In many places, education is not cheap; unless, of course, your hard work and outstanding achievements result in some sort of a scholarship.

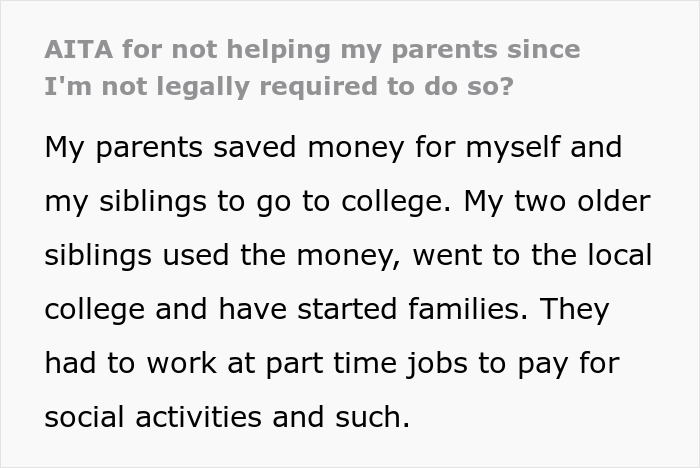

The latter is what this redditor got, which meant that his parents didn’t have to spend the money they had been saving up on his education. However, they didn’t give said money to their son, either, saying that they were “not legally obligated” to do so. That’s why the son told them the same thing roughly a decade later. Scroll down to find the full story below.

Education often leaves quite a big hole in one’s pocket

Image credits: Karolina Kaboompics / pexels (not the actual photo)

These parents didn’t need to pay for their son’s education, but they didn’t let him spend the money on other things, either

Image credits: Rick Han / pexels (not the actual photo)

Image credits: Salvador Escalante / unsplash (not the actual photo)

Image credits: David Hahn / unsplash (not the actual photo)

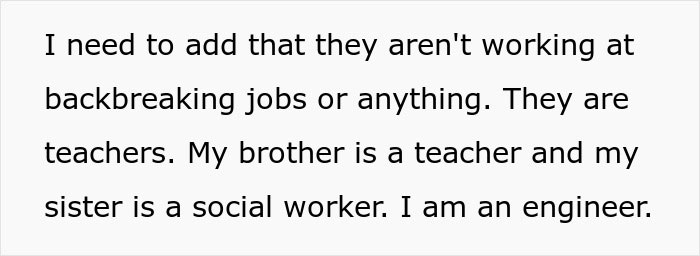

Image credits: Old-Conference295

Quite a few parents start to save up for their child’s education way in advance

Nowadays, education is quite costly, especially in the US, so it’s no surprise that it can leave quite a dent in one’s budget. That’s why many parents start saving quite early in case their offspring wants to continue studying after graduating high school.

According to a recent Northwestern Mutual Planning & Progress Study, two-in-three parents in the US try to cover at least part of the costs of their children’s studies; one-in-three aim to cover it all. Not only that, some of them—one-in-five, to be exact—are saving up to help their loved ones pay for higher education while paying back their own college loans.

According to Education Data, parents’ savings and investments only make up roughly 7% (as of 2023) of college student tuition funding. The largest piece of the pie—roughly 58%—are covered by income, grants, scholarships, and other funds that do not need to be repaid, and the second largest (close to 20%) is covered using money that has been borrowed.

Putting themselves through higher education can cost a student tens of thousands of dollars

Image credits: JESHOOTS.COM / unsplash (not the actual photo)

If you’re wondering how much one has to save up to put themselves—or their child or loved one—through higher education, the answer is: a lot. According to Statista’s 2022 data, the average cost for tuition and fees at US higher education institutions was over $14,000 US dollars; and that does not include expenses for the room and board. With the latter, the price can rise to as much as $30,000 USD for a four-year degree in the US.

Though it’s important to mention that the price can differ not only based on the length of the studies or the field of study, but on the specific location in the country, too. Forbes suggests that out of all the states in the US, South Dakota, Montana, and Wyoming are the most affordable options respectively. As for the global situation, Norway, Taiwan, and Germany are reportedly some of the cheapest countries to study abroad.

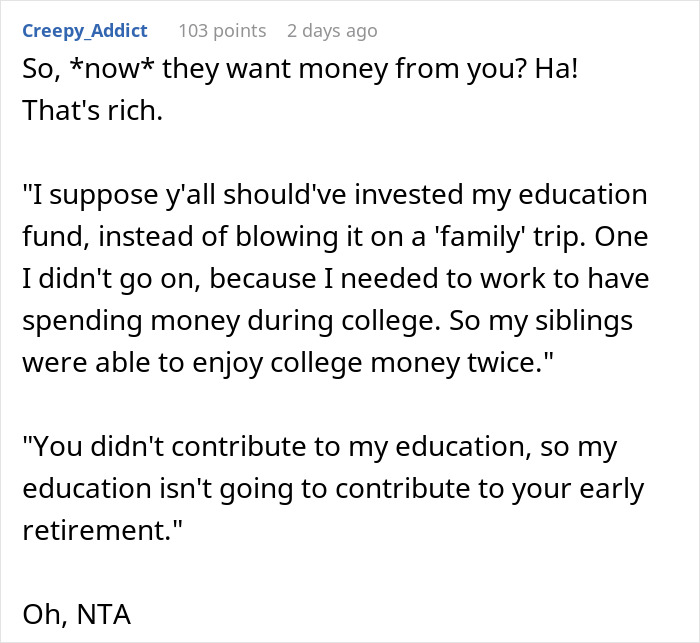

In the OP’s case, it wasn’t the price of the studies that was the cause of problems in the family. It was the fact that the parents didn’t want to share the money they saved once their son graduated high school, saying that they weren’t legally obligated to, which became the reason why their son didn’t want to share his savings later in life, either.

Many people believed that the son was not being a jerk for refusing to help his parents

Some, however, took a different stance