With more than $4 trillion in assets and growing, the municipal bond market is the main engine of public finance, fueling infrastructure, education and essential services nationwide.

Despite its scale and essentiality, the market remains fragmented and heavily influenced by retail investors, resulting in inefficiencies that present opportunities for active management.

Recent market conditions have led to specific trades that appear to offer questionable value for investors compared to alternative options.

While skilled active managers can strategically position portfolios to take advantage of these market conditions, passive strategies, such as many ETFs and bond ladders, may lack flexibility owing to guideline restrictions and static approaches.

California 1- to 10-year bonds priced too highly vs U.S. Treasuries

Investor demand for tax-exempt municipal bonds from California has been exceptionally strong.

This trend is even more evident for bonds with maturities between one and 10 years, as recent trades show yields are lower by as much as 40 basis points compared to similar bonds from other states (compared to general market AAA-rated municipal bonds with the same maturity).

Much of the demand stems from California's lofty income tax, from which California municipal bonds can provide relief — investors domiciled in the state benefit from state income tax-exemption, in addition to the federal tax-exemption.

At current prices, U.S. Treasury bonds often provide notably higher yields after-tax than 1- to 10- year California municipal bonds (U.S. Treasuries are federally taxable).

This situation is unusual, as investors typically require higher yields from municipal bonds than the after-tax yield on U.S. Treasuries, owing to Treasuries' liquidity and backing by the U.S. government.

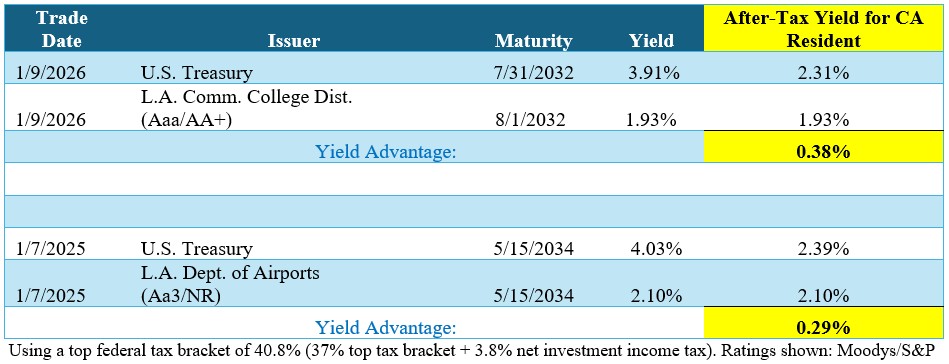

The following municipal bond trades illustrate the yield advantage for California-domiciled investors whose active managers are tactically allocating new capital into Treasuries in lieu of municipals.

For an active manager with the flexibility to tactically allocate into U.S. Treasuries, these municipal bond investments illustrate missed opportunities in capturing additional after-tax yield while taking on less risk, given the deep liquidity and government backing that U.S. Treasuries provide.

Passive municipal bond investing typically focuses on managing portfolios that generate 100% federally tax-exempt income, overlooking the bigger picture. We believe investors should focus on the after-tax yield vs the tax-exempt yield.

Active management with a focus on after-tax yield can produce higher income levels and improve the risk profile and liquidity of a portfolio in certain conditions.

Prioritizing the yield curve over lower credit quality

Lower-rated bonds represent another segment of the market that tends to be less appealing in today's environment.

Given the additional credit risk associated with BBB-rated bonds, investors should be compensated with higher yields when compared to higher-rated bonds (e.g., AA).

However, owing to the combination of a steep yield curve and, in our observation, tighter-than-average credit spreads, in certain instances, investors can capture yields in AA- and AAA-rated bonds that are similar to those of BBB-rated bonds by moving only slightly longer in maturity.

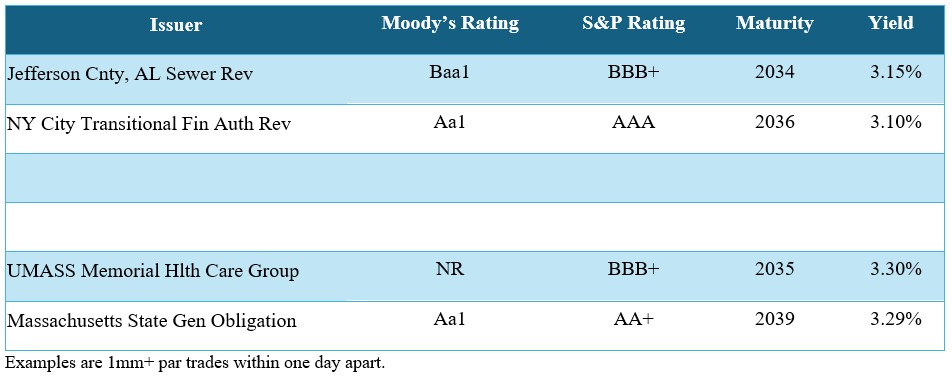

This table shows two instances that demonstrate this point.

The yields of the BBB bonds are comparable to those of AA and AAA-rated bonds, with just two years or four years longer maturities in these examples — a compelling value in our opinion, given the six-notch difference in credit rating.

These examples underscore our view that in today's market, unconstrained investors are generally better served by seeking income through high-quality bonds positioned further along the yield curve, rather than undertaking additional credit risk by moving down the quality spectrum.

Conclusion

Given the characteristics of the municipal bond market, we are seeing dislocations occur that provide possibilities for active managers to maximize value for investors.

In more passive strategies, certain transactions may prove suboptimal for the prevailing market environment.

Passive municipal bond ETFs and similar passive products may limit their responsiveness to evolving market conditions.

For instance, some short-maturity ETFs have over 15% of their portfolio in California bonds despite the rich valuations discussed earlier.

We believe skilled active managers, on the other hand, can adapt to market conditions like those that exist today.

Managers who can move across instruments, maturities and structures, guided by after-tax economics, are better positioned to turn transitory dislocations into lasting advantages.

Peter Aloisi is a fixed income portfolio manager at A&M Private Wealth Partners (AMPWP), where he focuses on tax-advantaged intermediate and short-duration strategies tailored to the unique needs of ultra-high-net-worth clients. Throughout his career, he has enhanced client value by identifying optimal risk-reward opportunities within the municipal bond landscape, leveraging market dislocations across various cycles.

Abdulla Begai is a director and head of Fixed Income Trading at AMPWP and a founding member of the firm. He brings deep expertise in financial analysis, risk management and portfolio construction, combining rigorous analytical skills with intuitive market insight to deliver consistent, risk-adjusted returns. Abdulla specializes in structuring tax-advantaged municipal bond portfolios, blending internal credit analysis with broader market dynamics.

Related Content

- Here's Why Munis Aren't Just for Wealthy Investors Now

- 10 Things You Should Know About Bonds

- This Boring Retirement Income Source Has Big Tax Benefits

- Keep Tax Collectors at Bay with Muni Bond Funds

- Financial Analyst Sees a Bright Present for Municipal Bond Investors

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.