Nvidia published its latest set of quarterly financials after markets closed on Wednesday evening. Reading the first paragraph of the press release is hardly inspiring, with mention of typical ups and downs in revenue trends. However, Nvidia shares have seen incredible interest overnight, and at the time of writing, they are up nearly 30% in value pre-market. In fact, it appears that Nvidia is on the path to being the first semiconductor chip maker with a $1 trillion market cap.

The reason for the Nvidia boom is little or nothing to do with gaming graphics cards, so popular with which PC enthusiasts and gamers. Instead, the rocket fuel here is Nvidia's pivotal perceived role in accelerating the AI revolution.

"The computer industry is going through two simultaneous transitions — accelerated computing and generative AI," said Jensen Huang, founder and CEO of Nvidia. Huang went on to predict a trillion dollars worth of data center infrastructure being readied for generative AI purposes. Coincidentally, with today's valuation boost, Nvidia is headed to being the first trillion-dollar chip company.

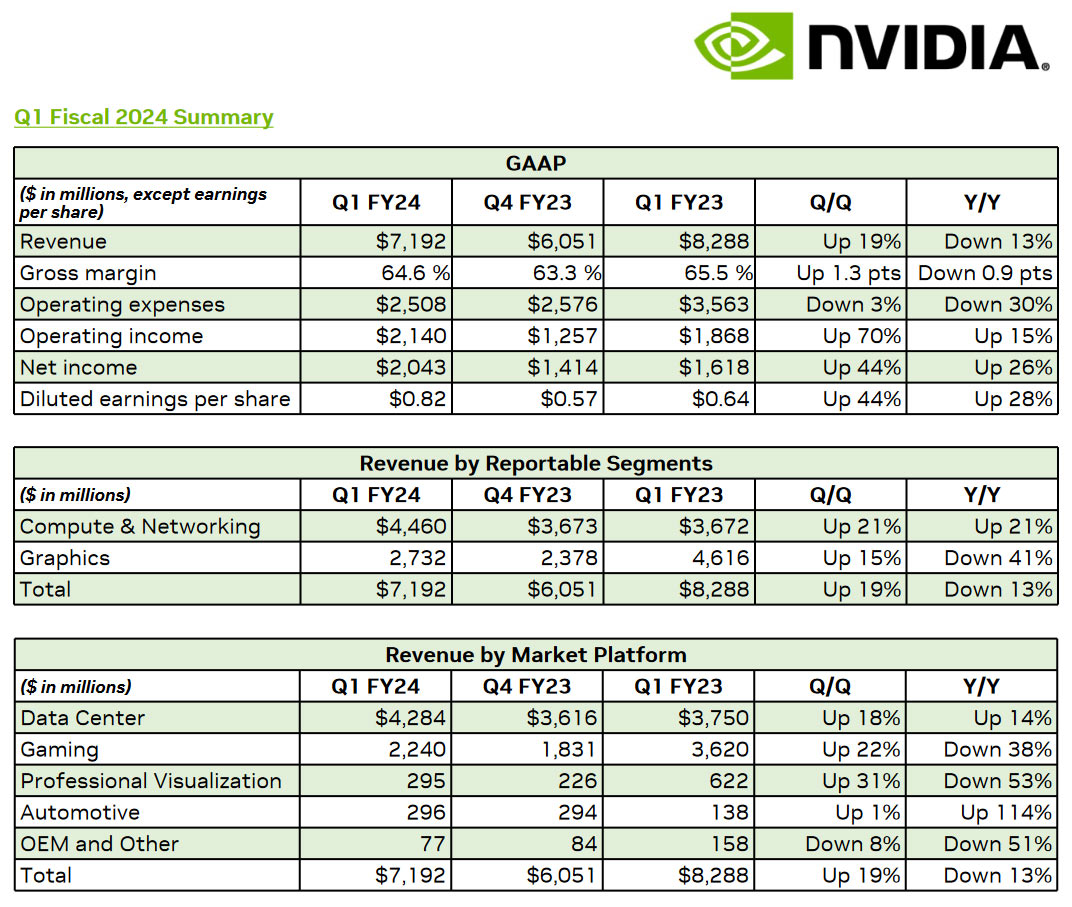

In the above chart, you can see that Nvidia, the PC graphics company that used to talk a lot about data centers, is now firmly a data center accelerator company. This transition has really gripped the company over the last year, after a long time in gestation. The latest figures show that Data Center revenue was almost double that raised by the Gaming division. Also, looking at the changes/trends, you can see the positive momentum is in segments like Data Center, Visualization, and Automotive.

In summary, for Nvidia, it is its forecasts which have gripped investors in the last few hours. Its stronger-than-expected forecast of sales growth of about $11 billion, plus or minus 2%, in the current quarter, is over 50% better than Wall Street had estimated.

Impacts Felt by The Wider Market

The other part of our story today is the impact Nvidia's results are having on the wider chip design and manufacturing landscape. Our headline highlights great news for AMD investors. While the red team might have made no financial announcements yesterday (or today), shares in AMD are up nearly 10% pre-market. That's a nice bonus to wake up to, and it seems to be entirely on the coattails of fierce rival Nvidia.

The good news for AI accelerator designers at both Nvidia and AMD is also good news for the wider semiconductor business, and both ASML and TSMC shareholders have been basking in sympathetic sunshine today. Dutch firm ASML, a key player in the chip manufacturing equipment business, is up over 5% at the time of writing. Additionally, the world's largest contract chipmaker TSMC is up 3.5%. The valuations of shares in these companies are usually quite sticky - they have a lot of inertia - so these movements are pretty strong.