Many of us might have heard about the warnings about using credit cards—those sky-high interest rates, the urge to spend more than we should, and the financial mess that can follow if we miss a payment. But one danger that isn’t talked about enough is the possibility that someone close to us might be the one responsible for that debt.

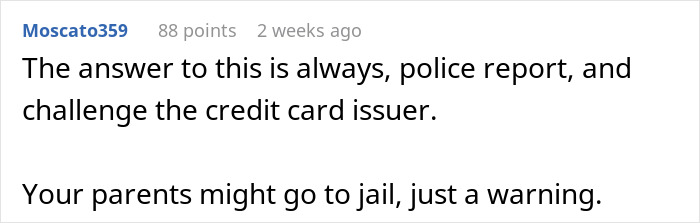

Like this person, who took to Reddit to share how their parents committed credit card fraud in their name, using the money to go on cruises. The parents then suggested the author file for bankruptcy and even proposed opening more cards before doing so. Keep reading to uncover the full story and find out just how deep the debt really goes.

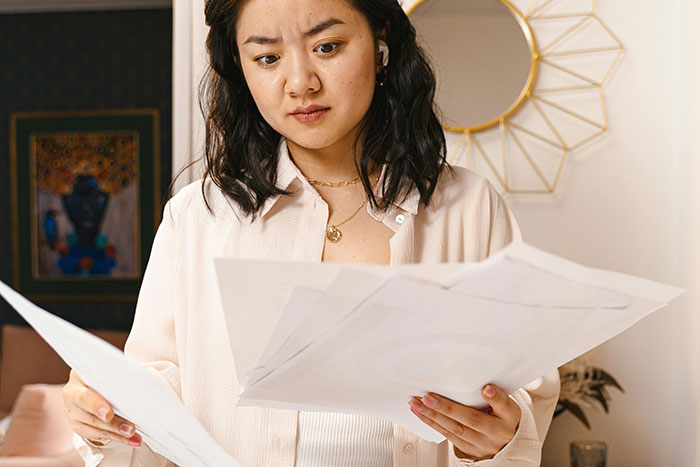

Taking a vacation can be pricey, but that doesn’t mean you should max out your credit card

Image credits: Georgy Trofimov (not the actual image)

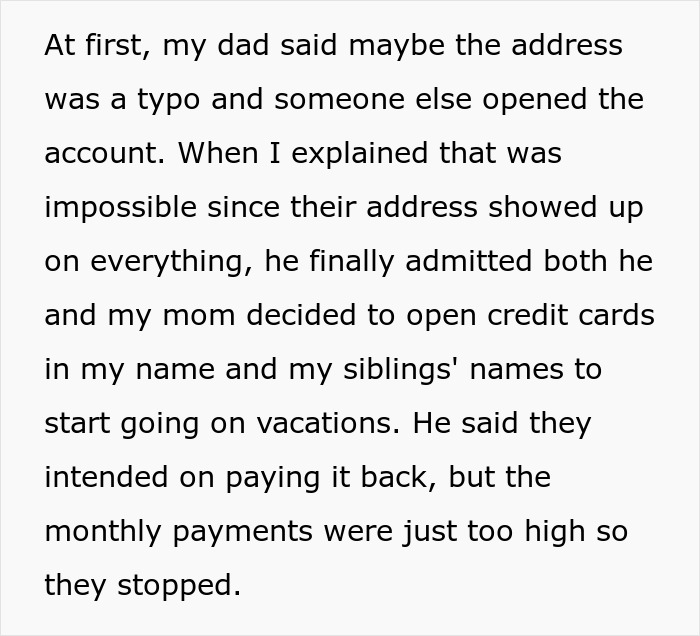

Someone revealed how their parents committed credit card fraud in their name just to fund a cruise vacation

Image credits: ANTONI SHKRABA production (not the actual image)

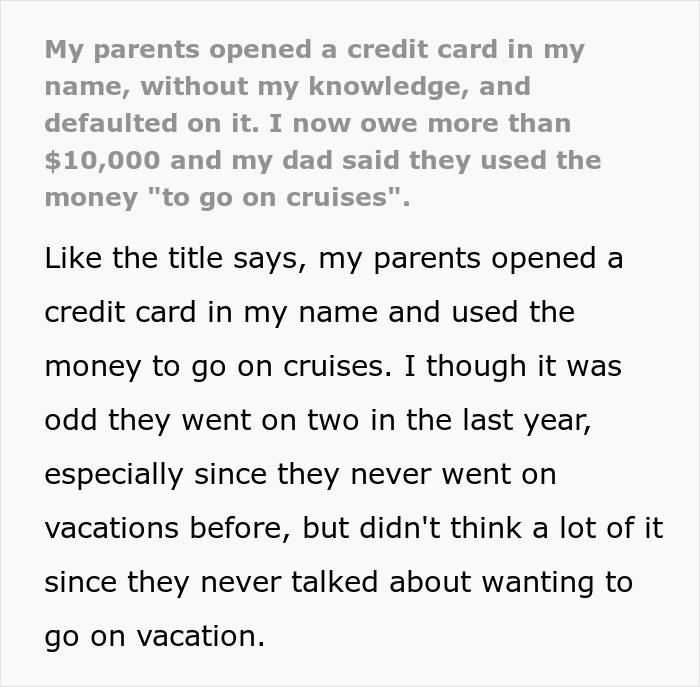

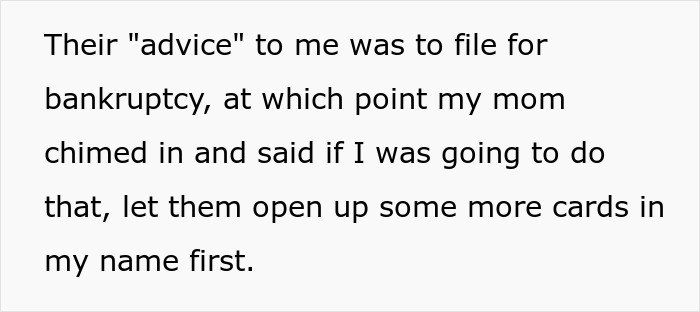

Image credits: notatypo-dad

It’s not uncommon for those closest to you to commit identity theft

Trust is the foundation of any relationship. We rely on our parents to look out for our best interests, our partners to assist us in making financial choices, and our friends to respect our privacy. But what happens when that trust is betrayed and someone uses your name, your credit cards to fund their own desires?

It might seem like a scene straight out of a television drama but unfortunately, it is one of those things that happens in reality more often than you think. Picture receiving a statement on a credit card that you never applied for, or discovering that your credit score has taken a nosedive because of purchases you didn’t make.

The awareness that a person you consider dear has perpetrated fraud using your details is both emotionally painful and financially damaging as well. This is not only a question of finances – this is about betrayal. You might have a good relationship with this person, trusting them with your life and your secrets, only to find out that they’ve exploited your trust for financial gain.

In such cases, the first reaction is usually one of denial. One might assume that it was a misunderstanding – a typo in the billing address or maybe illegal impersonation by someone else. But when the truth comes out—that it was someone close to you who did this—it’s like a punch in the gut. For many people, the feelings of aggression, sorrow, and disorientation are so great that it seems too hard to find the way out.

Once the shock wears off, the practical reality of the situation sets in. You have to deal with the debt. If the person responsible admits to it, you’re left with a difficult choice: do you forgive them and try to work together to pay it off, or do you cut ties and pursue legal action?

Additionally, filing for bankruptcy is not a simple fix. Bankruptcy stays on your credit report for years, affecting your ability to get loans, buy a home, or even get certain jobs. It’s a drastic measure that can provide relief but also has long-term consequences.

Maintaining financial security is crucial for peace of mind and stability

While you can’t always predict or prevent someone close to you from committing credit fraud in your name, there are steps you can take to protect yourself. Regularly check your credit report for any unusual activity. Set up alerts with your bank and credit card companies to notify you of any new accounts opened in your name. Be cautious about who has access to your personal information, and never feel bad about setting boundaries, even with those you trust.

In the end, credit card debt, whether it’s your own or thrust upon you by someone you trusted, is a burden that no one should have to carry alone. Money is an objective thing that can be lost or regained but trust is subjective and is much harder to rebuild. Be kind to yourself as you navigate the fallout, and take the steps necessary to protect your future.

Remember, financial security starts with knowledge and vigilance. By staying informed and cautious, you can avoid becoming a victim of credit card debt, even when it’s caused by someone close to you. Have you ever had someone close to you commit credit card fraud in your name? How did you handle the situation?

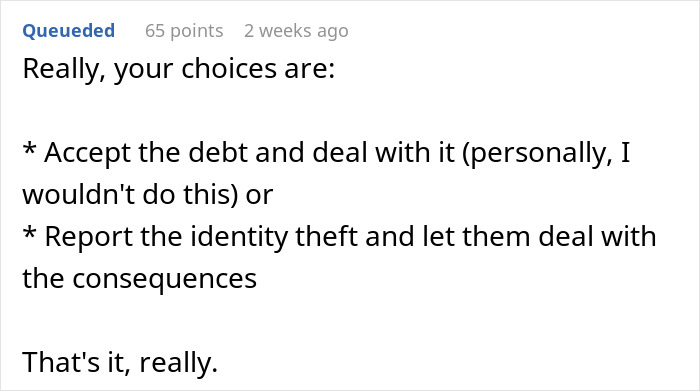

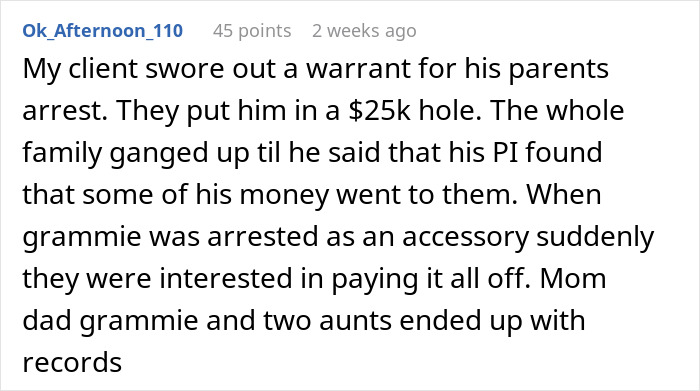

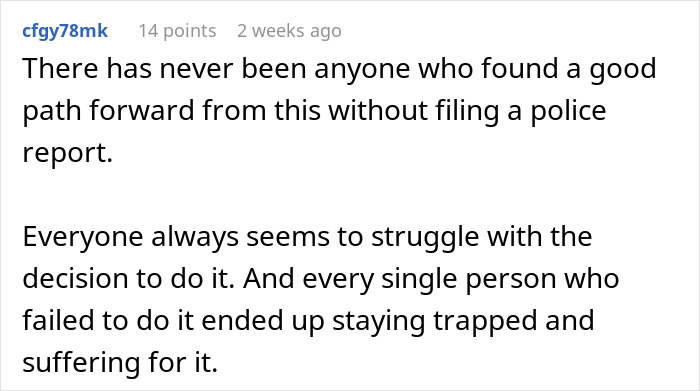

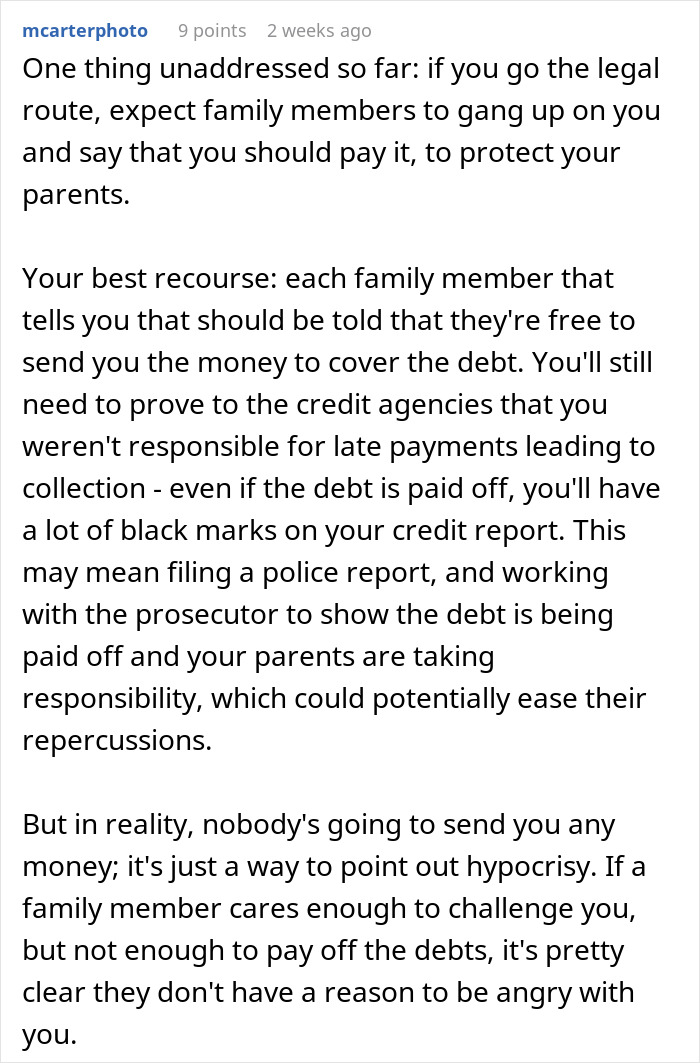

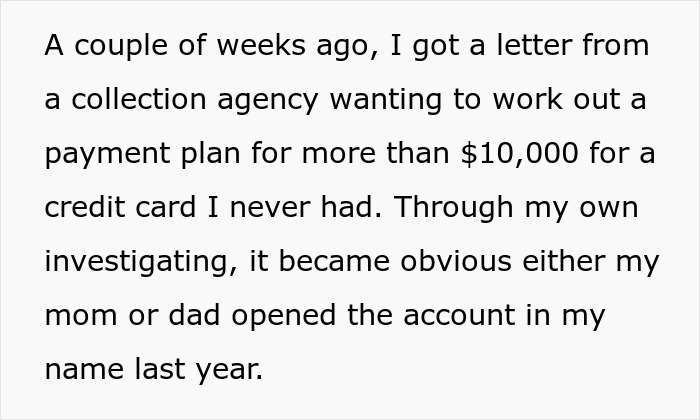

Many people suggested that the author should file a police report against their parents.