Shares of Nordstrom (JWN) are getting hit on Wednesday, down almost 20% after the retailer reported earnings.

Target (TGT), Walmart (WMT) and others reported last week. This week, we’re hearing from Macy’s (M) and other department stores. The results have been mixed, to say the least.

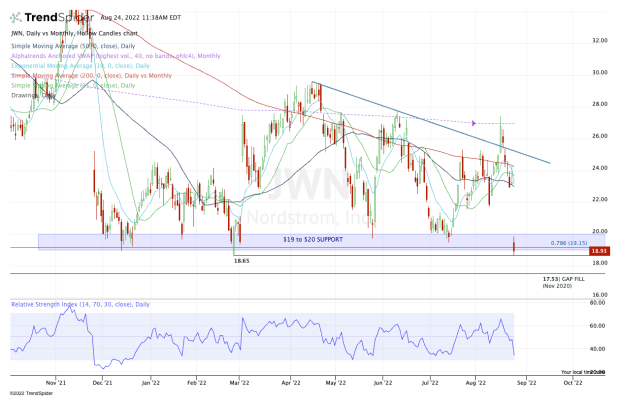

For Nordstrom, the stock is on the cusp of losing a key support zone in the $19 to $20 range. As highlighted below, this zone has been support all throughout 2022.

Driving today’s losses is the company’s quarterly update. While the retailer beat on earnings and revenue estimates, it gave a slight trim to its full-year revenue outlook and a significant cut to its full-year earnings outlook.

The guidance almost always has a bigger impact than the quarter the company just completed. And given that Nordstrom beat expectations for its second quarter, a tough six months could be on the way.

Let’s look at the chart to see what might happen if Nordstrom stock drops below the $19 to $20 zone.

Trading Nordstrom Stock’s Earnings Selloff

Chart courtesy of TrendSpider.com

As noted above, this level has been significant support. Nordstrom flirted with a break of this level in February before bottoming at $18.65 and rallying more than 50%.

Interestingly, the shares bottomed at $18.66 this morning, just a penny above the 2022 low, but they are struggling to piece together a significant bounce so far in the post-earnings action.

If Nordstrom stock can turn higher, the bulls would love to see it clear $20.25. Not only would that send the shares back above the key $19 to $20 zone, but it would also put Nordstrom back above the July low.

It would also put it back above the 78.6% retracement (as measured from the 2022 high to the 2020 low).

Technically speaking, that opens the door to a potential gap-fill near $23, as well as a test of its short- and intermediate-term moving averages.

The concern on the downside is simple: A close below $19 and failure to get back above this mark opens the stock up to more downside.

Specifically, one area that jumps out to me is the $17.50 zone. Near that level — at $17.53 — is the gap-fill mark from November 2020.

Below that could open up even more downside. But without a significant deterioration in the overall market, I would hesitate to start mapping out downside levels that are more than 25% below yesterday’s closing price.

Should Nordstrom stock break down and fill the gap at $17.53, we can reassess the stock at that time.