The OECD raised its global economic growth forecast for 2024 on Thursday, driven by strong performances in the United States and emerging countries while Europe lags behind.

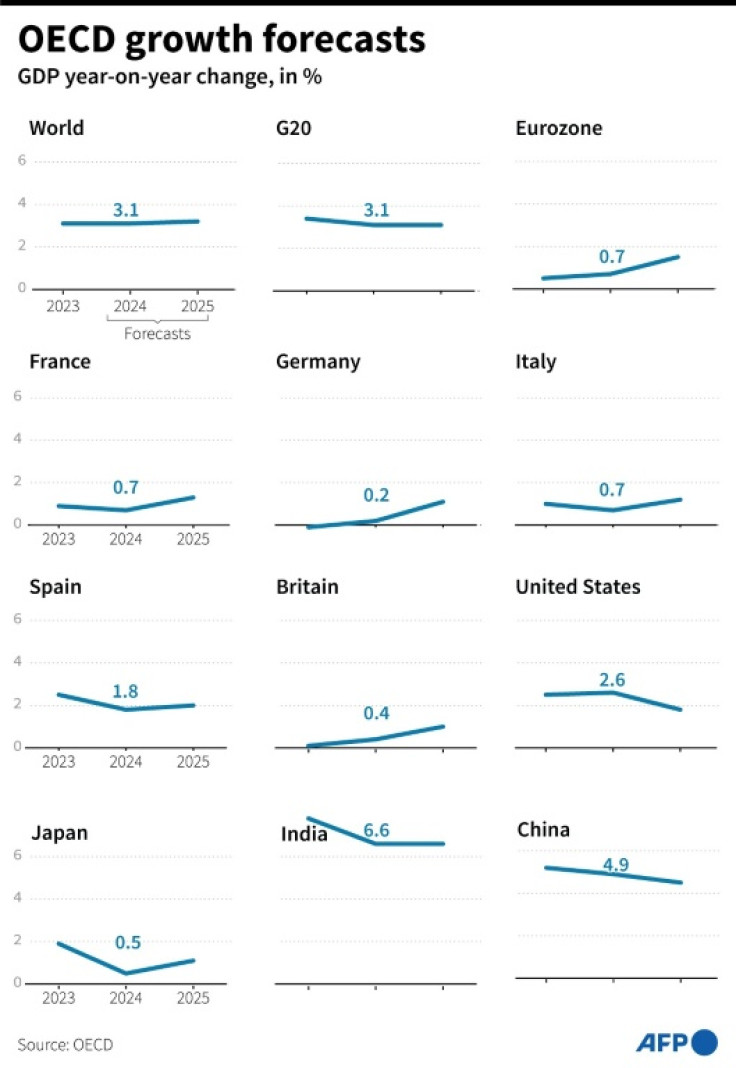

The world economy is expected to expand by 3.1 percent this year, up from a previous projection in February of 2.9 percent, according to the the Organisation for Economic Cooperation and Development.

"Cautious optimism has begun to take hold in the global economy, despite modest growth and the persistent shadow of geopolitical risks," OECD Clare Lombardelli said in the quarterly report.

But Lombardelli noted that "this recovery is unfolding differently across regions."

The US economy -- the world's biggest -- is now expected to expand 2.6 percent in 2024, up from the 2.1 percent previously expected, and faster than last year's 2.5 percent.

The OECD also raised its forecast for the second biggest economy, China, to 4.9 percent from 4.7 percent previously, thanks notably to an expansionary budgetary policy.

But the OECD expects timid growth of 0.7 percent in the eurozone, slightly better than the 0.6 percent previously expected.

It anticipates a slight recovery to 1.5 percent in 2025, compared to the 1.3 percent expected in February, thanks to a recovery in domestic demand.

"The global economy has proved resilient, inflation has declined within sight of central bank targets, and risks to the outlook are becoming more balanced," said OECD Secretary-General Mathias Cormann.

Central banks worldwide raised interest rates in efforts to combat inflation, which rose after countries emerged from Covid lockdowns and soared further following Russia's assault on Ukraine in 2022.

The US Federal Reserve and the European Central Bank have frozen their rates and markets are hoping to see cuts in the coming months as inflation has eased.

But the Fed is expected to make its cuts later than previously thought due to the resilience of the US economy and an uptick in consumer prices.

The US central bank held its interest rate at a 23-year high on Wednesday, with Fed chairman Jerome Powell saying that it will "take longer than previously expected" to have confidence that inflation is on track to meet the institution's two-percent target.

The OECD warned that "high geopolitical tensions, particularly in the Middle East, could disrupt energy and financial markets, causing inflation to spike and growth to falter".

"Policy action needs to ensure macroeconomic stability and improve medium-term growth prospects," Cormann said.

"Monetary policy should remain prudent, with scope to lower policy interest rates as inflation declines," he said.

He added that "fiscal policy needs to address rising pressures to debt sustainability, and policy reforms should boost innovation, investment and opportunities in the labour market particularly for women, young people and older workers."

The OECD report said a recovery in household incomes, tight labour markets and the expected interest rate cuts will help to "generate a gradual rebound."

But it warned that "the mixed macroeconomic landscape is expected to persist, with inflation and interest rates declining at differing paces, and differing needs for fiscal consolidation."

The OECD cut its 2024 growth forecast for Germany, Europe's largest economy, to 0.2 percent from 0.3 percent previously.

France, the eurozone's second biggest economy, is expected to post 0.7 percent growth, up from 0.6 percent in a previous forecast, lifted by consumer spending.

In Britain, the economy is seen growing 0.4 percent in 2024 and 1.0 percent in 2025, slower than what was expected in February, which the OECD blamed on persistent inflation.