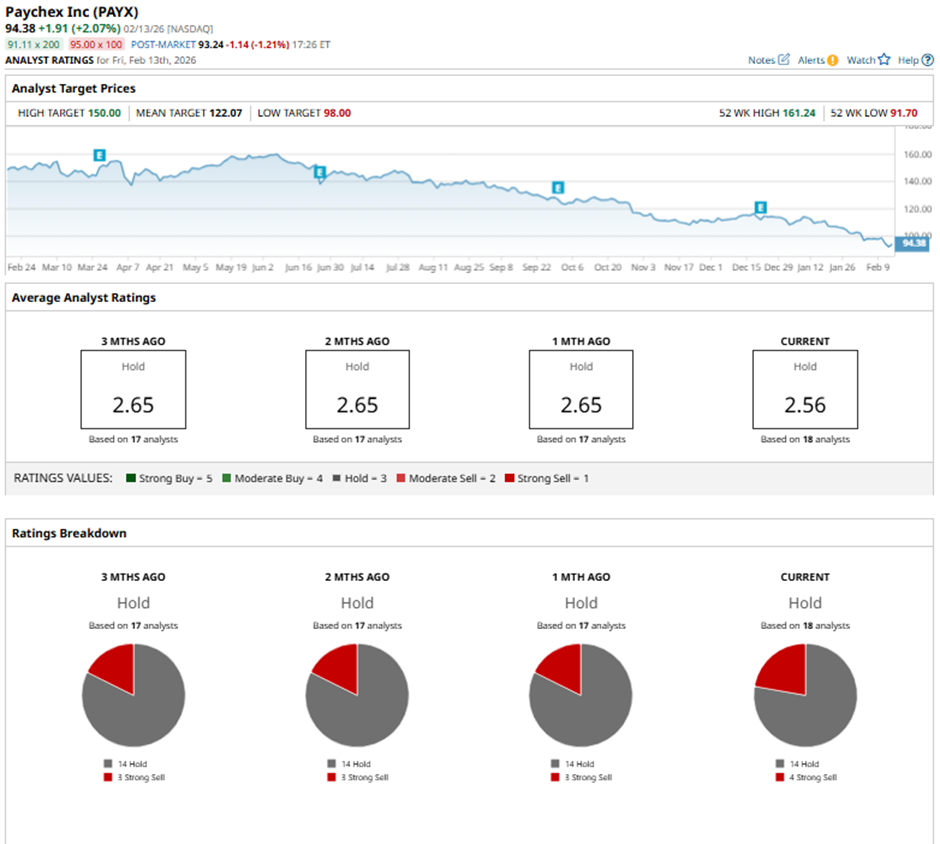

Shares of the Rochester, New York-based company have lagged behind the broader market over the past 52 weeks. PAYX stock has decreased 36.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. Moreover, shares of the company are down 15.9% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the payroll processor and human-resources services provider have underperformed the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.3% return over the past 52 weeks.

Paychex reported Q2 2026 results on Dec. 19. The company posted adjusted EPS of $1.26 and revenue climbed 18% year-over-year to $1.56 billion, both topping forecasts. Investor sentiment was further boosted by 21% growth in adjusted operating income to $649 million and strong momentum from the Paycor acquisition, which contributed approximately 17% to Management Solutions revenue growth. Additionally, Paychex raised its full-year fiscal 2026 outlook, projecting 10% - 11% growth in adjusted EPS.

For the fiscal year ending in May 2026, analysts expect PAYX’s adjusted EPS to grow 9.2% year-over-year to $5.44. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on 14 “Hold” ratings and four “Strong Sells.”

On Jan. 29, Kevin McVeigh of UBS maintained a “Hold” rating on Paychex, setting a price target of $110.

The mean price target of $122.07 represents a 29.3% premium to PAYX’s current price levels. The Street-high price target of $150 suggests a 58.9% potential upside.