This country's exporters are nervously watching a key vote in the US Congress that will determine whether the world's biggest economy defaults on its debts.

Farmers are feeling bruised enough at the continuing rise of on-farm inflation, reported this week at a 40-year high at 16.3 percent. The volatility of the export prices they can earn for their produce is the final straw.

Many will be praying today for agreement in the US House of Representatives, to forestall the risk of America defaulting on its debts – what US Treasury Secretary Janet Yellen calls an “economic catastrophe”.

Sam McIvor, the chief executive of Beef + Lamb NZ, says the US is an incredibly important market for New Zealand beef and lamb, particularly for ingredient beef, but also premium grass-fed lamb.

READ MORE: * Reserve Bank faces new inflation headwinds * Credit agency warns NZers are blind To 'astronomical cost' * Govt under pressure to guarantee debt of big new water corporations

According to Stats NZ, New Zealand is projected to export more than NZ$8 billion in goods and services to the US this year, making it our third largest export market.

But the concerns are wider than that: a US default would impact on prices for our goods around the world. That includes $21b of dairy, $9b of meat, $5b of logs and timber, and $4b of fruit.

McIvor is a member of the NZ-US Council executive committee. "Our global markets are experiencing volatility as a result of high inflation and economic uncertainty," he says. "So an agreement is vital to improve consumer confidence in this key market."

"This deal fails completely. We will do everything in our power to stop it and end it now.” – Scott Perry, Republican Congressman

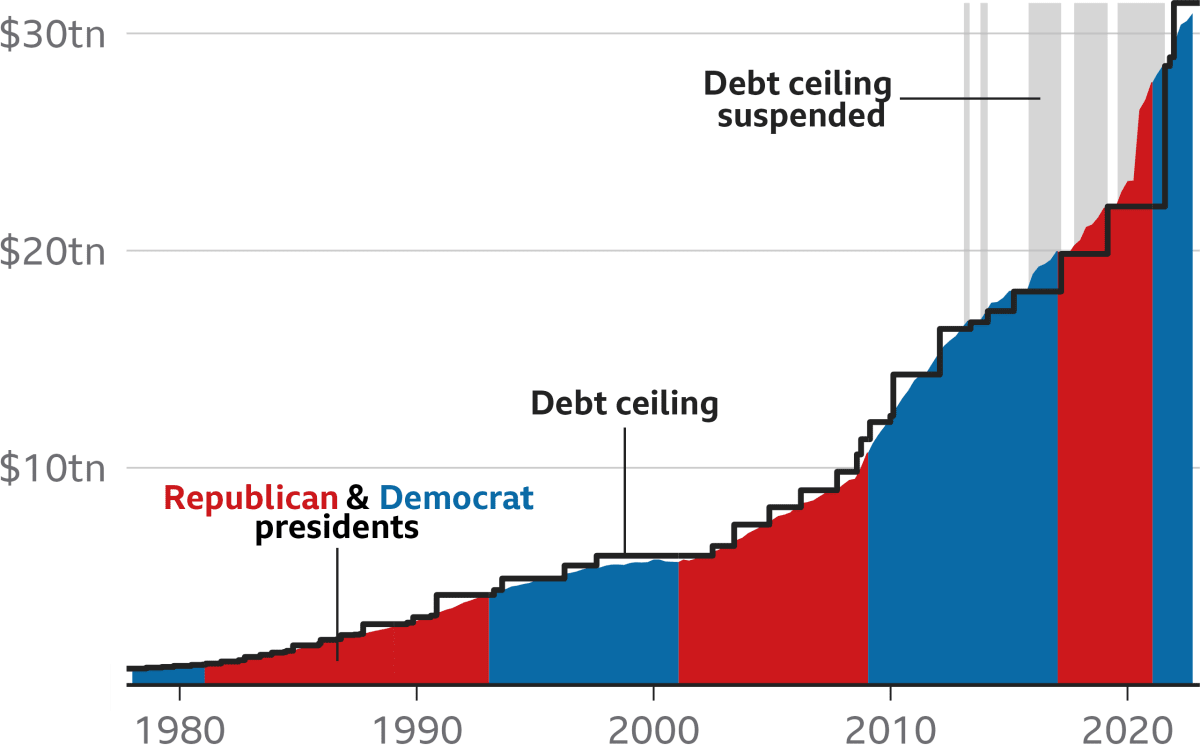

US President Joe Biden and the House Speaker Kevin McCarthy agreed a package of spending cuts at the weekend, in exchange for the Republican House majority agreeing to raise the debt ceiling above US$31.4 trillion.

That's a net government debt equivalent to 96 percent of GDP, and forecast to rise to 110 percent by 2028. By contrast, New Zealand's net government debt is just 19 percent.

The compromise bill, named the Fiscal Responsibility Act, would suspend the debt ceiling until 2025, allowing the US to avoid a default. Yellen has warned the federal government will be unable to pay its bills from June 5, unless the debt ceiling is suspended or raised.

US debt rises regardless of administration (US$)

Discretionary spending would be cut by what looks, from the outside, like a relatively inconsequential US$1b. The Republicans claim a win with a work test for food and healthcare programmes for people up to the age of 54. Previously only those under 50 were work tested. But eligibility will be easier for military veterans, and McCarthy is happy to allow defence spending to increase.

But it's not enough for Biden and McCarthy to agree; their bill needs to be passed by Congress. And in the lower house, the Republicans have a majority comprising a hard-right element who could easily remove McCarthy is he doesn't do their bidding.

Members of the the House Freedom Caucus have attacked the proposed spending cuts in the debt ceiling bill as woefully inadequate, and vowed to oppose the legislation when it hits the floor.

"If no can’t be turned into yes, and the US were to default, the impact could be catastrophic with severe impacts on the US dollar and chaos in global financial markets. Only Putin would be very happy!" – Stephen Jacobi, NZ International Business Forum

“We had the time to act, and this deal fails – fails completely,” says Congressional representative Scott Perry of Pennsylvania, the chair of the Freedom Caucus. “We will do everything in our power to end it now.”

Stephen Jacobi, executive director of the NZ International Business Forum, says we’ve been here before.

The US Treasury was forced to take "extraordinary measures" when the country hit its debt ceiling in 2013; Republicans tried to force President Barack Obama to defund his signature Affordable Care Act – the so-called Obamacare programme.

Then again in 2021 the Senate initially agreed to grant the US Treasury authority to borrow for only two months, before both houses finally agreed to lift the ceiling by $2.5 trillion to $31.4 trillion – the level at which it still sits today.

Jacobi says the impact of a 'no' vote would be "very serious for the global economy" – there would be a loss of confidence at a time when things are slowly starting to recover.

"If 'no' can’t be turned into 'yes', and the US were to default, the impact could be catastrophic, with severe impacts on the US dollar and chaos in global financial markets," he says. "Only Putin would be very happy!"

The US is a significant trade and innovation partner for New Zealand, so there would be some potential impact for this country of spending cuts on the US economy. But since the cuts are not directed at big budget items like defence or social security, Jacobi says that may not be so significant.

"What if anything does this ritual say about the strength of the US as a global economic leader? Or is it just part and parcel of their messy democracy? There is no real intent to deal with the US astronomical debt and the can just gets kicked down the road."

Leon Grice is a former New Zealand Consul-General in Los Angeles and chair of the NZ-US Council. He still has academic and business links in the United States: his biotech firm Tara Science works closely with the University of Illinois and he retains strong links into the investment community in California.

"Kiwis have to remember a large amount of the taxes paid by Americans are city, county and state taxes which pay for education, large amounts of healthcare for the uninsured, roads and law and order. It is not the federal Government," he says.

"So in a debt default or a closed down government, which has happened before, a huge part of the United States continues to function."

Grice says New Zealanders can expect "maximum entertainment" in the House over the next few days.

The bill must be passed by June 1 (June 2, NZ time) to allow the Treasury to continue to borrow to meet the government's spending on legislation already passed into law.

With support from most Democrats and most Republicans, the votes should be there for it to pass. But before it passes will be the first serious test of the faction-ridden Republican party and McCarthy as Speaker. If he is rolled, it will cause a critical delay.

A failure to pass the debt ceiling won't be a disaster, Grice says, but would undermine the confidence of global markets. "The last thing we need in New Zealand is some external inflation impetus. We have enough homegrown inflation as it is."