Although the U.S. government has set rather tight restrictions on the performance of AI GPUs that can be shipped to Chinese entities without an export license by the Department of Commerce's Industry and Security Bureau, Nvidia's latest offerings tailored for the country are still good enough to compete against China's domestic GPUs. As a result, the company will earn some $12 billion selling them to its Chinese customers, analysts believe, reports Financial Times.

Nvidia's HGX H20 GPUs are seeing strong demand in China. The company expects to ship over one million HGX H20 GPUs to China, significantly more than Huawei's anticipated Ascend 910B AI processor sales. According to FT, Huawei is projected to sell about 550,000 of its Ascend 910B in 2024, based on data from SemiAnalysis. Nvidia's HGX H20 GPUs are priced between $12,000 and $13,000 each, potentially generating over $12 billion in revenue, surpassing Nvidia's total China earnings from the previous year, which included sales to PC gamers and other products, based on data from analysts cited by the business daily.

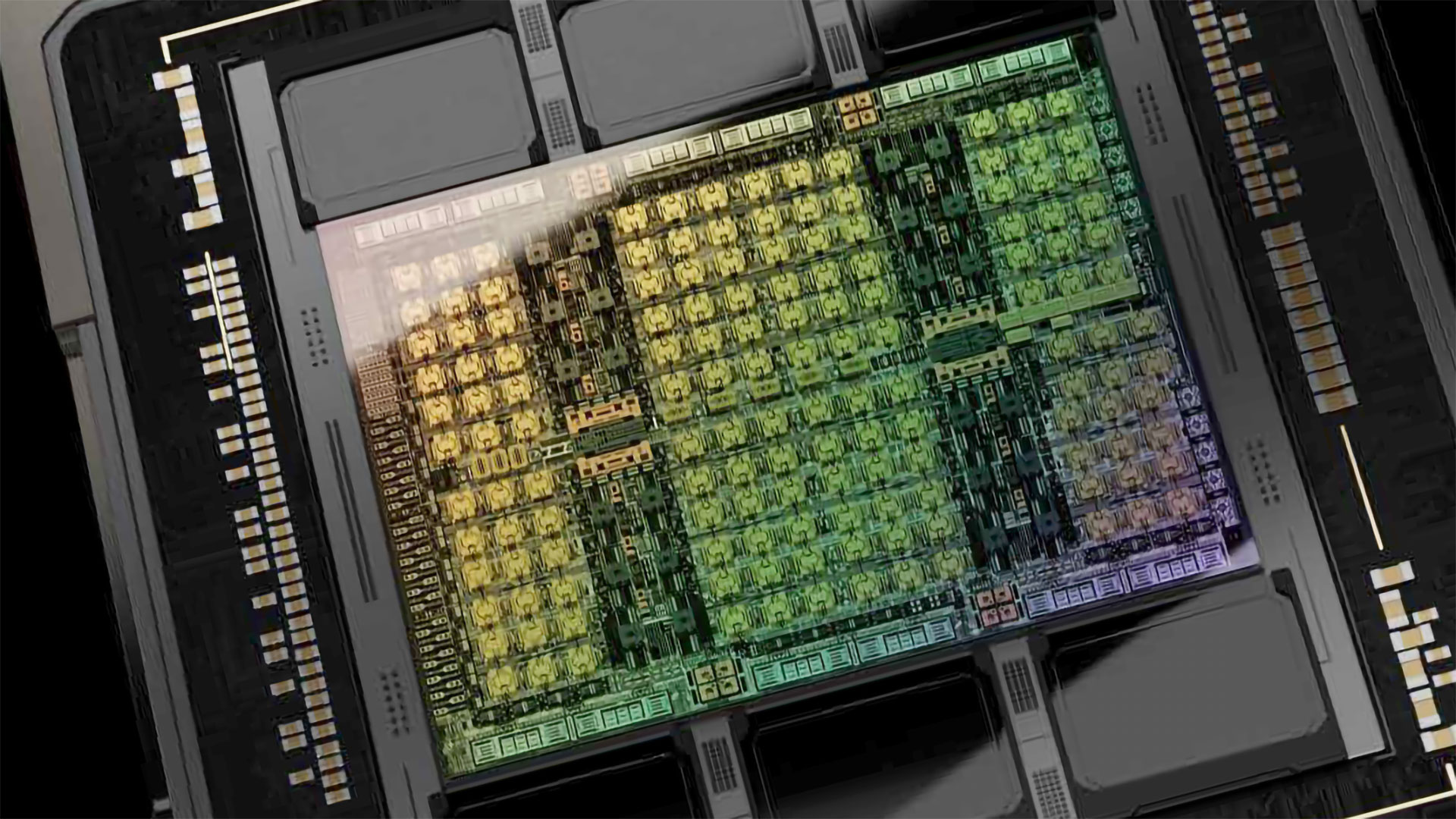

Nvidia's new HGX H20 GPUs for AI are designed to comply with U.S. export rules while still providing rather formidable performance for AI applications. In particular, these GPUs offer up to 296 INT8 TOPS/FP8 TFLOPS, 96 GB of HBM3 memory onboard, and up to 4.0 TB/s of memory bandwidth. Such performance, memory bandwidth, and capacity make it a tough competitor for all entry-level AI processors. Although less potent on paper, HGX H20 outperforms Huawei's AI processors in practical applications due to superior memory performance, according to Dylan Patel from SemiAnalysis.

Most Chinese AI companies have built their application ecosystem using Nvidia's CUDA platform, making a switch to Huawei costly and time-consuming. Considering that the HGX H20 GPU fully supports Nvidia's CUDA platform, this will be a default choice for many companies and applications, even though it is dramatically slower than the full-blown H100.

U.S. restrictions aim to limit China's access to powerful AI processors due to concerns about national security and economic competition. It has made it harder for Chinese tech giants like Alibaba, ByteDance, and Tencent to compete with their U.S. counterparts, such as OpenAI, Microsoft, Meta, and Google. However, the export restrictions have significantly impacted Nvidia's business in China, reducing its revenue share from the region. China now represents only 9% of Nvidia's total revenue compared to 22% a year earlier. Despite reduced sequential sales ahead of the HGX H20 rollout, Nvidia's overall revenues from China grew by over 50% year-on-year to $2.5 billion in the most recent quarter, according to FT.

Nvidia's strategic adaptation to U.S. export controls by introducing the H20 processor reflects its effort to maintain a presence in the Chinese market. Based on estimates from analysts, Chinese companies will welcome the HGX H20 wholeheartedly.