Advanced Micro Devices (AMD) shares powered higher Thursday, adding to the stock's impressive year-to-date gains, as investors repriced Nvidia's chip-sector rivals following its blowout fourth-quarter earnings last night.

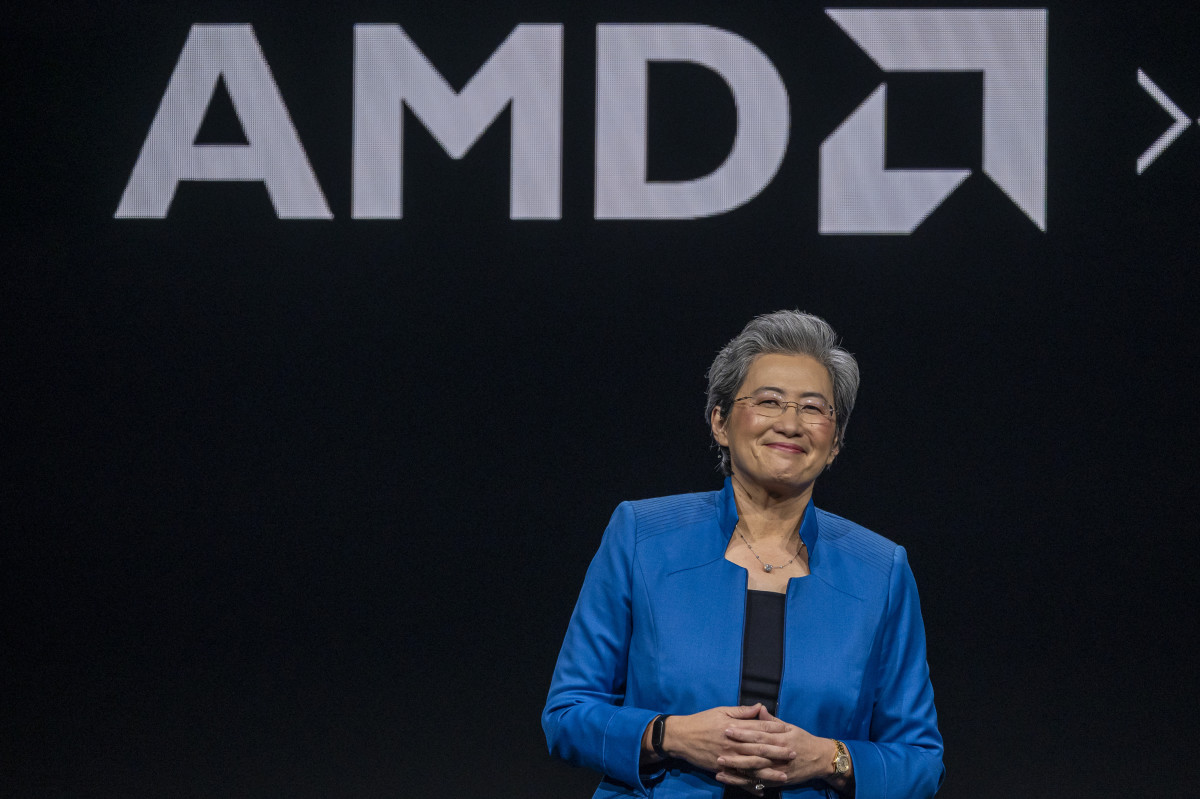

AMD, led by the highly-respected CEO Lisa Su, is the only real rival to Nvidia's (NVDA) global market dominance in the AI-chip space with its new MI300X chip.

Late last year the group launched the MI300 line, designed to support generative artificial intelligence technologies, and unveiled a next-generation semiconductor focused on supercomputing, the Instinct M1300A.

The MI300X, analysts say, could challenge Nvidia's dominant H100 graphics processing unit chip in the large language model AI market.

"We believe that AMD’s MI300 is one of the most competent products poised to challenge Nvidia," said Huatai Research analyst Purdy Ho. "Notably, Lamini AI has announced the receipt of MI300 and plans to use it in training large models."

"Tech giants such as Microsoft, Meta, and Oracle have also pledged to use the MI300 series as well," he added.

Xing Yun / Costfoto/Future Publishing via Getty Images

Last month, AMD said the new chip could generate around $3.5 billion in sales over the coming year as the group leverages its new launch against Nvidia's ability to meet the global surge in demand.

AMD: AI market could reach $400 billion

In what was an even bigger upgrade to prior forecasts, Su said the market for AI chips could reach $400 billion over the next four years, double her prior estimate from August.

"When we think about $400 billion, it's an accelerator (total addressable market)," AMD's chief technical officer, Mark Papermaster, told an event earlier this week. "Think about it as a buildout like when the internet launched and you had an entire buildout, not just of compute but networking, infrastructure, et cetera. It's a new platform."

Meeting the surge in demand has strained capacity, however, even as Su told investors last month that AMD has made "significant progress with our supply-chain partners and have secured additional capacity to support upside demand."

Related: Analysts revamp Nvidia price targets as AI hype tests $2 trillion value

That statement, while not directly mentioning its larger rival, certainly highlights one of Nvidia's key near-term headwinds.

Chip-on-wafer-on-substrate, or CoWoS, is a crucial component of AI-chip making and has been weighing on Nvidia deliveries for much of the past year.

Taiwan Semiconductor (TSM) , the world's biggest chip contractor, has struggled to meet the surge for its high-end stacking and packing technology, warning investors "that condition will continue probably to next year."

China and supply-chain issues cloud Nvidia

Nvidia said it expects its next-generation chips, including the higher-priced B100 Blackwell "to be supply-constrained as demand far exceeds supply" over the near term.

"We expect the demand will continue to be stronger than our supply provides through the year and we'll do our best," Nvidia CEO Jensen Huang told investors on a conference call late Wednesday. "The cycle times are improving and we're going to continue to do our best."

AMD is also less-exposed to markets in China, where the Biden administration has placed limits on the kinds of high-end technology, much of it made by Nvidia, that can be exported by U.S. companies.

Nvidia said it would ramp its H20 chip, designed to comply with the new export rules, later this year.

Related: Big tech stocks are doubling down on AI

"Our business significantly declined as we stopped shipping in the China marketplace (last quarter) and we expect this quarter to be about the same," Huang told investors late Wednesday. "But after that, hopefully we can go compete for our business and do our best, and we'll see how it turns out."

Nvidia's hammerlock on the broader AI-chip market is unlikely to be challenged by AMD over the coming year, or even beyond. But as companies (and, increasingly, governments) look to harness the potential of AI technologies, they'll be looking for new GPU sources so as not to be standing in line behind other high-paying customers.

That could accelerate AMD's near-term growth rates significantly.

FOMO could give AMD sales a boost

"We are encouraged by higher data-center [graphics-processing-unit] prospects for '24 as AMD ramps its MI300x to cloud providers," CFRA analyst Angelo Zino said in a recent client note. "We view GPU expectations as conservative, with upside to figures in both '24 and '25."

Zino added that the group will soon launch new Zen 5 chips for the PC market, making them capable of managing AI tasks directly on a laptop.

AMD stock is also cheaper than that of Nvidia, with a forward price-to-earnings multiple of 44 times (compared with its larger rival's 57 times), although that also reflects the fact that Nvidia is growing sales at a much faster rate with fatter overall profit margins.

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it's not Nvidia!)

Still, AMD shares have rallied 65%, compared with a 152% surge for Nvidia, after the latter effectively fired the starting gun to the global AI investment race with its stunning fiscal-first-quarter earnings report last May.

"We are firm believers in AMD's revitalized product roadmap strategy, and its product traction is compelling," said KeyBanc Capital Markets analyst John Vinh, who carries an overweight rating with a $270 price target on the stock.

"However, expectations for share gains and growth are high. We're concerned that any moderate downtick to expectations could add substantial risk to the stock based on valuation levels well above peers," he added.

Advanced Micro Devices shares rose 10.7% Thursday to close at $181.86, a move that extends the stock's year-to-date gain to around 31.2% and values the Santa Clara, Calif., group at around $294 billion.

Related: Veteran fund manager picks favorite stocks for 2024