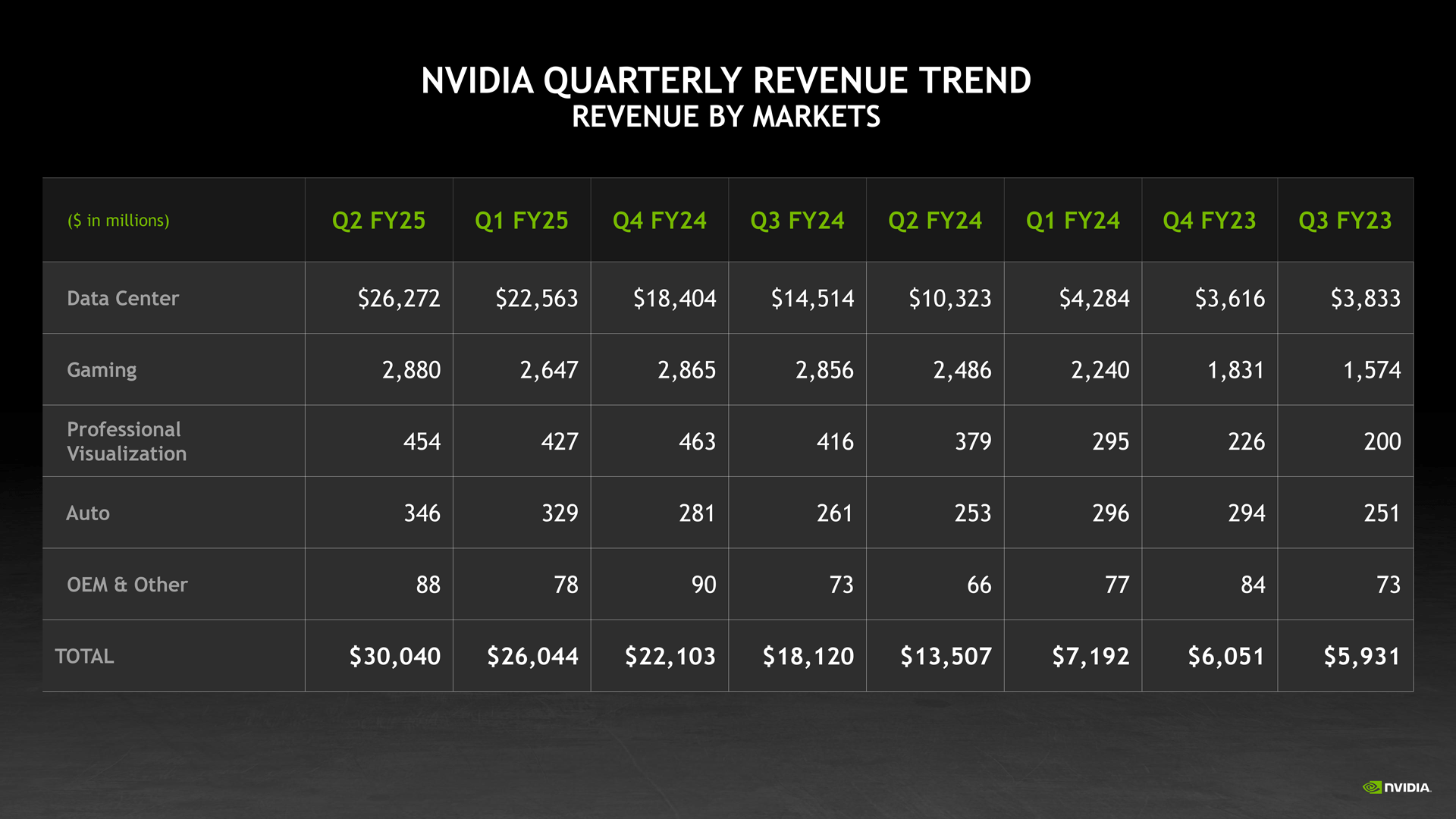

Driven by unprecedented demand for AI GPUs, Nvidia on Wednesday posted its all-time-record quarterly revenue of $30.040 billion. Yet its gross margins dropped a bit as the company prepped for its Blackwell product rollout in the fourth quarter. Surprisingly, even Nvidia's gaming revenue was up in the second quarter, which is not typical at all.

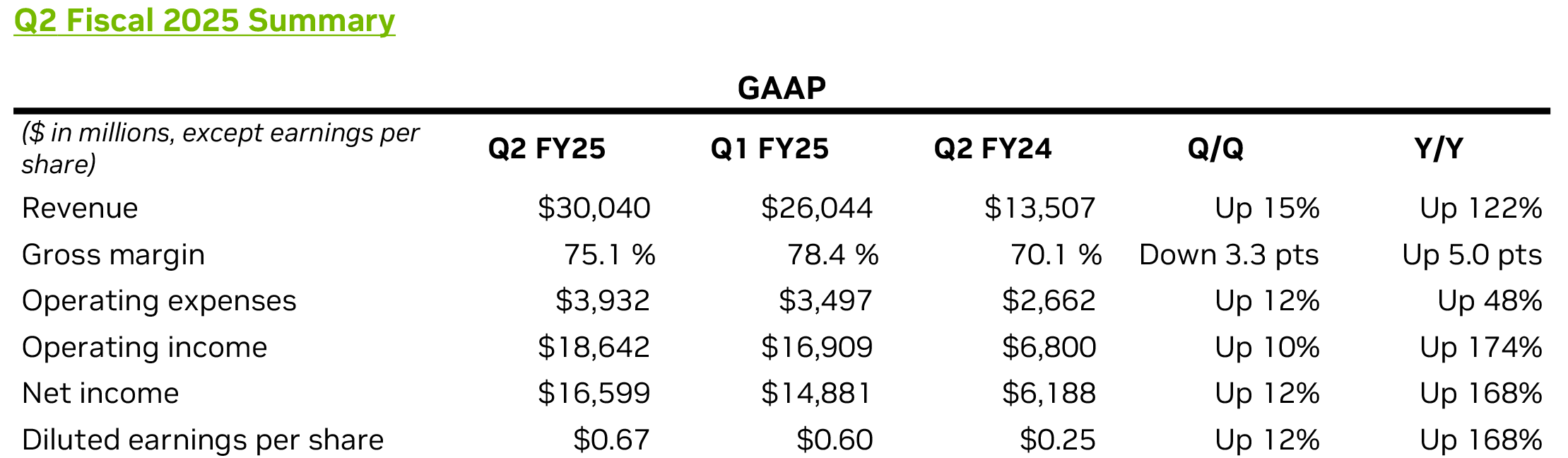

Nvidia's revenue for the second quarter of its fiscal 2025 reached $30.040 billion, up 122% year-over-year and 15% quarter-over-quarter. The company's net income for the quarter totaled $18.642 billion, up a modest 10% sequentially but a whopping 174% compared to the same quarter a year ago. However, Nvidia's gross margin for the quarter was 75.1%, up 5% from Q2 FY2024 but down 3.3% from Q1 FY2025, as the company produced a low-yield Blackwell design in preparations for volume launch late this year.

Data Center

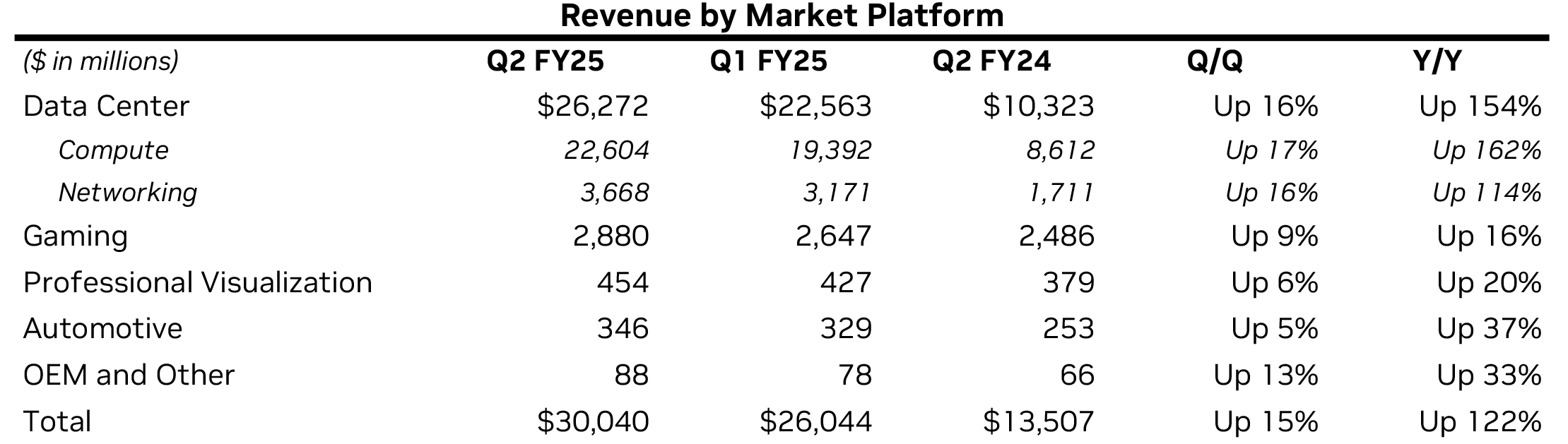

Data center business accounts for 87.4% of Nvidia's revenue. Last quarter, Nvidia sold some $26.272 billion worth of data center hardware (up 16% sequentially and up 154% year-over-year), which included compute hardware (primarily GPUs) worth $22.604 billion. Networking revenue reached $3.7 billion, a 114% increase compared to the previous year, fueled by InfiniBand and AI-related Ethernet revenue, including the Spectrum-X end-to-end Ethernet platform. On a sequential basis, networking revenue grew by 16%.

The company increased sales of its AI and HPC GPUs by 162% compared to the same quarter a year ago, even though its sales to Chinese entities are now seriously curbed.

During the quarter, the company began shipping its H200 GPU with 141 GB of HBM3E memory in volume, which helped to elevate sales. With yield issues plaguing the first version of Nvidia's Blackwell-based B100/B200 GPU, Nvidia's Hopper products will probably remain the company's working horses this fiscal year. Still, demand for these proven products is strong.

"Hopper demand remains strong, and the anticipation for Blackwell is incredible,” said Jensen Huang, chief executive of Nvidia. "Nvidia achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI."

Graphics

On the gaming side, Nvidia's sales catapulted to $2.88 billion, an increase of 9% sequentially and 16% year-over-year. This is not in line with seasonality, as gaming graphics card sales are usually down in the second quarter, but Nvidia said that it sold quite some GPUs in July as part of the back-to-school season. In the high end, the company probably stole some market share from AMD.

Professional Visualization revenue increased to $454 million, 20% year over year and 6% sequentially. These gains were primarily driven by the ongoing growth of RTX GPU workstations built on the Ada Lovelace architecture.

Automotive, OEM, other

Nvidia's automotive revenue was up 5% sequentially and 37% year-over-year and totaled $346 million, thanks to sales of self-driving platforms and AI cockpit solutions. Nvidia's sales to OEMs reached $88 million, up 13% QoQ and 33% YoY, as PC makers finished their inventory corrections.

Q3 Guidance

The guidance for the third quarter is perhaps the weakest part of Nvidia's report. The company expects its sales to be around $32.5 billion ±2%, with GAAP and non-GAAP gross margins expected to be 74.4% and 75.0%, respectively. While the company's margins remain the highest in the industry, the modest revenue growth prediction worries Wall Street analysts.

Then again, demand for Nvidia's Hopper and Blackwell products exceeds supply, so the humble guidance could reflect TSMC's ability to supply Nvidia with enough processors.