Nvidia shares moved higher again Thursday, extending the stock's astonishing run to a fresh record, as the clear market leader in AI-chip production continues to dominate its megacap tech rivals.

Nvidia (NVDA) , which took only 74 trading days to add another trillion in value and top the $3 trillion mark, is now set to open as the world's most valuable company, having overtaken Microsoft (MSFT) late Tuesday and Apple (AAPL) earlier in the month.

The stock is set to open Thursday with a value of $3.46 trillion, extending its 2024 gain by around $2.1 trillion.

Related: Analyst resets Nvidia stock price target as CEO unveils new AI platform

The tech giant's recent surge began in spring 2023 with a revenue-growth forecast that shocked Wall Street and cemented the group's place as the artificial-intelligence-market benchmark.

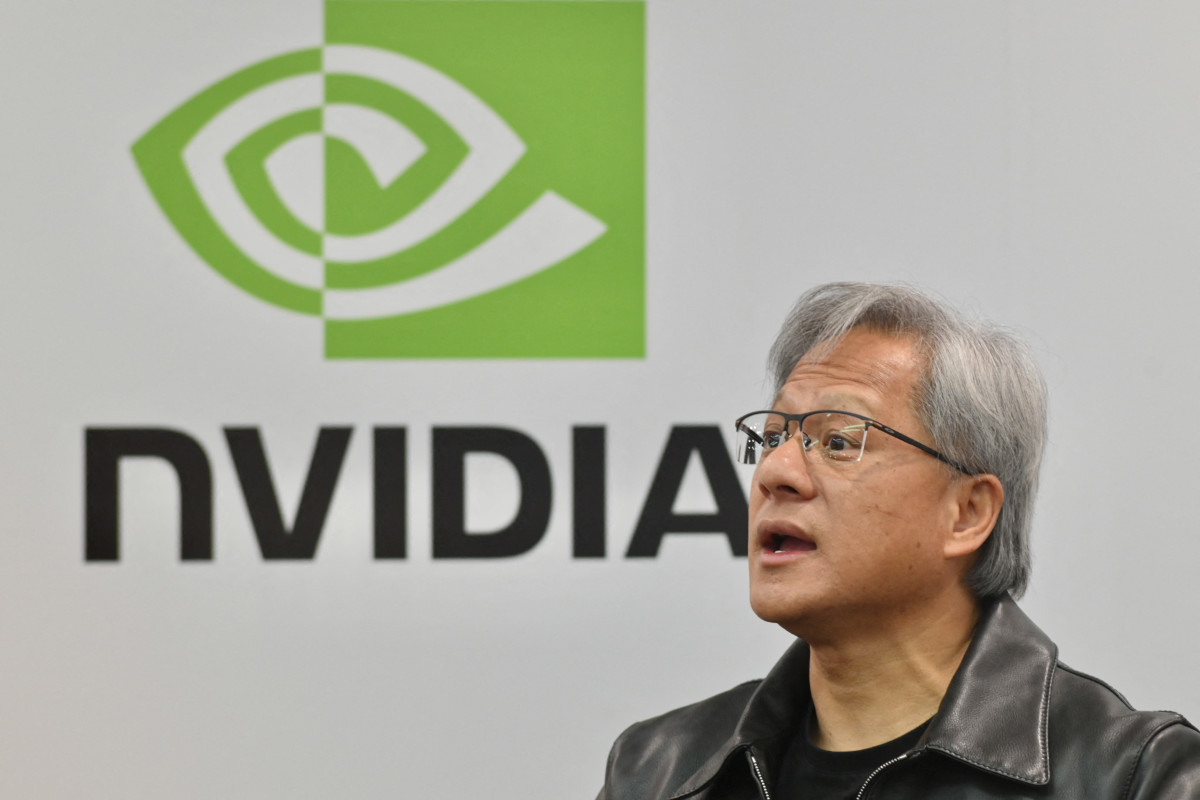

Since then, under the leadership of Co-Founder Jensen Huang, Nvidia has tightened its grip on the market for the advanced chips and processors that power the new wave of AI systems under construction from tech giants such as Amazon (AMZN) , Google (GOOGL) and Meta Platforms (META) .

These so-called hyperscalers in fact are poised to spend around $92 billion this year alone building out their massive computing infrastructure. The effort reflects their clients' move to leverage their massive datasets to enhance sales of everything from drive-through dining to the most complicated pharmaceutical testing.

Nvidia gets boost from Blackwell processor launch

That's helping Nvidia, which earlier this spring launched a line of Blackwell computing processors, which will likely replace the company's benchmark H100 chips and drive consistent revenue gains.

"Right now, we’re in an initial investment or research phase of AI, where companies, governments, cloud service providers, etc. are investing in AI and trying to figure out what it can do for them," said John Belton, portfolio manager at Gabelli Funds.

"The hardware providers such as Nvidia are benefiting, and I think there’s still some room for this initial phase to run."

Related: Analysts overhaul Nvidia stock price targets as earnings address key problem

Nvidia said last month that current-quarter revenue would rise to around $28 billion, with a 2% margin for error, even as it said the Blackwell system of processors and software wouldn't start shipping until the back half of the year.

Analysts had worried that a gap between the current H100 chips and the new Blackwell offering would create a kind of air pocket in revenue as customers dumped orders for the older chips and waited for the newer system.

"GPUS such as Blackwell and Hopper are much more efficient than legacy CPUs. So the total cost of ownership for running a data center with Nvidia’s GPUs is lower than that of running a data center with CPU servers,” said Belton at Gabelli Funds.

"There’s a case to be made that the installed base of CPU servers and data centers will need to be replaced by GPUs in the coming years, and there should be ongoing tailwinds for Nvidia from data-center upgrades and data-center modernization," he added.

Next stop for Nvidia stock: $4 trillion?

Dan Ives of Wedbush, a longtime Nvidia bull, likens its GPUs to "the new gold or oil in the tech sector," which will power a "fourth Industrial Revolution." That revolution, he argues, is already well underway.

"Its all about the pace of data-center AI-driven spending, as the only game in town for GPUs to run generative-AI applications all go through Nvidia," Ives said. "We believe over the next year the race to $4 trillion market cap in tech will be front and center between Nvidia, Apple and Microsoft."

More AI Stocks:

- Analysts retool C3.ai stock price target after earnings

- Analysts revamp Salesforce stock price targets after earnings

- Veteran fund manager issues blunt warning on Nvidia stock

Nvidia shares were marked 3.63% higher in premarket trading to indicate an opening bell price of $140.50 each, a move would extend the stock's 2024 gain past 210%.

The group's 10-for-1 stock split, which was completed earlier this month, has also added to speculation that Nvidia could be added to the Dow Jones Industrial Average, with chipmaker Intel (INTC) , valued at $130 billion, is seen as the most likely candidate for replacement.

Related: Single Best Trade: Wall Street veteran picks Palantir stock