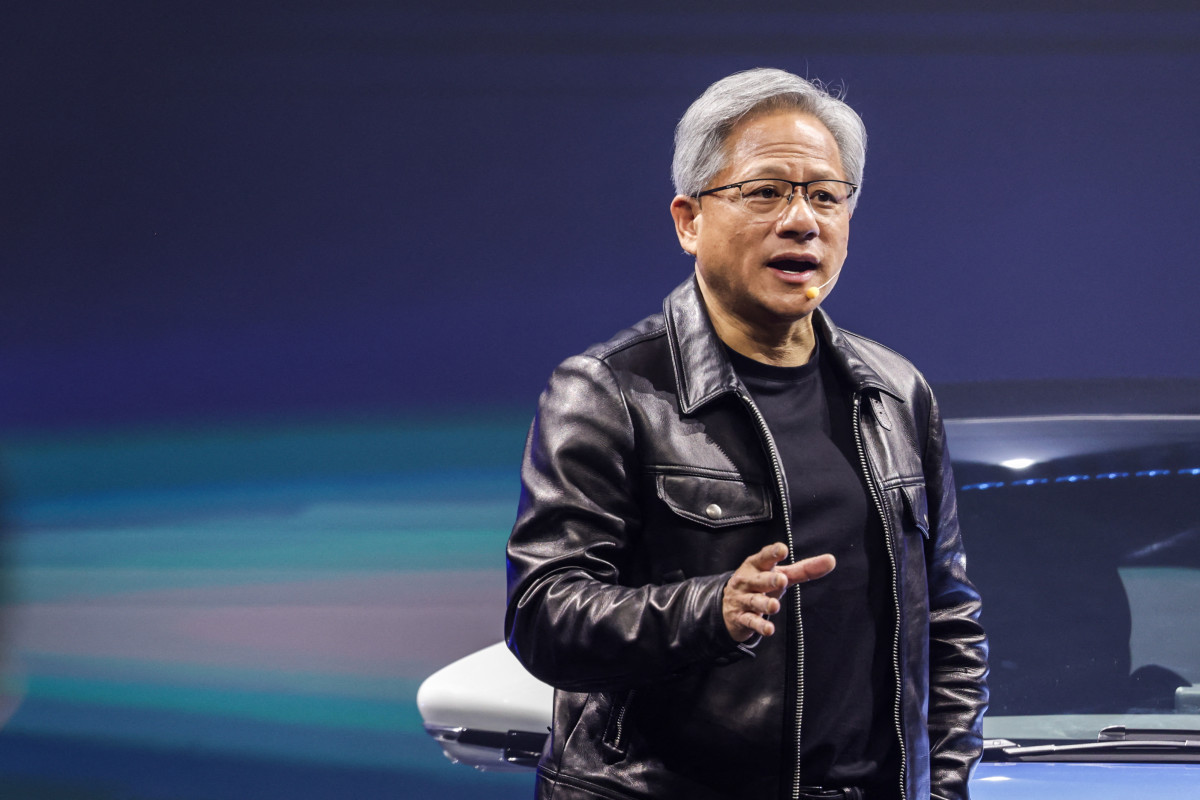

Nvidia's stock has ridden a frenzy of interest in developing artificial intelligence applications to new highs. However, Nvidia's management team, led by CEO Jensen Huang, delivered an important message to investors about its future on its quarterly conference call that could weigh down its share price.

The AI boom has Nvidia running "full throttle"

Artificial intelligence took center stage this year after OpenAI released ChatGPT last December. A generative AI, ChatGPT's ability to quickly search, digest, and create content uncorked a flurry of interest among companies eager to explore how AI could reshape their businesses for the better.

For example, banks are using AI to help with financial hedges, drugmakers are considering its use for drug research and development, retailers are seeing if it can help cut down on theft, and enterprises and governments are deploying it in the war against cybercrime.

Patrick T. Fallon/Bloomberg via Getty

The interest in developing AI programs has been a boon for companies like Nvidia that supply the infrastructure necessary to train and operate them.

Most data centers compute power comes from CPUs ill-designed to handle AI workflows, so cloud hyperscalers like Amazon (AMZN) -) Web Services, Microsoft (MSFT) -) Azure, and Google (GOOG) -) Cloud are spending billions to upgrade to Nvidia's GPUs, which are more energy efficient and faster than other options.

Related: Nvidia earnings crush forecasts, outlook tops estimates, amid surging AI demand

As a result, Nvidia's (NVDA) -) business has been firing on all cylinders. CEO Jensen Huang surprised investors in the first and second quarters of the year, reporting revenue and profit results that trounced expectations and guiding for sales strength to continue due to a healthy backlog of demand.

The message was similar for the third quarter. It reported revenue of $18.12 billion that was 206% above the same quarter last year, and nicely higher than the $16.11 billion Wall Street was looking for.

Driving the sales growth was the data center, which benefited largely from sales of its H100 AI chip. That segment's sales jumped to $14.5 billion, much better than analysts $12.8 billion estimates. Data center revenue was up 41% from Q2 and a whopping 279% from the same quarter last year.

Nvidia's gaming revenue rose to $2.86 billion, ahead of $2.7 billion estimates, while automotive sales were $266 million.

The profit picture was similarly attractive. Nvidia earned $4.02 per share, trouncing $3.39 estimates.

"NVIDIA GPUs, CPUs, networking, AI foundry services, and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off," said Huang.

Nvidia admits it faces a big challenge

Nvidia's business in Asia was dealt a big blow in October when the Commerce Department closed loopholes that had allowed Nvidia to sell throttled-down AI chips to Chinese companies.

The decision to include the H800 and A800 chips designed for the Chinese market in its latest restrictions has big implications. Roughly 20% to 25% of Nvidia's data center sales come from China, and there's considerable concern that Nvidia won't be able to orchestrate a workaround this time to keep AI chip sales flowing there.

More Business of AI:

- Here's the startup that could win Bill Gates' AI race

- Meet your new executive assistant, a powerful AI named atlas

- The company behind ChatGPT is now facing a massive lawsuit

While the new guidelines didn't impact the third quarter, management delivered a tough message to investors about its impact this quarter.

Nvidia's CFO Colette Kress doesn't expect sales of impacted chips to be a meaningful percentage of its fourth-quarter revenue.

Specifically, Kress said that sales to China will "decline significantly in the fourth quarter."

That means that the entirety of Nvidia's upside fourth-quarter guidance is driven by shifting sales from China to Western markets, a move that could reduce its backlog and potentially, create a headwind next year, especially since year-over-year comparisons will be stiffer.

Worse, Nvidia's management acknowledged what many fear, that strict export controls could provide an opening for competitors to win away business that may never return.

"Our competitive position has been harmed, and our competitive position and future results may be further harmed over the long-term if there are further changes in the USG's export controls," wrote management in their quarterly 10-Q filing with the Securities Exchange Commission.

Such a shift may already be underway. Now that it can't get them from Nvidia, Chinese Internet company Baidu is reportedly turning to Huawei for AI chips.

Investing it hard. We make it easier. There are thousands of stocks you can invest your hard-earned money in. Our pros help you decide what stocks to buy and when to buy them. Sign up to find out what stocks we're buying now (Nvidia isn't one of them!)