The coalition government recently announced its plan to reverse a ban on new oil and gas exploration to deal with an energy security challenge brought on by rapidly declining natural gas reserves.

But this assumes, rather optimistically, that repealing the ban will prompt companies to invest in new gas fields.

In practice, those companies will be carefully considering whether there is anyone to sell their gas to, or whether a future government could change the rules again.

Investors don’t love political volatility or market risk, and New Zealand currently has both.

The coming gas crunch

Modelling by the Ministry for Business, Innovation and Employment (MBIE) suggests the ban repeal would result in an additional 14 million tonnes of carbon dioxide emitted by 2035.

This estimate is based on an assessment of climate impacts resulting from the policy reversal, compared to a baseline.

The usual baseline used for such assessments was set in 2022 by the Climate Change Commission. But the government argued it was already out of date and instead proposed a different one, with 15% fewer emissions from gas, because the country is running out much faster than expected.

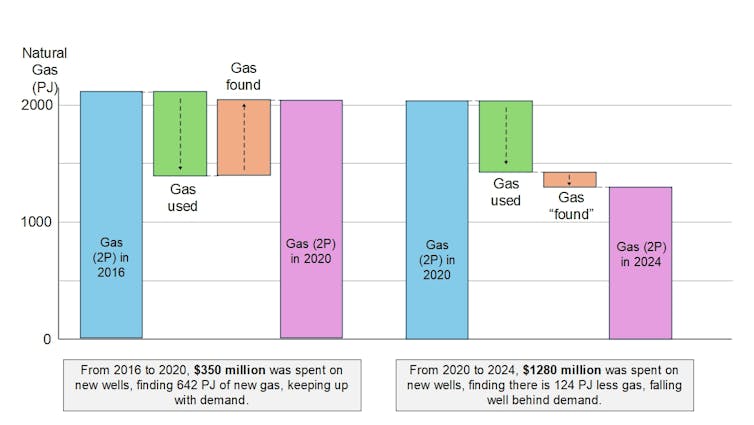

In one sense, New Zealand is perpetually running out of gas. Energy companies estimate how much is left underground and how long that resource will last. At the same time, they are drilling new development wells – $350 million worth between 2016 and 2020 – which adds more gas to the reserves and pushes out the ultimate end date.

What has changed is that all the extra drilling hasn’t turned up much extra gas in the past few years. This is despite record amounts spent on new wells – nearly $1.3 billion between 2020 and 2024. Energy companies now think there’s less gas than previously thought.

It seems the end date is much closer, which is why the government has shifted to a new baseline to reflect less gas (and lower emissions). This is a good result for the climate – but it might not be great for New Zealand’s economy in the near term.

When gas runs low

As an island nation, New Zealand can’t easily import more gas from overseas. There is no pipeline to Australia, and liquefied natural gas terminals are expensive to build.

Macroeconomics tells us that when a resource becomes scarce in a closed market, the following things happen.

First, with a fixed amount of gas to go around, its use has to be prioritised. This means some users might miss out. As it happens, the government has been struggling to renew a contract to supply schools, prisons and hospitals with gas.

Second, when a resource becomes scarce, its price tends to rise. This tracks with the experience of Pan Pac, a forestry owner and processor in Hawkes Bay which reported a three-fold increase in gas costs, from $3 million a year to potentially $9 million at current prices.

Now, some would say the cure for high prices is exactly that: high prices. A gas crunch could ultimately shift demand to other sources such as heat pumps for home and industry. Some of this was subsidised through the previous administration’s Government Investment in Decarbonising Industry Fund.

But until the switch happens, resource scarcity means you can’t produce as many goods, and this could have an effect on GDP. Methanex, a major exporter of methanol produced from natural gas, is a key concern here. Less methanol would mean fewer exports and, potentially, job losses.

Methanex is already operating at reduced capacity, and it recently initiated high court proceedings against Nova Energy, which uses natural gas to produce electricity. Nova cut gas supply to Methanex and the companies disagree on whether their contract allows for this.

Tough decisions ahead

A new gas field could take a decade or longer to find, develop and bring online. At the same time, if there are no new reserves (regardless of whether the government goes through with the repeal of the ban), we can expect gas supply to drop to half within six years, according to MBIE forecasts.

This means there might not be enough gas to simultaneously maintain synthetic (ammonia-based) fertiliser production, peak electricity generation and methanol exports. What should get prioritised?

Ammonia is essential to the farming sector and food production. In the future, we might replace natural gas used to make ammonia with green hydrogen produced from ultra cheap solar. But that’ll take investment and intention.

Methanex exports are worth $800 million a year and the company is a significant contributor to the economy. A transition to a green methanol industry is possible, but would need a huge amount of green hydrogen (made using renewable energy) and green carbon dioxide (sourced from biomass or direct air capture).

This would be transformative to the economy but also take a lot of financial support.

Lastly, we burn a lot of gas to keep heat pumps running in winter when hydro lakes are low. And we almost ran out earlier in the year.

A future energy system with abundant solar, grid-scale batteries and smarter use of hydro storage might avoid this as gas is phased out. The problem is that these solutions cost a lot of money and take time to implement. New Zealand apparently doesn’t have much of either.

David Dempsey receives science funding from MBIE to work on topics related to the energy industry.

Jannik Haas receives science funding from public institutions like MBIE to work on topics related to energy systems and holds clean energy stocks.

Rebecca Peer receives science funding from MBIE to research topics related to energy transitions and future energy systems.

This article was originally published on The Conversation. Read the original article.