Super Micro Computer had a super-bad week.

The maker of liquid-cooled artificial intelligence servers was one of the stock market's brightest bulbs earlier this year. But Super Micro shares have been clobbered since they peaked in March, and they got absolutely battered last week when short-seller Hindenburg Research took aim at it.

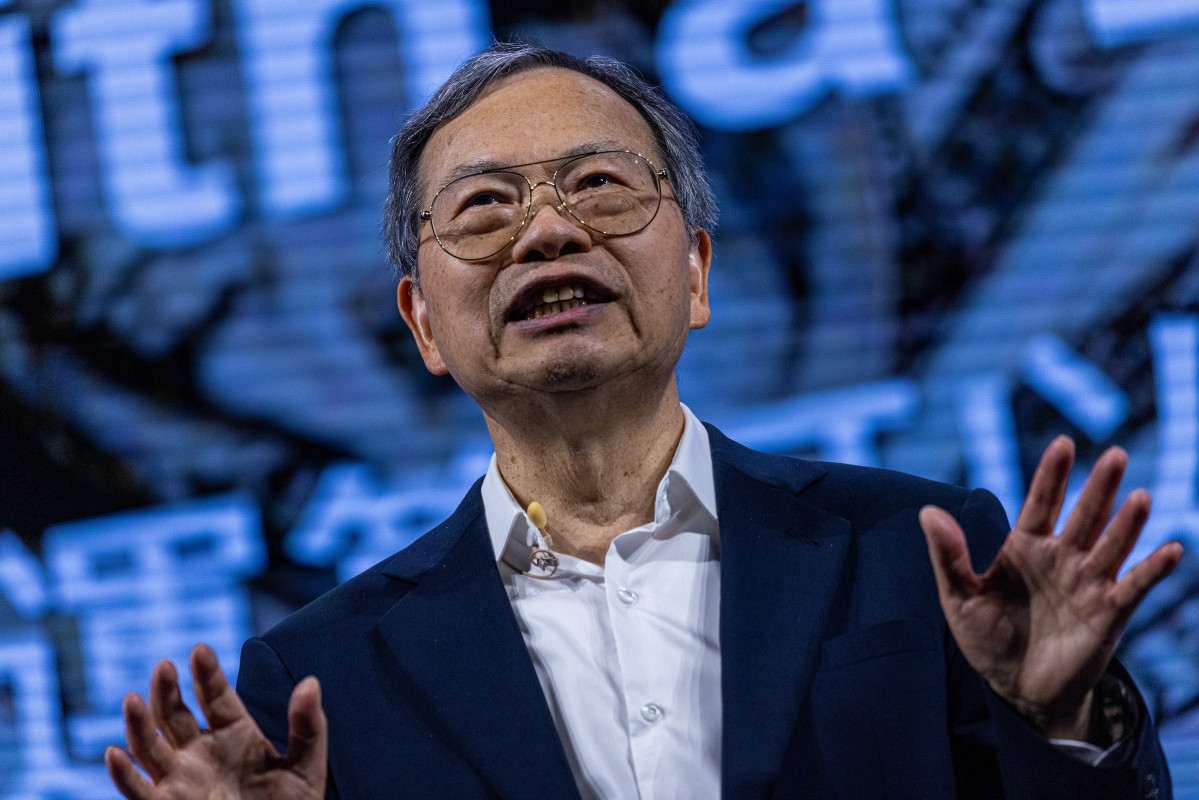

It didn't help matters that Super Micro's CEO, Charles Liang, announced a delay in filing quarterly results with the Securities and Exchange Commission, either.

Related: Apple stock forecasted as top AI pick before crucial rollout

What happens to Super Micro's stock next is anyone's guess, but the shellacking hasn't gone unnoticed. Many of the analysts who have weighed in so far are bearish. Wells Fargo, for example, cut its Super Micro stock price target by over 40%.

However, not everyone is convinced that the short report represents 'new' news or that SMCI share price deserves to have fallen so much this week.

JP Morgan: different view of Hindenburg SMCI report

Analysts at JP Morgan have a different view of the Hindenburg report.

The investment firm, which has an overweight rating on Super Micro Computer (SMCI) , said it saw limited evidence of accounting mistreatments beyond revisiting the 2020 charges from the SEC.

Related: Major analyst delivers crushing blow after Super Micro stock price crashes

It also saw limited new information relative to the "existing and already known" business relationship with related companies owned by Liang's siblings.

"The allegations relative to sanction evasion are tough to verify," JP Morgan analysts said, "but it is still worth highlighting that the magnitude of revenues referenced in the report does not change the medium-term revenue opportunity for the company in relation to the addressable $275 billion artificial intelligence server [total addressable market] in 2026 and 2027."

Super Micro’s challenges from 2018-2020 are known to investors, JP Morgan said.

The report "relies in revisiting history to make the suggestion of similar practices at this time and quotes ‘Our investigation found major corporate governance red flags and evidence of continued improper revenue recognition...’ without any details.”

The report also highlights several rehires as evidence of repetition of prior practices, JPM said, although with limited details around the correlation between the two.

More AI Stocks:

- Analyst revisits Microsoft stock price target after AI reporting change

- Analyst resets Nvidia stock price target before earnings

- Analysts revise Palo Alto Networks stock price targets after earnings

"Interestingly, evidence about recent culture and practices are based on interviews with former employees in all instances cited in the report," JPMorgan said.

The firm said that it saw the report "as largely void of details around alleged wrongdoings from the company that change the medium-term outlook, and largely revisiting the already known areas for improvement in relation to corporate governance and transparency."

"It is not surprising that the company has areas for improvement to further refine governance, transparency, and communication with investors, which would be more appropriate for a company of its size following its recent spurt of growth in conjunction with AI server demand," JP Morgan said.

"However, the lack thereof does not immediately suggest wrongdoing by the company, in our view," the firm added.

Evercore analysts shift focus to Dell, others

Nevertheless, there are other investment options in the AI server space, and given the adage, "where there's smoke, there's fire," some analysts are pivoting.

Related: Analysts revise Dell stock price target ahead of earnings

Analysts at Evercore ISI said that given some recent negative concerns around Super Micro, "it's critical to think through the competitive landscape when it comes to AI servers."

The firm said Dell (DELL) was poised to gain share and “remains a logical partner for customers who look for better/different supply chain diversity, and crucially, a strong services offering through the deployment life cycle.”

Evercore ISI said that its view remains that key customers like CoreWeave and the "Musk companies" of EV producer Tesla, social-media platform X, and supercomputer developer xAI are "largely dual sourcing production" across both Dell and Super Micro.

The firm said that HP Enterprise can "potentially scale into some of these ramps as well."

Evercore ISI, which maintained an outperform rating and $140 price target on Dell shares, estimated that Dell's AI server revenue is on track to exceed $8 billion this year and likely to exceed $10 billion next year.

Related: Veteran fund manager sees world of pain coming for stocks