Nvidia Corporation (NASDAQ:NVDA) was popping almost 5% in the premarket Thursday after Meta Platforms, Inc (NASDAQ:META) increased its capital expenditures outlook for 2023.

In its third-quarter earnings report, Meta guided next years’ capex to come in between $34 billion and $39 billion as it raises its investments in data centers, servers and network infrastructure. Traders and investors expect Nvidia to benefit from Meta’s increased spending as the latter continues its foray into the Metaverse.

Meta and Nvidia have formed partnerships in the past, including in January when the Facebook parent chose the chip maker’s technologies to build its AI Research Supercomputer.

Nivida rebounded 17% between Oct. 13 and Wednesday’s closing price, in tandem with the general markets, which have seen the S&P 500 gain 8.81% over the same time period.

For now, the stock market environment appears to be a bull cycle within the longer-term bear market that began earlier this year. For bullish traders hoping to play more upside, the trend is your friend (until it’s not), and from a technical standpoint Nvidia looks set to trade higher.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

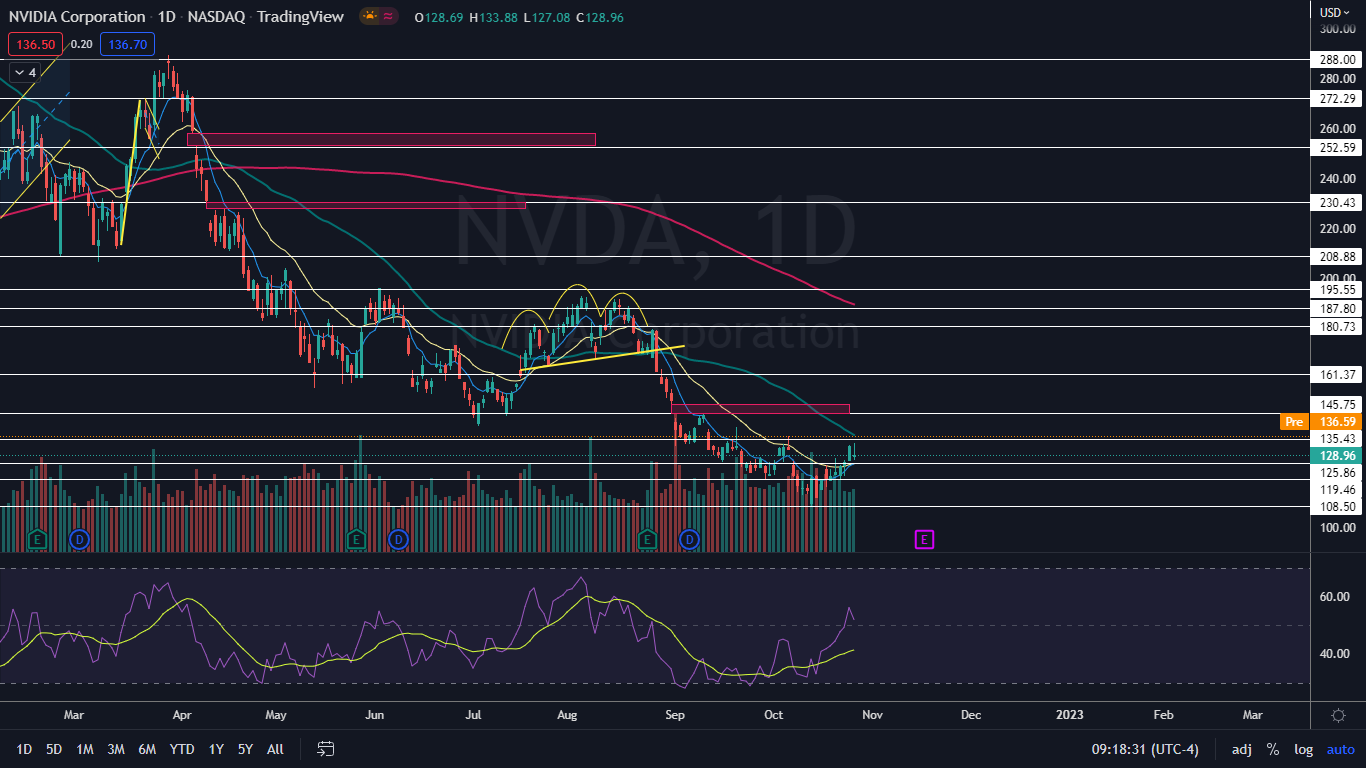

The Nvidia Chart: Nvidia’s most recent higher low within its uptrend was formed on Oct. 22 at $118.87 and the most recent confirmed higher high was printed at the $127.69 mark the day prior. On Thursday, Nvidia looked to be gapping up to the 50-day simple moving average (SMA), and if the stock can hold the level as support, longer-term sentiment will turn bullish.

- If the 50-day SMA holds, Nvidia could continue to trade up to fill an upper gap that was left behind on Sept. 1, although retracements to form higher lows may come before that happens. The gap exists between $145.47 and $149.59.

- If Nivida closes the trading session on Thursday near its high-of-day price, the stock will print a bullish kicker candlestick, which could indicate higher prices will come on Friday. If the stock closes the trading day flat or near the low of day, the stock will print a bearish candlestick, which could indicate the next higher high has formed and a retracement is on the horizon.

- Nvidia has resistance above at $145.75 and $161.37 and support below at $135.43 and $125.86.