Retail sales took a hit in January, weighed down by blizzards and wildfires that kept shoppers indoors after the holiday rush. The bigger concern, however, lies ahead. February is unlikely to deliver the rebound many had hoped for, especially with mounting economic pressures. Mass layoffs and the looming threat of more job cuts add to the unease.

The broader economic landscape offers little reassurance. According to Trivariate Research founder Adam Parker, key indicators like job numbers, wages, and rising credit card delinquencies are showing signs of weakness. Yet, not every corner of retail is struggling. Bargain-hunting is no longer limited to budget-conscious shoppers, as even the wealthy are embracing smart spending. And luxury brands are continuing to outperform.

With this in mind, the TJX Companies (TJX), Tapestry (TPR), and Ralph Lauren (RL) continue to thrive.

Stock #1: The TJX Companies

Based in Framingham, Massachusetts, The TJX Companies (TJX) is a dominant force in off-price retail, specializing in apparel and home fashions. With a market cap of approximately $136.9 billion, it thrives on a flexible business model that enables swift inventory shifts and compelling pricing strategies.

Its continued expansion in both physical stores and market reach, along with disciplined cost management, has been a key driver of success. Owing to this, over the past 52 weeks, TJX has surged 26.4%, outshining the broader S&P 500 Index’s ($SPX) 15% return during the same stretch.

On Feb. 26, TJX posted fiscal 2025 fourth-quarter results, which blew past both Wall Street’s top and bottom line forecasts. Total revenue reached $16.4 billion, slightly down year-over-year but surpassing estimates of $16.2 billion. EPS came in at $1.23, outpacing projections of $1.16 and marking a 10% jump from the prior year’s $1.12.

In the quarter alone, TJX added 131 new stores, reinforcing its long-term ambition to reach 6,275 locations. Management is doubling down on shareholder returns as well, announcing a 13% dividend hike and a robust stock repurchase plan between $2 billion and $2.5 billion for fiscal 2026.

Looking ahead, TJX expects consolidated comparable store sales growth of 2%-3% for fiscal 2026, with projected EPS between $4.34 and $4.43. By comparison, analysts forecast fiscal 2026 EPS to come in at $4.43, reflecting a 4% year-over-year increase.

Among 22 analysts covering TJX, 19 advocate a “Strong Buy,” while three suggest a “Hold.” The consensus stands at a “Strong Buy.” With an average analyst price target of $139.09, the stock has potential upside of 13%, and the Street-high target of $158 suggests that the stock can climb as much as 28.5% from here.

Stock #2: Tapestry

Tapestry (TPR) is a powerhouse in the luxury fashion world, overseeing iconic brands such as Coach, Kate Spade, and Stuart Weitzman.

With a market cap of $16.8 billion, Tapestry has honed its focus on attracting younger consumers, particularly Gen Z and millennials, to sustain long-term growth. Over the last 52 weeks, its stock has skyrocketed 70%, with an astonishing 96.5% surge in just the past six months.

Momentum intensified on Feb. 6, when shares spiked more than 12% following a stellar fiscal 2025 second-quarter earnings report that exceeded expectations and led to an upward revision of its fiscal 2025 outlook. Revenue rose 5.3% year-over-year to $2.2 billion, narrowly surpassing the consensus estimate of $2.1 billion. It posted non-GAAP EPS of $2.00, marking an impressive 22.8% increase from the previous year and outpacing Wall Street’s $1.74 projection.

Looking ahead, Tapestry has lifted its fiscal 2025 outlook. The company now anticipates revenue exceeding $6.85 billion, reflecting 3% growth despite a projected currency headwind of over 50 basis points. Additionally, it anticipates generating around $1.2 billion in adjusted free cash flow. For the fiscal third quarter of 2025, analysts project EPS of $0.88, an 8.6% increase from the previous year. Full-year EPS is expected to climb 14.5% to $4.91.

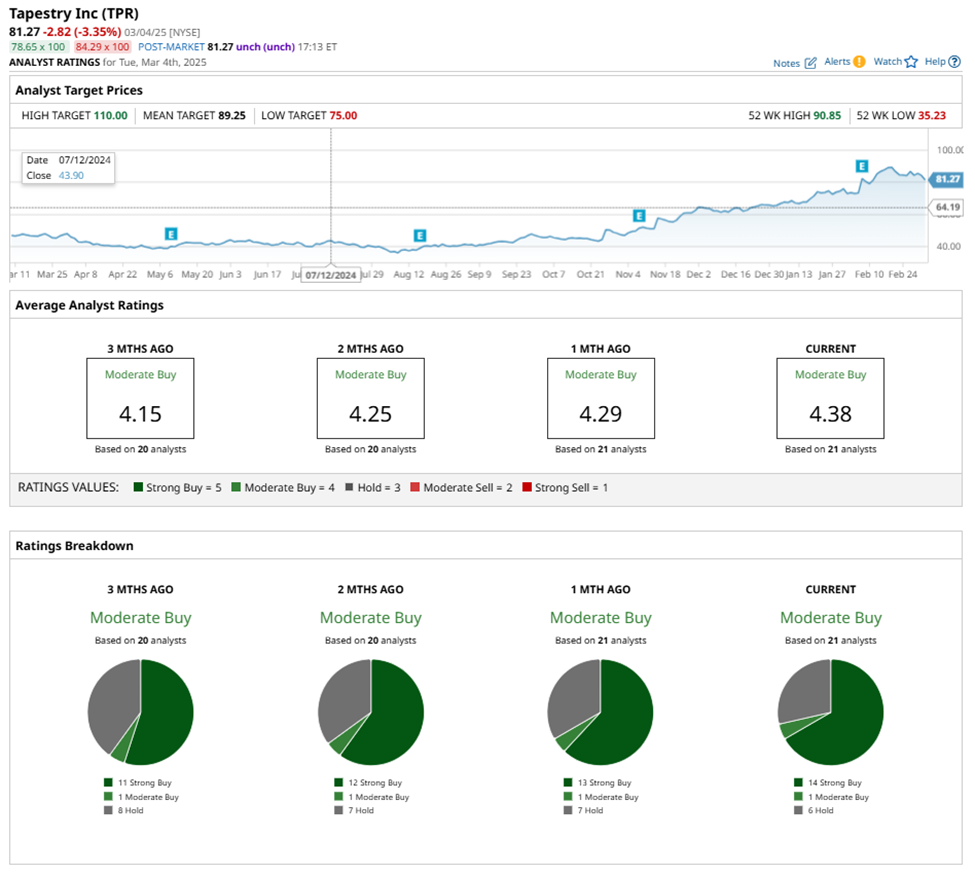

Among 21 analysts covering TPR, 14 recommend a “Strong Buy,” while one suggests a “Moderate Buy.” Six analysts rate it a “Hold,” leading to an overall consensus of “Moderate Buy.” The average price target of $89.25 implies 10% upside, while the Street-high target of $110 suggests potential gains of up to 35.4% from current levels.

Stock #3: Ralph Lauren

Based in New York, Ralph Lauren (RL) is a defining name in American luxury, known for its signature apparel, accessories, and fragrances. With a market cap of $15.6 billion, the company continues to refine its direct-to-consumer strategy, strengthening customer relationships and boosting profitability. Its expansive retail footprint, with over 560 stores worldwide, supports this approach.

RL’s stock has climbed 39% over the last 52 weeks and surged 44.4% in just six months.

Shares of the fashion brand closed up more than 9% on Feb. 6 after Ralph Lauren dropped its financial results for the third quarter of fiscal 2025, which ended Dec. 28, 2024. Revenue increased 10.8% year-over-year to $2.1 billion, surpassing estimates of $2 billion. Adjusted EPS reached $4.82, a 15.6% increase over the prior year, beating expectations of $4.48.

Encouraged by strong momentum, the company has raised its full-year fiscal 2025 revenue outlook, now projecting growth of 6%-7% in constant currency terms. Analysts also anticipate a solid finish to the year, with fourth-quarter EPS estimated to climb 13.5% year-over-year. Full-year EPS is expected to grow 16.5% to $12.01, highlighting continued earnings strength.

Of the 18 analysts covering the stock, 12 rate it a “Strong Buy,” one calls it a “Moderate Buy,” while four suggest a “Hold,” and one a “Strong Sell.” The average price target of $302.76 implies 20.9% upside, while the Street-high target of $348 signals potential gains of up to 39% from current levels.