/Paychex%20Inc_%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Rochester, New York-based Paychex, Inc. (PAYX) provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses. With a market cap of approximately $40 billion, Paychex's operations span the United States, Europe, and internationally.

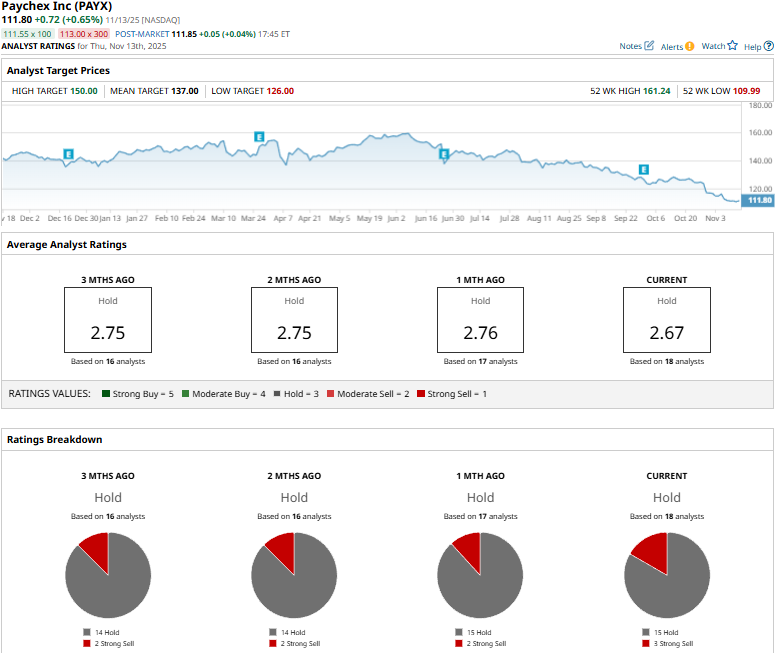

Paychex has significantly underperformed the broader market over the past year. PAYX stock prices have declined 20.3% on a YTD basis and 23.7% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 14.6% gains in 2025 and 12.6% returns over the past year.

Narrowing the focus, Paychex has also underperformed the Technology Select Sector SPDR Fund’s (XLK) 23.3% gains in 2025 and 21.8% surge over the past 52 weeks.

Despite reporting better-than-expected results, Paychex’s stock prices declined 1.4% in the trading session following the release of its Q1 results on Sept. 30. Q1 marked a solid start to the fiscal year 2026, registering robust double-digit growth in revenues and cash flows. The company’s topline came in at $1.5 billion, up 17% year-over-year and 21 bps above the Street’s expectations. Meanwhile, its adjusted EPS grew 5% year-over-year to $1.22, exceeding the consensus estimates by 83 bps. Further, its cash flows from operations surged 31.6% year-over-year to $718.4 million.

On an even more positive note, the company raised its full-year adjusted EPS growth guidance range to 9% - 11%.

For fiscal 2026, ending in May, analysts expect Paychex to deliver an adjusted EPS of $5.47, up 9.8% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

Among the 18 analysts covering the PAYX stock, the consensus rating is a “Hold.” That’s based on 15 “Holds” and three “Strong Sells.”

This configuration is slightly more pessimistic compared to a month ago, when two analysts gave “Strong Sell” recommendations.

On Oct. 20, Morgan Stanley (MS) analyst James Faucette reiterated an “Equal-Weight” rating on PAYX, and notched up the price target from $132 to $133.

Paychex’s mean price target of $137 represents a 22.5% premium to current price levels. Meanwhile, the street-high target of $150 suggests a notable 34.2% upside potential.