TSMC admitted in mid-2023 that demand for its chip-on-wafer-on-substrate (CoWoS) has exceeded its production capacity, and the company vowed to double capacity by the end of 2024. But while TSMC is building up its CoWoS capabilities, Nvidia would like to ship as many of its high-demand AI processors as possible — which is why it's tapping Intel to use its advanced packaging technology (in addition to TSMC's), according to a report from money.UDN.com, citing industrial sources. As with all unconfirmed reports, we'll have to take this with a grain of salt until the companies involved comment. The deal is purportedly for 5,000 wafers per month, and according to quick back-of-the-napkin math, that would equate to 300,000 of Nvidia's H100 chips (assuming perfect yield and that the contract is for H100) per month.

TSMC is projected to remain the main supplier, providing around 90% of Nvidia's advanced packaging capacity. But starting from Q2, Nvidia is also poised to use Intel's capacity for at least some of its products, the report claims. If this information is accurate, adding Intel's capacities will let Nvidia produce more GPUs for AI and HPC workloads, satisfying demand for its existing products quicker. There is a catch, however.

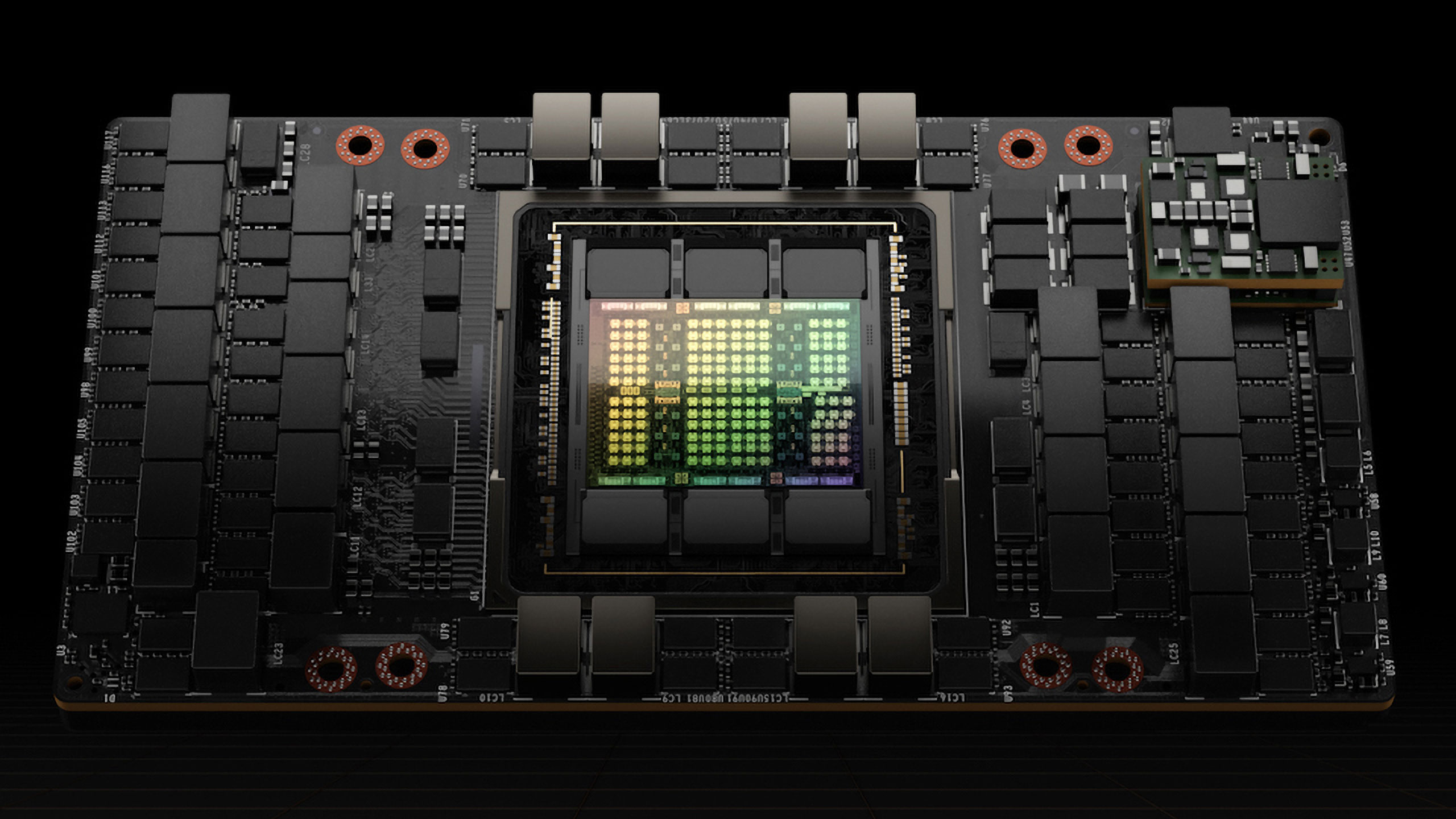

All of Nvidia's current and previous generation products, such as the A100, A800, A30, H100, H800, H200, and GH200 rely on TSMC's CoWoS-S packaging process, which relies on a silicon interposer. The closest advanced packaging technology that Intel has is called Foveros, which also relies on an interposer, albeit a different one (CoWoS-S presumably uses a 65nm interposer, and Foveros uses a 22FFL interposer).

To use Intel's Foveros, Nvidia will need to validate the technology and then qualify actual products, which will likely have slightly different characteristics (because interposers are made on different process technologies and have different bump pitches) than those packaged by TSMC, so the company's partners will probably also need to qualify them before deployment. If this is the case, it will be interesting to see whether Nvidia outsources only select products to Intel, or all of them.

Intel is expected to join Nvidia's supply chain in the second quarter, producing about 5,000 Foveros wafers monthly (if the report is accurate). This is quite a significant number for Nvidia alone. To put this into context, TSMC could produce as many as 8,000 CoWoS wafers per month as of mid-2023 (which is when Nvidia consumed the lion's share of this capacity) and aimed to increase the output to 11,000 by the end of 2023 and then to around 20,000 by the end of 2024. If Nvidia gets an additional 5,000 advanced packaging wafers per month, this will give it a significant edge over rivals.

Outsourcing some of its advanced packaging to Intel Foundry Service can be seen as a strategic move for Nvidia to diversify its supply chain. As an added bonus, by employing IFS's packaging capacities, Nvidia will also ensure that these capacities cannot used by rivals — allowing Nvidia to solidify its position in the market.