Nucor Corporation (NYSE:NUE) is set to release second-quarter 2022 results ahead of the bell on Jul 21.

The U.S. steel giant surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missed once. It has a trailing four-quarter earnings surprise of 2.2%, on average. It posted an earnings surprise of around 4.4% in the last reported quarter. The company is likely to have benefited in the second quarter from strong end-market demand and higher year-over-year sales prices.

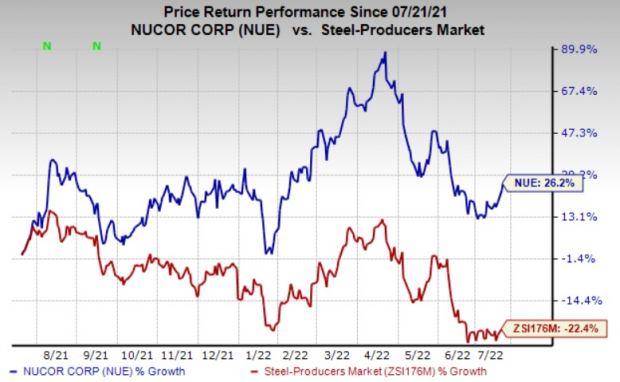

Nucor's shares are up 26.2% over a year, compared with the industry's 22.4% decline.

What do the Estimates Say?

Nucor, last month, issued its earnings guidance for the second quarter. It anticipates a new record second-quarter earnings of between $8.75 and $8.85 per share.

The Zacks Consensus Estimate for second-quarter consolidated revenues for Nucor is currently pegged at $11,420.9 million, reflecting a year-over-year increase of 29.9%.

The Zacks Consensus Estimate for second-quarter average sales price per ton for the company's steel mills unit stands at $1,466, suggesting a 32.4% year-over-year increase. The consensus estimate for average sales price per ton for the company's steel products unit is pegged at $2,672, suggesting a year-over-year rise of 56.4%.

A Few Factors to Watch

The company's second-quarter results are likely to reflect strong end-market demand, especially in the non-residential construction market. Strong end-use market demand for steel and steel products is likely to have supported its results. Its steel products segment is expected to have benefited from strong demand in non-residential construction markets.

Nucor, in June, said that it expects earnings in the steel mills segment to strengthen mainly due to higher profitability at its bar, sheet and plate mills. Its raw materials segment is also projected to generate increased profits in the second quarter due to relatively higher selling prices for raw materials.

U.S. steel prices witnessed a significant downward correction during the second quarter. After surging to nearly $1,500 per short ton in April 2022 due to supply concerns stemming from the Russia-Ukraine war, the benchmark hot-rolled coil ("HRC") prices are on a downward trend and have retreated to levels before the conflict. HRC prices have fallen below the $1,000 per short ton level. The downward drift partly reflects shorter lead times. Mills are also negotiating lower prices for new orders. Fears of a recession have also impacted prices.

Nevertheless, higher year-over-year selling prices are likely to have aided Nucor's revenues and margins in the to-be-reported quarter.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Nucor this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that's not the case here.

Earnings ESP: Earnings ESP for Nucor is 0.00%. The Zacks Consensus Estimate for earnings for the second quarter is currently pegged at $9.01. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: Nucor currently carries a Zacks Rank #5 (Strong Sell).

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

Albemarle Corporation (NYSE:ALB), scheduled to release earnings on Aug 3, has an Earnings ESP of +18.98% and carries a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Albemarle's second-quarter earnings has been revised 10.3% upward over the past 60 days. The consensus estimate for ALB's earnings for the quarter is currently pegged at $2.93.

Celanese Corporation (NYSE:CE), scheduled to release earnings on Jul 28, has an Earnings ESP of +1.03% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Celanese's second-quarter earnings has been revised 3.9% upward over the past 60 days. The Zacks Consensus Estimate for CE's earnings for the quarter is currently pegged at $4.58.

FMC Corporation (NYSE:FMC), slated to release earnings on Aug 2, has an Earnings ESP of +0.62% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for FMC's second-quarter earnings has been stable over the past 60 days. The consensus estimate for FMC's earnings for the second quarter stands at $1.90.

To read this article on Zacks.com click here.

Zacks Investment Research

Image sourced from Shutterstock