When Federal Reserve Chairman Jerome Powell said the time had come to start cutting interest rates, one could almost hear the cheering from one side of the United States to the other.

Stocks soared in reaction to Powell's speech. Interest rates went down. Gasoline prices fell, too, and most people ignored that oil prices were up on Friday.

It was a good day. While the vibe, as it were, was benign going into the weekend, one could still see that things could get unraveled.

Related: Analysts revise Target stock price estimates after earnings

To emphasize the point, Israel early Sunday attacked Hezbollah positions in southern Lebanon.

Information on casualties and deaths was not available at 12 a.m. ET Sunday. It's not clear how the attacks and other fighting might affect global markets on Monday.

The geopolitical situation adds more tension to an undercurrent of unease that continues with layoffs coming in many companies, including technology, and lengthening lists of small business bankruptcies.

The U.S. presidential and national election campaigns will swing into high gear over the Labor Day Weekend. In addition to the Middle East worries, the Ukraine-Russia War could become even more dangerous than it already is.

Meanwhile, here is what to keep an eye on this week for markets.

Watch the PCE report

The Fed started what seemed like an era of good feelings last week with the Aug. 21 release of minutes from its July meeting. Normally, these are drab, wonky documents. This one stated clearly that interest rate cuts were on the Fed's mind in a big way.

On Aug. 30, the Commerce Department's Bureau of of Economic Analysis will release its July report of the Personal Consumption Expenditures Price Index. This measures price changes of the goods and services consumers buy and use. It has fewer idiosyncrasies than the Consumer Price Index, and the Fed governors and staff prefer it.

In June, the PCE showed the index rising 2.5% from a year earlier. The consensus estimate is for a 2.4% change, maybe a little less. Gasoline prices are lower. So are interest rates and some food prices.

If the PCE report shows a sudden jump, markets will behave badly, and the Fed, ever data-dependent, may have to react.

More on markets:

- Analysts reset targets for key Nvidia supplier after earnings

- Jerome Powell's latest interest rate comments suggest investors' next move

- From Nike to UnitedHealth: Top Dividend-Growth Stocks for High Returns

Nvidia will dominate the investor talk

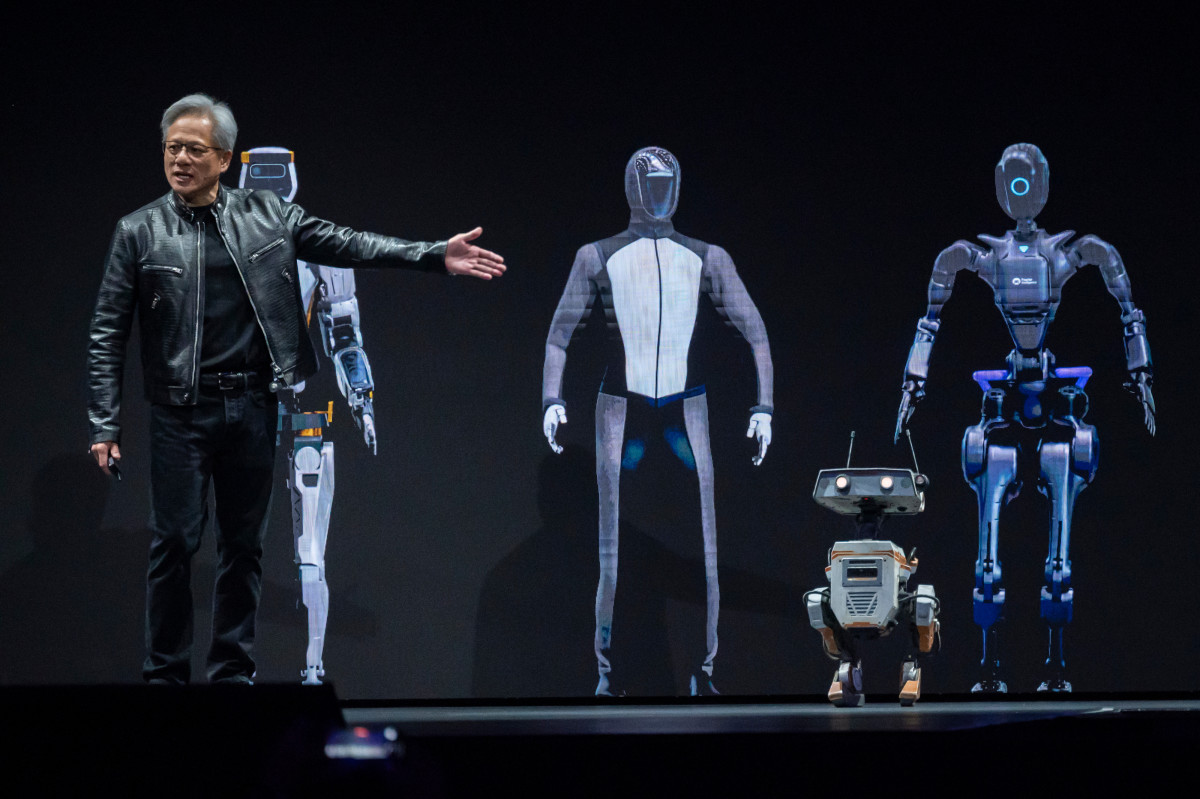

Nvidia (NVDA) , the developer of graphical processing units that are at the heart of artificial intelligence applications, is the star of the week. It reports its fiscal-second quarter earnings after the close Wednesday.

Nvidia shares are up 161.2% in 2024, based on Friday's close of $129.37. Its market cap of $3.182 trillion is now second among U.S.-based companies, behind Apple's (AAPL) $3.45 trillion market capitalization. Microsoft's (MSFT) $3.01 trillion market cap is third.

Nvidia is expected to report 64 cents a share, up an astonishing 156% from the 25 cents a share reported a year ago. Revenue is projected at $28.6 billion, up 110% from a year earlier.

The reason is that everyone involved in developing applications that use AI can't get enough of Nvidia's Hopper GPUs and, they hope, the new Blackwell family of GPUs. The difference: The average Hopper GPU has 80 billion transistors. The average Blackwell GPU has 208 billion transistors.

There is an issue and a risk: Blackwell GPUs were supposed to be available at the end of the year. Now, according to The Information and other sources, the products won't be available until March 2025 because of design flaws.

The problem will affect the plans of Microsoft, Facebook-parent Meta Platforms (META) and Google-parent Alphabet (GOOGL) . All have said they are prepared to spend billions of dollars on the GPUs and the related pieces of the units to get ahead.

So far, the reports haven't affected the stock price. But analysts will surely ask about the Blackwell GPUs on the conference call after the earnings report is released.

Don't forget CrowdStrike

CrowdStrike (CRWD) , the big cybersecurity company, would probably prefer if no one notices they release their earnings literally at the same time as Nvidia.

That's because a flawed update that it sent out in July to clients' networks built on Microsoft software caused computer outages across the globe. Among the hardest hit were airlines, especially Delta Air Lines (DAL) , which couldn't get the disruptions fixed for several days. Television reports showed stranded passengers camped out near Delta ticket counters at airports across the country.

So far, it's not clear if CrowdStrike faces any financial liability from the computer disruptions.

CrowdStrike is expected to report fiscal second-quarter earnings of 97 cents a share, up 31% from a year ago. Revenue is projected at $958.6 million, up 30% from $731.5 million a year earlier.

Between the computer outage and the market selloff in late July and early August, the stock has had a volatile summer. The shares fell 49.7% between a $393.33 intraday peak on July 9 to an Aug. 5 intraday low of $200.81. It's up 35% since and up 6.4% for the year.

Despite all the volatility, only one of the 50 analysts who cover the company rates it a sell, with two giving it an underweight rating. Thirty-two rate the shares a buy. Eight rate it a hold.

Companies also reporting this week

Tuesday: Department store retailer Nordstrom (JWN) . Estimate: 74 cents a share, down from 84 cents a year ago.

Wednesday: Dow component Salesforce (CRM) . Estimate: $1.73 a share, up from $1.63. HP Inc. (HPQ) . Estimate 86 cents, unchanged from a year ago. Netapp (NTAP) . Estimate $1.15, up from 84 cents a year ago.

Thursday: Server maker Dell Technologies (DELL) . Estimate $1.49, up from $1.44. Chip-maker Marvell Technology (MRVL) . Estimate: 13 cents, down from 18 cents a year ago. Fashion retailer Lululemon Athletica (LULU) , Estimate: Estimate 2.94, up from $2.68.

Related: Veteran fund manager sees world of pain coming for stocks