Paramount Global reported a third-quarter profit of $295 million, with the media conglomerate expanding its direct-to-consumer revenue by 38% and closing DTC losses for the year by more than 30%.

Paramount’s stock surged over 10% in Thursday day trading and close to another 10% in after-hours trading.

It was business as usual on the linear side.

Paramount’s linear TV business saw sales decline another 8% to $4.57 billion. Despite rampant cord-cutting, the division held the line year over year on affiliate and subscription revenue at $2 billion, but advertising sales dropped 14% to $1.7 billion and licensing revenue fell 12% to $860 million.

You can see Paramount's full Q3 earnings release here.

Filmed entertainment revenue, meanwhile, increased by 14% in the quarter, driven by the strong summer theatrical performance of Mission Impossible: Dead Reckoning, as well as coin from spring blockbuster The Super Mario Bros. Movie.

But the big story for Paramount in Q3 was streaming, with Paramount Plus subscribers up by 2.7 million from July-September to reach 63 million.

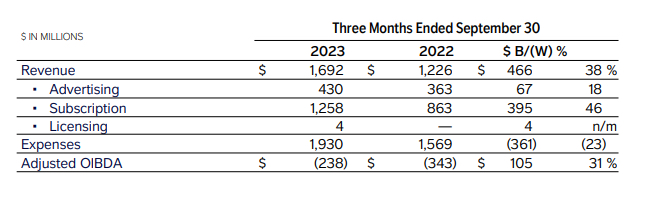

Overall DTC revenue was up 38% to $1.69 billion, with subscription sales increasing 46% to $1.26 billion.

Paramount Plus revenue specifically expanded by 61%, driven partly by a $1-per-month price increase initiated back in July. Paramount Plus global ARPU expanded 16% year over year.

Also Read: ‘Yellowstone’s’ Final 6 Episodes Pushed All the Way Back to November 2024 on the Paramount Network

DTC ad sales thrived in Q3 on Paramount Plus and FAST platform Pluto TV, too, up 18% to $430 million.

Perhaps the happiest news of all for Paramount Global investors was that DTC losses are now expected to be more than 30% lower in 2023 than they were in 2022, with Paramount now predicting streaming profitability by next year.

Speaking to equity analyst on Thursday's earnings call, Paramount CEO Bob Bakish said his team was in active discussions with pay TV operators to establish "hard bundle" distribution of Paramount streaming, similar to the groundbreaking arrangement carved out between Charter Communications and Disney back in September.

Charter's renewal terms allow it to distribute Disney Plus at wholesale to its video customers, as well as the upcoming streaming version of the ESPN cable channel.

Bakish noted that Paramount has already established arrangements with pay TV operators including Comcast to bundle Paramount Plus with Showtime, resulting in significantly lower customer acquisition cost, reduced churn and increased scale.

"If we go this direction, we think it could be an accretive development," Bakish said.

With these prior arrangements, "no linear channels were dropped and revenue increased," he added. "We like that very much."