The holidays have always been an expensive time, but, with inflation rates hitting new highs, some are seriously tightening Santa's belt this year.

Covering everyone on one's list can add up fast and cutting a few people is one of the easiest ways to bring down cost this year. According to Deloitte's 37th annual Holiday Retail Survey, the average shopper plans to buy nine holiday gifts this season--a drop from the 16 that they planned to buy in 2021.

With the inflation rate hitting 8.2% in September, price hikes have hit everything from clothes to popular toys and electronics.

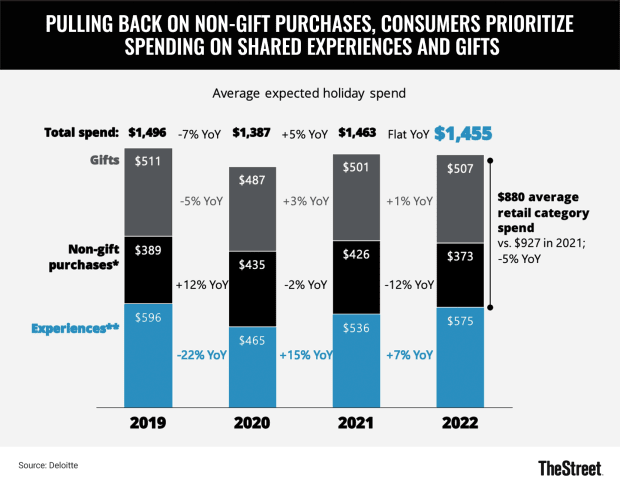

And while what the average consumer plans to spend on gifts is almost unchanged from year to year ($501 in 2021 and $507 now), many are staying within budget by making some cuts to the people on one's holiday list

By contrast, consumers are planning to also spend an average $575 on holiday-related experiences and $373 on non-gift items like tree decoration and home décor.

Fewer Gifts Under the Christmas Trees

"What's informing this holiday season is a consumer who has lived with inflation for a year," Steve Rogers, the managing director of Deloitte's Consumer Industry Center, told TheStreet. "They are living within the same cost envelope but reducing the number of gifts that [they're] buying. So hopefully you've been nice to your favorite aunt and are on her list."

TheStreet

While cutting gifts for people is an easy way to bring down one's spending, making these types of decisions is having an adverse effect on many people's holiday cheer. The survey said 37% feel that their financial situation is worse than it was last year while 41% expect the economy to weaken further in the new year.

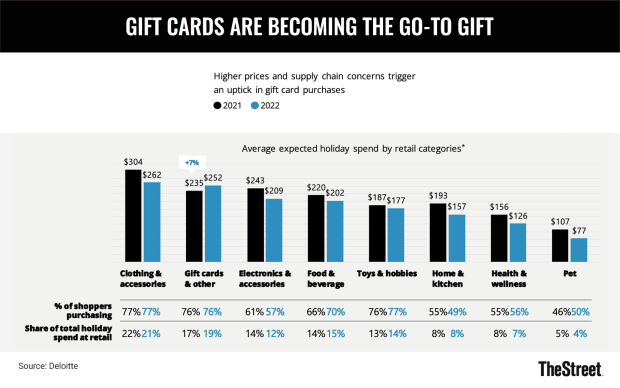

Concurrently, gift cards are becoming a popular gift to both give and receive this year. Even as expected spending in categories like clothing, electronics and toys fell from 2021 to 2022, gift card spending was the only one that grew 7% from $235 to $252.

It is also, after clothing and apparel, the second most popular gifting category. The ability to pay for things one needs is particularly invaluable after blowing through the holiday budget.

Making the Holidays Happen on a Budget

The second-hand route is another way that some are hoping to bring down the overall cost of gifting.

The number of consumers planning to buy resold items grew from 30% to 32% while clothing, toys and electronics are some of the most popular categories to give used.

TheStreet

"Prior to this, there was perhaps a stigma of resellers," Rogers said. "Now, you see a number of retailers who have websites dedicated to either refurbished or resold items. [...] People are willing to reach for that to stretch their budget and give something a little nicer than what they could buy off the rack."

But while the cost of both new and used gifts adds up fast, those who earn at the lower end of the income bracket (below $50,000) expect to increase their holiday spending by 25% this year to cover rising expenses. Those at the higher end earning above $100,000 plan to cut spending by 7%.

"People always make the holidays happen one way or another," Rogers said. "[...] There are numerous challenges to the holiday season this year but people tend to make sure the presents show up under the tree."